“Tomorrow never happens. It’s all the same fucking day, man. ” Janis Joplin

Distribution of Returns

Analysing history and hoping it will somehow repeat itself is the big hope of all quantitative traders. This article is about the distribution of market returns, but not about normal distribution, Gauss and standard deviation. This article is about the visualisation of market returns and what can be learned from it.

Probability distribution diagrams show the probability of a specific outcome. How likely is it that the market will be at a specific price sometimes in the future? How does a specific bullish or bearish indicator signal affect the future market behaviour on a statistical basis? An approaching visualisation of the statistical probabilities are the best way to understand market behaviour and find your chances in trading.

Distribution of returns

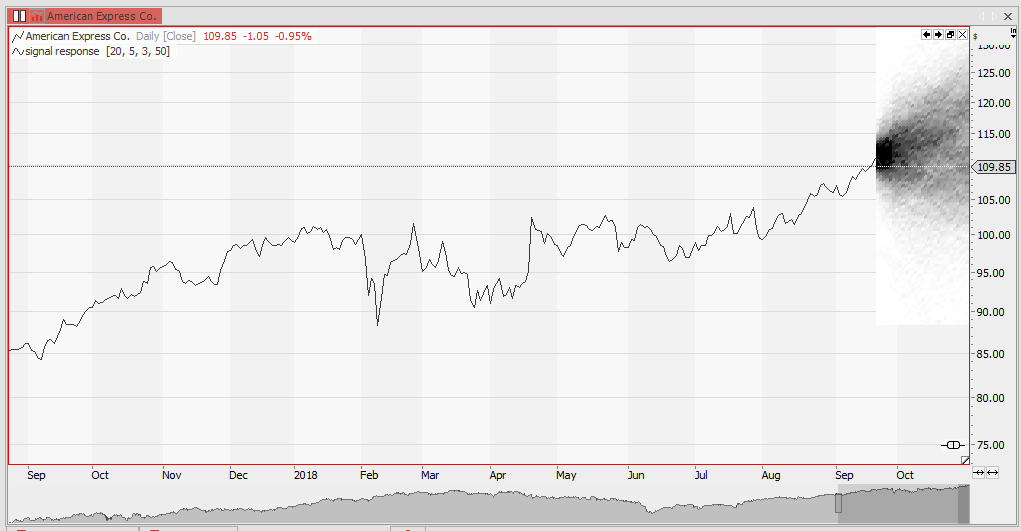

The chart below shows the distribution of returns of the American Express stock.

The probability of a specific future return is coded in shades of grey. The darker the distribution diagram, the higher the probability that the market will be there in the future. To generate this kind of chart all 1 to 50 day returns over the last 10 years have been analysed. A 50 day forward projection of expected returns is shown.

When changing the contrast settings of the distribution indicator, one gets a better impression on how likely specific events will be. As there are only 255 types of grey from white to black, a multiplication of the density by a contrast setting will overexpose the likely events. Everything that is not black, has hardly ever happened in history.

The shape of he probability distribution shown on the chart is somehow different than a normal distribution; and the shape of this shown distribution will differ largely from market to market. This is the representation of different, inherent attributes of each market. The distribution of Nasdaq will look different than that of EURUSD. To see these differences helps when designing custom trading strategies, price targets and fair option prices.

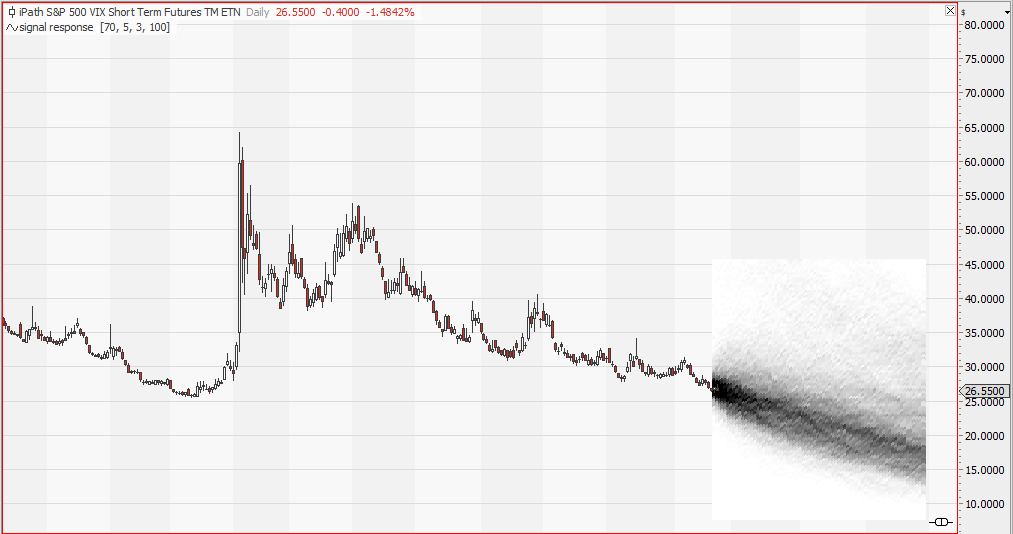

The next chart is a returns projection for the VXX volatility ETF. We already had an article regarding the volatility of VIX ; this indicator offers a more intuitive representation of future returns than the classic distribution diagrams used back then. Data since 2011 has been used to generate this likelihood projection for the next 100 days.

Signal response and returns distribution

That different markets behave differently is nothing new to the experienced trader, this indicator just helps to visualise this fact.

An other interesting usage of this distribution indicator is to analyse the behaviour of the market after a specific technical trading signal has occurred. A path analysis of the market.

The loop on the chart below shows the distribution of German power trading returns after a bullish-, neutral- and bearish signal. Significant differences between the distribution and probability of the realised returns after these 3 signals can be observed. These differences will finally lead to a trading strategy tailored to the specific signal-market response.

Also have a look at Demystifying the 200 day average for further ideas on how to analyse the quality of signals.

A picture says more than a thousand words..

Sorry Janis, it seems it`s not always the same f****** day. Tomorrow depends on today’s action.