When developing a new trading strategy you are usually confronted with multiple tasks: Design the entry, design the exit and design position sizing and overall risk control. This article is about how you can test the edge of your entry signal before thinking about your exit strategy. The results of these tests will guide you… Continue reading The Edge of an Entry Signal

Category: General

The Edge of Technical Indicators

Technical indicators are the basis of all algorithmic trading. But do these really give you an edge in your market? Are they able to define the times when you want to be invested? This article will show you a way to quantify and compare the edge of technical indicators.

Daily Extremes – Significance of time

Analysing at which time daily market extremes are established shows the significance of the first and last hours of market action. See how different markets show different behaviour and see what can be learned from this analysis.

Noisy Data strategy testing

Algorithmic trading adds noise to the market we have known. So why not add some noise to your historic market data. This way you can check if your algorithmic trading strategies are fit for the future. Learn how to generate noisy data and how to test your strategies for stability in a noisy market.

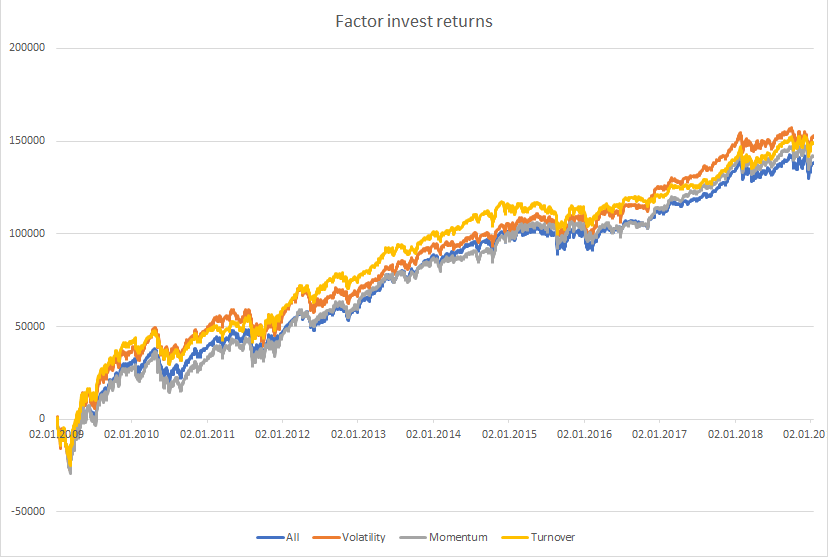

Factor investing in portfolio management

Factor investing has been around in portfolio management for some years. Based on algorithmic rules it became the big thing in trading and the ETF industry. But is there still some money to be made? Is small beta still smart or just beta? This article will give you a Tradesignal framework to test the factor… Continue reading Factor investing in portfolio management

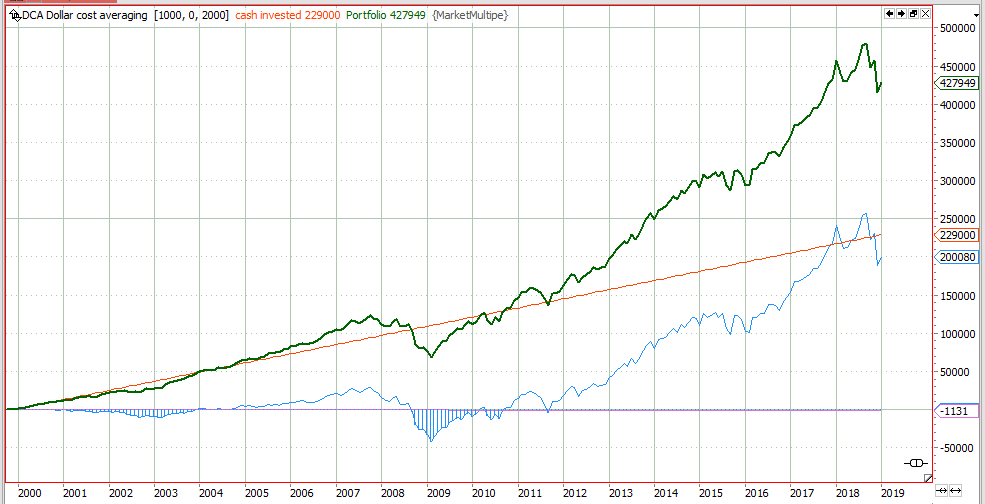

Dollar Cost Averaging Investment Strategy – success based on luck?

The dollar cost averaging investment strategy doubled your savings over the last 20 years, but will it continue to perform? See the facts.

Historic Bear Markets & Crashes (business as usual)

Since S&P500 has lost 20% from its top in 2018 and everybody is talking about bear markets. See what has happened in history.

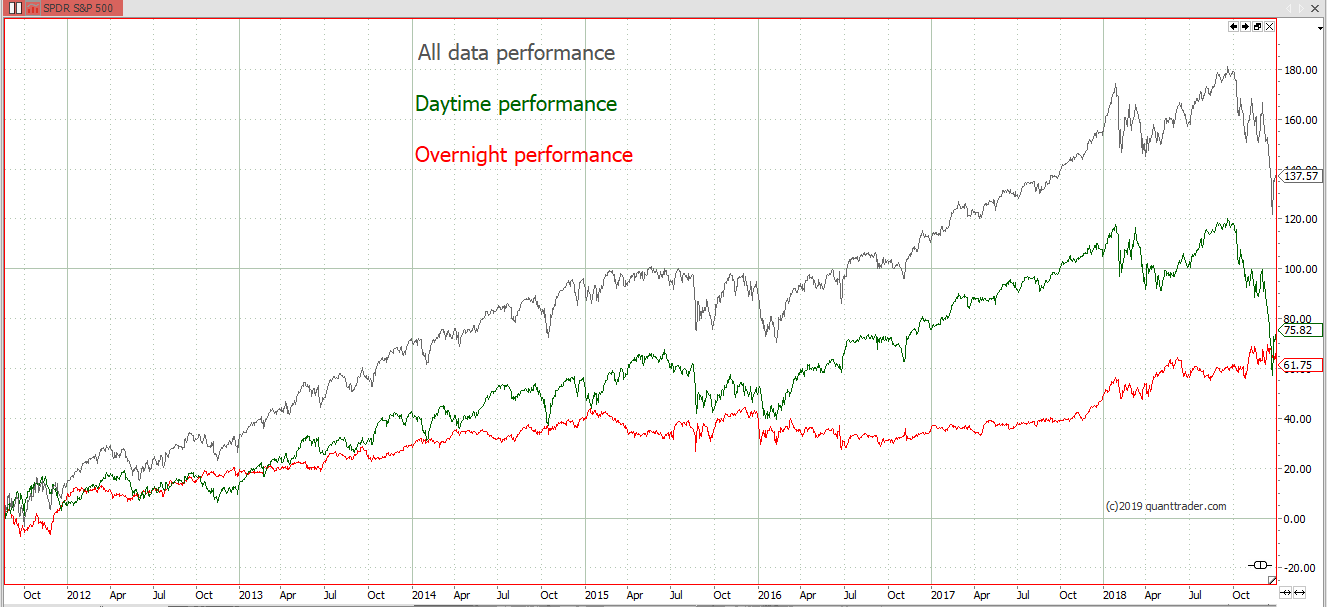

Overnight vs Daytime Performance & Volatility

Analysing the market performance of the day session vs. the overnight movement reveals some interesting facts. Daytime vs. Overnight Performance

Pears Global Real Estate – calling the devil by its name

Maximising the net yield for the Pears family, 33 Cavendish Square, London, W1G 0LB, United Kingdom, is destroying local neighbourhoods. May they choke on their money!

Bullish? Buy stock or sell put option?

Is it more favourable to buy shares directly or to get assigned from a short put position. See the arguments and learn how to decide this question.

Technical vs. Quantitative Analysis

Technical and quantitative analysis are two different types of market analysis. Both are based on price and historic market behaviour. Which is the one you should trust, which you should avoid?

An Algorithmic Stock Picking Portfolio

A volatility and return based stock picking algorithm. Portfolio construction, picking criteria and the ideas behind this approach. Excess returns of your portfolio against an equally weighted index portfolio.

The average move of a market

Markets have a high degree of randomness (and madness), but there are some things which hardly change over time. One is the width of an average market move before a counter-move can be observed.

Market crash or market correction?

The difference between a crash and a market correction. VIX and realized volatility give the answer

Bollingerband: The search for volatility

Will the market stay within it’s normal distribution range or will there be a breakout of this range? The Bollinger percentile indicator will give the answer.

IV Percentile – when to sell volatility

IV percentile and IV rank both describe implied volatility. Which one is better in finding out if it is time to sell volatility? Read the answer in this article

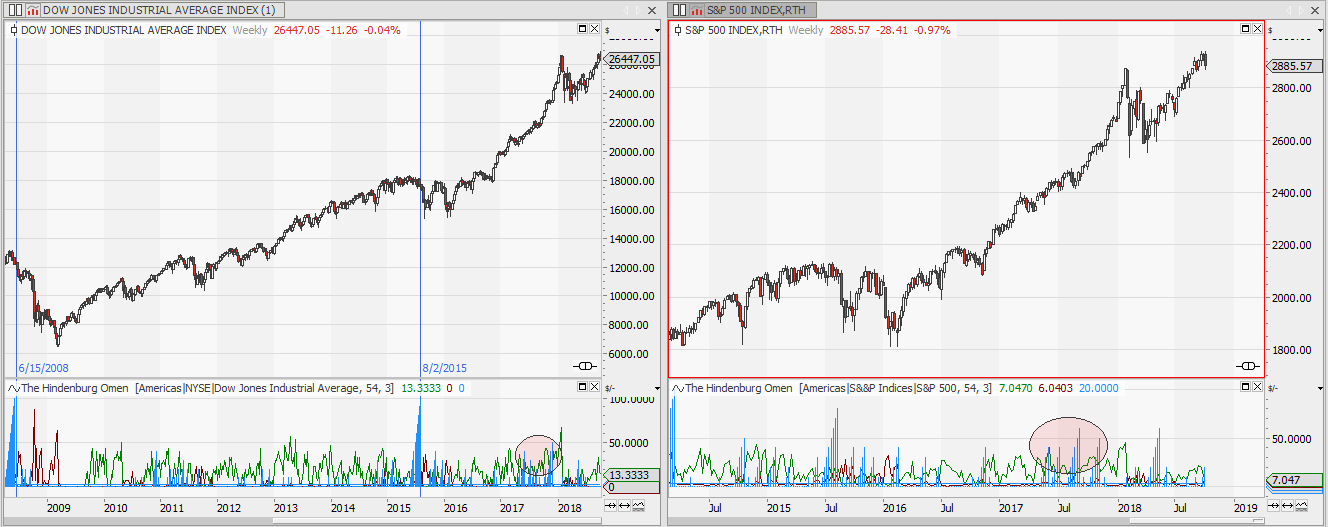

The Hindenburg Omen – Stock Market Crash Ahead?

The Hindenburg Omen is a market breadth indicator analyzing new highs and lows on the market. It signals the end of the current bull market. Tradesignal Indicator Code is provided

Implied vs. Realized Volatility for NASDAQ100 stocks

Comparing implied volatility to realized volatility can show you the right stocks to sell volatility. An overview over the implied and long term realized volatility of NADAQ100 stocks is given.

Distribution of Returns

“Tomorrow never happens. It’s all the same fucking day, man. ” Janis Joplin

Bet on Bollinger

Ever since John Bollinger introduced his Bollinger Bands in the early 1980s the bands have been a favourite indicator to all technical trades. This article is about the prediction capabilities of Bollinger bands.