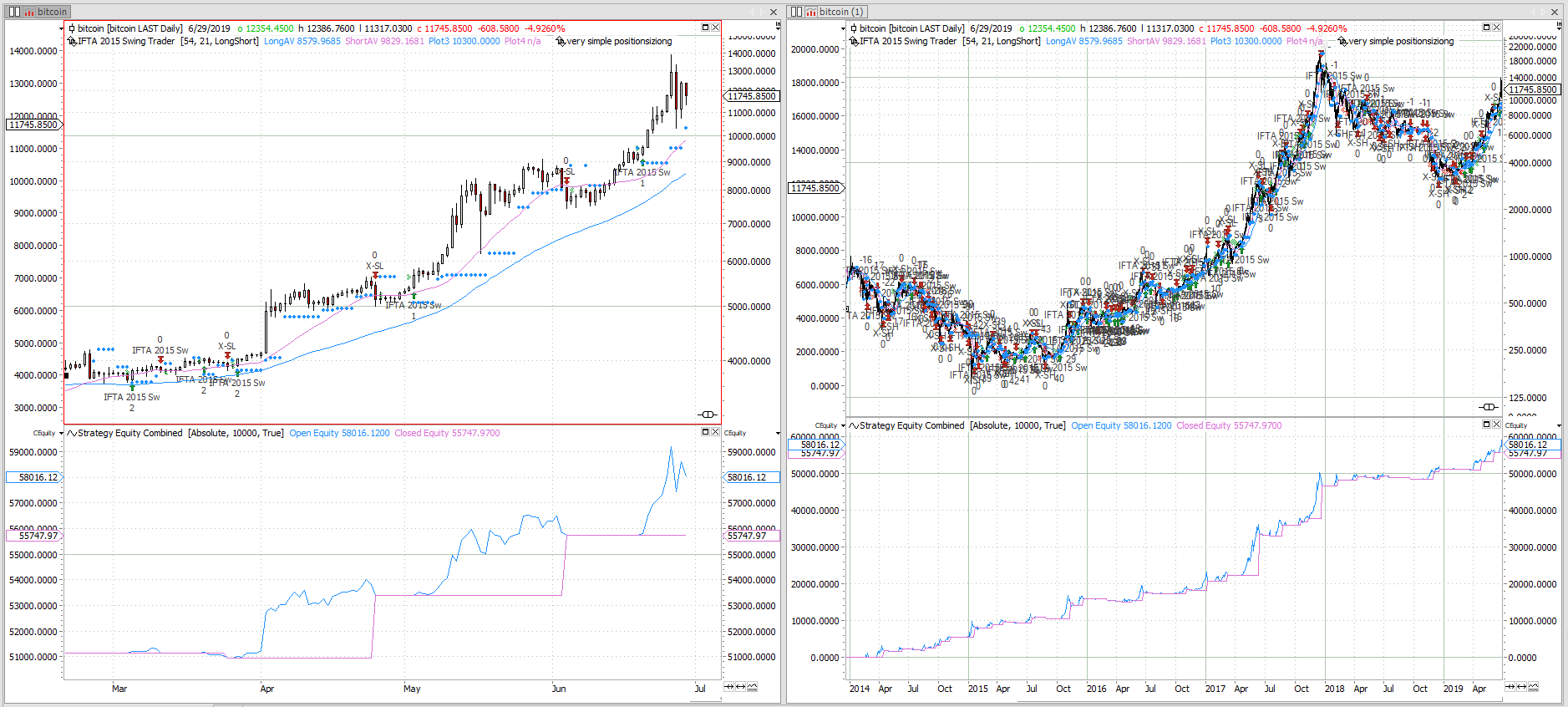

A simple bitcoin Swing Trading strategy originally published in 2015. See the out of sample performance and how it is done.

Category: Bitcoin

Bitcoin – end of the bullish bubble

Bitcoin has come a long way but now it is time to say good bye. Being a trend following trader on the long side, the chart right now suggest anything else but a trend following long strategy. It might all look completely different in a few weeks or months, but right now the bitcoin market… Continue reading Bitcoin – end of the bullish bubble

Bitcoin Trading Strategy – review of returns

Bitcoin is not as bullish as it used to be. May it be due to fundamental reasons like transaction cost and slow speed, or maybe the herd found a new playground, whatever it might be, it is a good time to have a look how my bitcoin trading strategy performed. The bitcoin trading strategy uses… Continue reading Bitcoin Trading Strategy – review of returns

Bitcoin Handelsstrategie

Die Cryprowährung Bitcoin ist zurück! Sie erlebte ihren Hype vor 2014, doch ging es seitdem fast nur noch bergab. Nach den Hochs um 1000$ für einen Bitcoin Ende 2013 verfiel der Preis bis auf 150$. Doch diese Zeiten scheinen vorbei zu sein, bitcoin is back! Bitcoin Chart Analyse Der Chart zeigt den Bitcoin / USD… Continue reading Bitcoin Handelsstrategie

Bitcoin Revolution

Cryptowährung Bitcoin Die digitale Währung Bitcoin scheint nicht mehr aufzuhalten. Immer stärker wird die Verzahnung mit der Realwirtschaft, immer mehr Händler nehmen Bitcoin als Zahlungsmittel, immer mehr institutionelle Anleger können diesen Markt nicht mehr ignorieren. Ich verbrachte die letzten 2 Tage mit Davide Capoti, Emanuele Colacchi und Matteo Maggioni in Rom. Die 3 sind institutionelle… Continue reading Bitcoin Revolution