When developing a new trading strategy you are usually confronted with multiple tasks: Design the entry, design the exit and design position sizing and overall risk control. This article is about how you can test the edge of your entry signal before thinking about your exit strategy. The results of these tests will guide you… Continue reading The Edge of an Entry Signal

Category: Tradesignal Codes

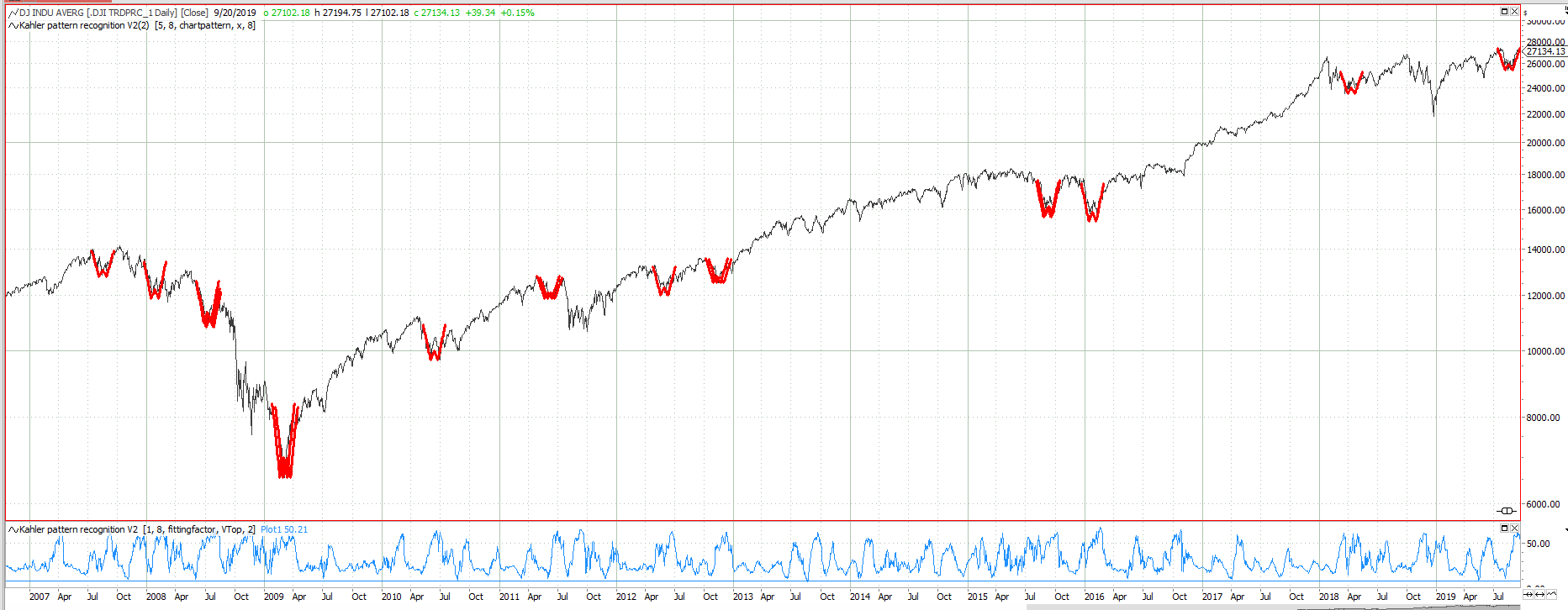

A simple algorithm to detect complex chart patterns

How to detect complex chart patterns in Tradesignal. See how a chart pattern is defined and how the pattern recognition algorithm is working. A free indicator code is provided.

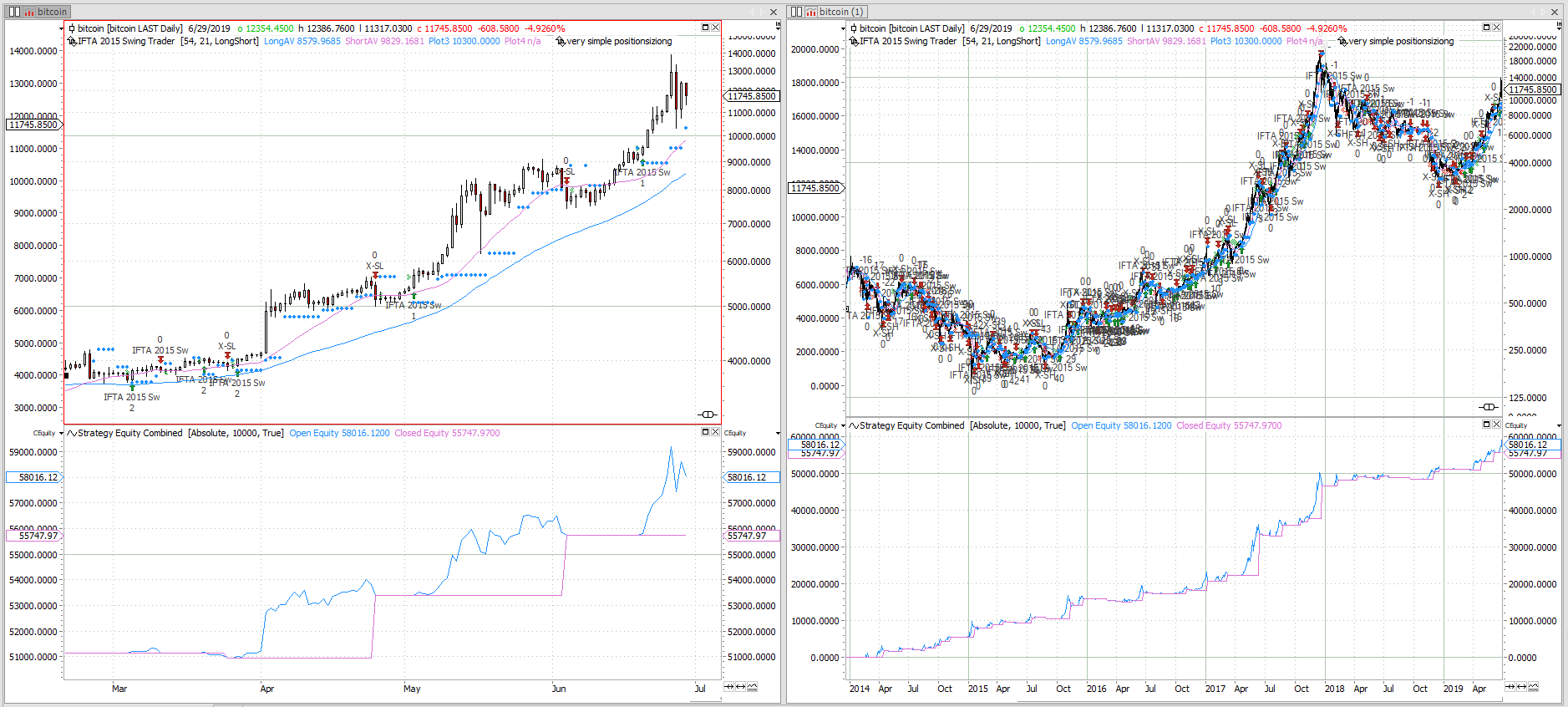

Bitcoin Swing Trading

A simple bitcoin Swing Trading strategy originally published in 2015. See the out of sample performance and how it is done.

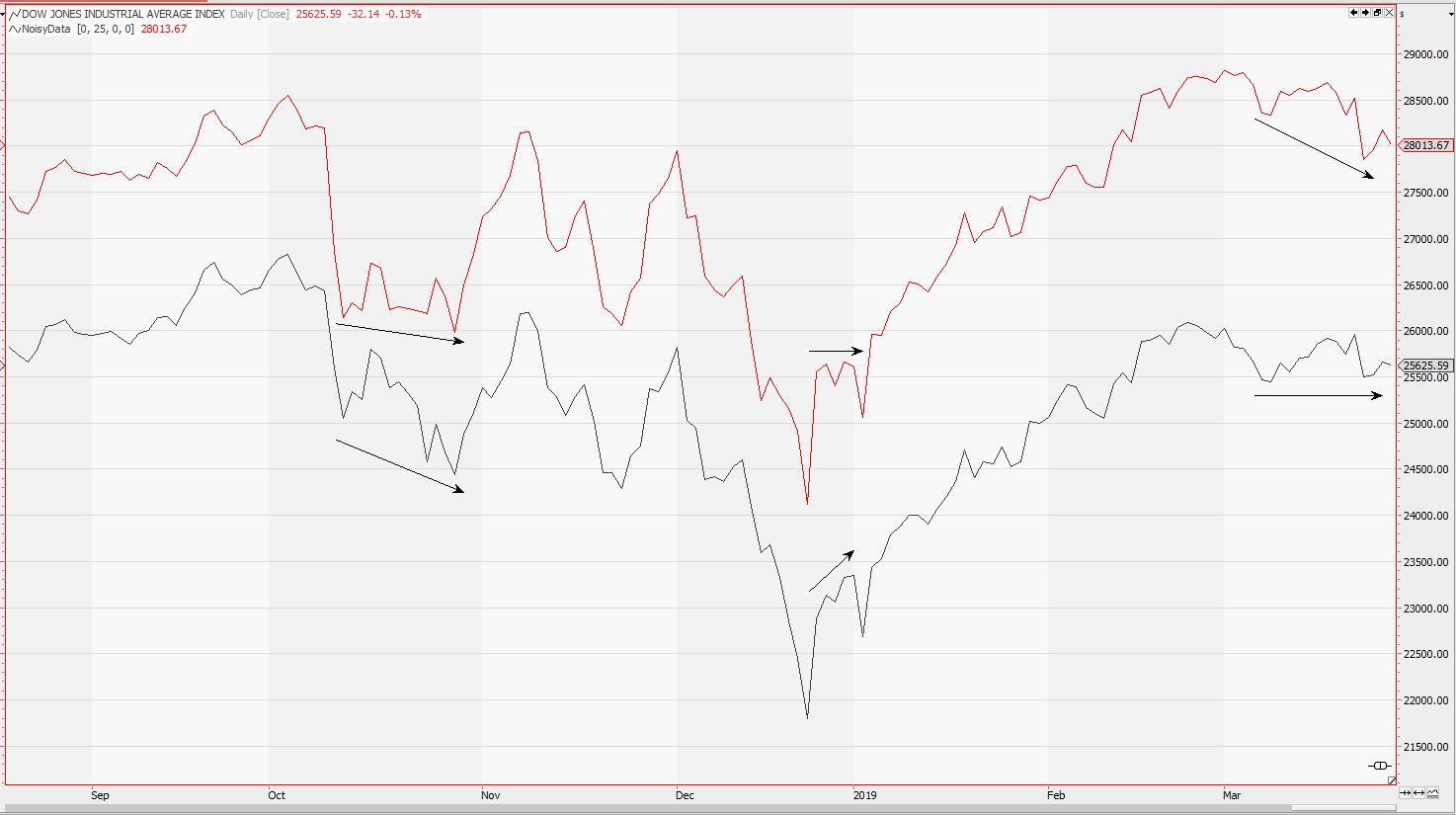

Noisy Data strategy testing

Algorithmic trading adds noise to the market we have known. So why not add some noise to your historic market data. This way you can check if your algorithmic trading strategies are fit for the future. Learn how to generate noisy data and how to test your strategies for stability in a noisy market.

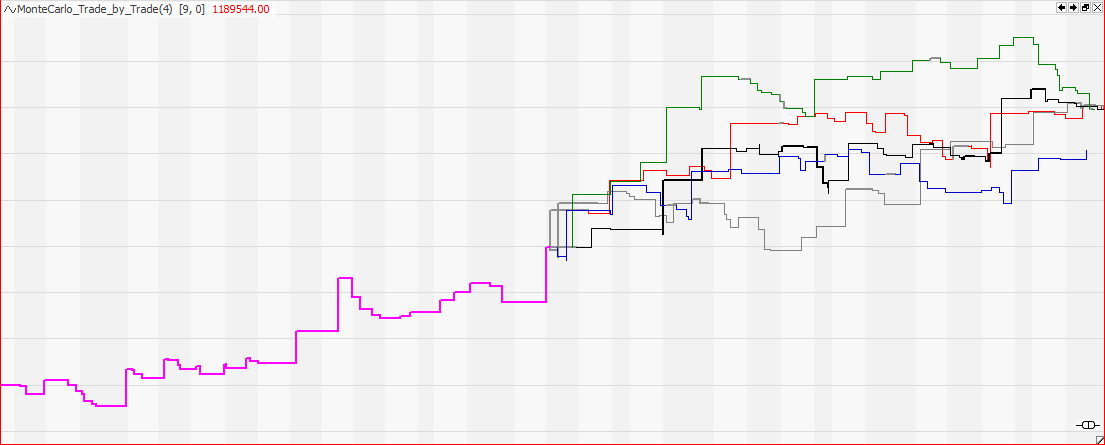

Monte Carlo Simulation of strategy returns

Monte Carlo Simulation uses the historic returns of your trading strategy to generate scenarios for future strategy returns. It provides a visual approach to volatility and can overcome limitations of other statistical methods. Monte Carlo Simulation

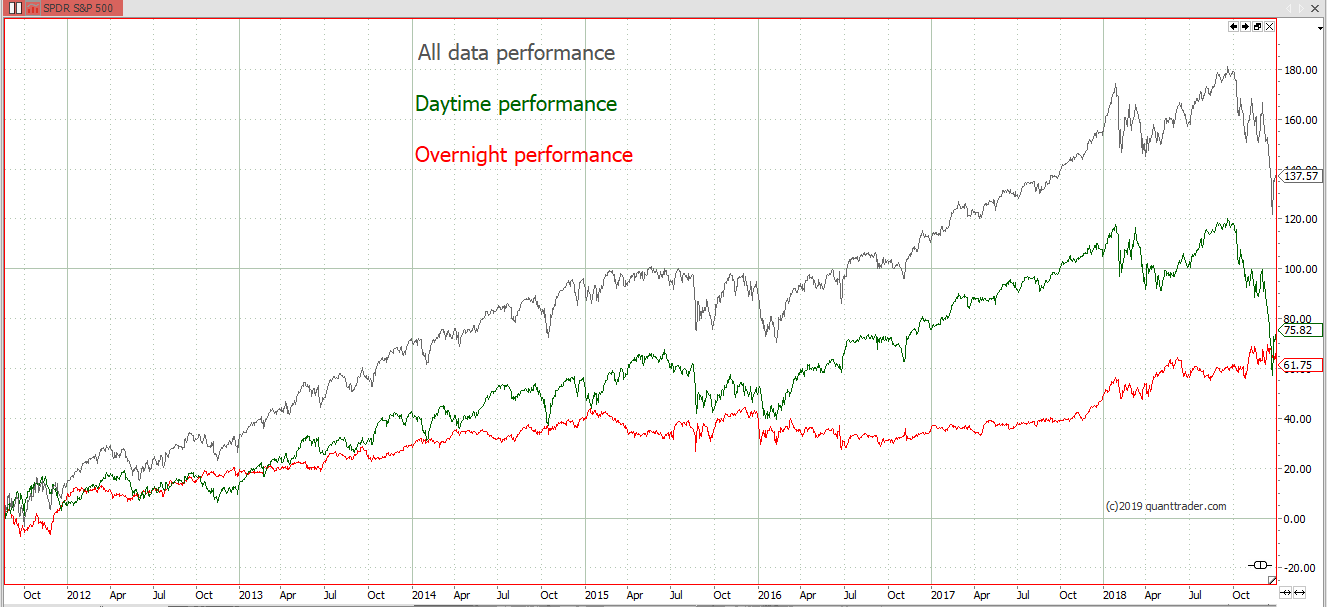

Overnight vs Daytime Performance & Volatility

Analysing the market performance of the day session vs. the overnight movement reveals some interesting facts. Daytime vs. Overnight Performance

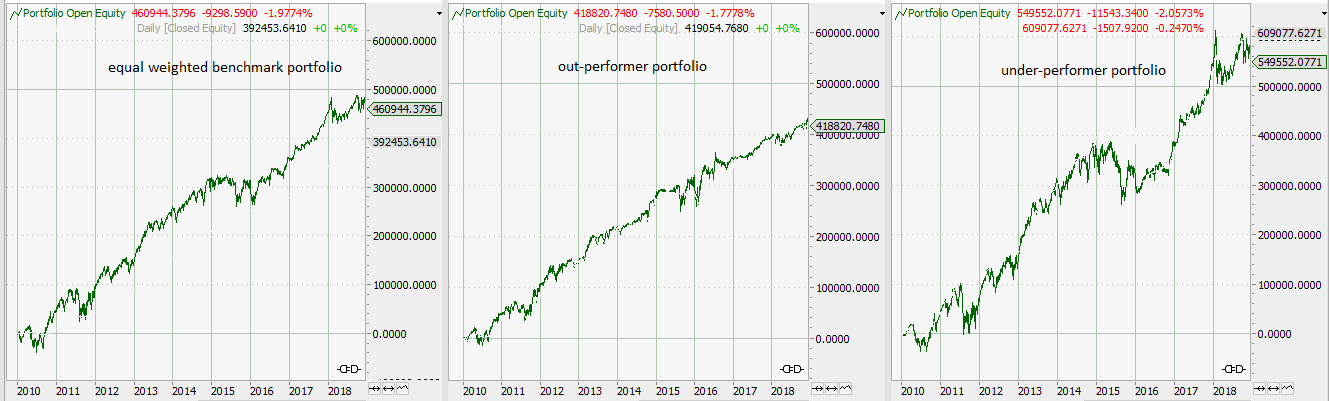

An Algorithmic Stock Picking Portfolio

A volatility and return based stock picking algorithm. Portfolio construction, picking criteria and the ideas behind this approach. Excess returns of your portfolio against an equally weighted index portfolio.

Weis Wave indicator code for Tradesignal

The Weis Wave indicator for Tradesignal combines volume and trend information to detect turning points of the market.

Tradesignal Implied Volatility and IV Percentile Scanner

Use free data from the web and load it into Tradesignal to scan for implied volatility and IV percentile. Full code given for free

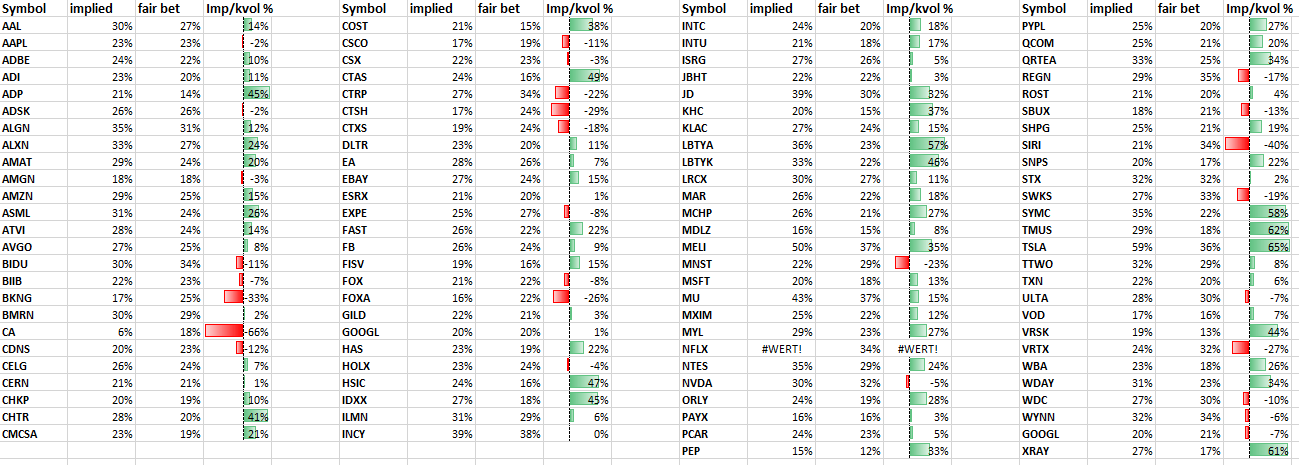

Implied vs. Realized Volatility for NASDAQ100 stocks

Comparing implied volatility to realized volatility can show you the right stocks to sell volatility. An overview over the implied and long term realized volatility of NADAQ100 stocks is given.

Seasonal trouble ahead

Seasonal Projection and Volatility prognosis for german DAX. Trouble ahead…

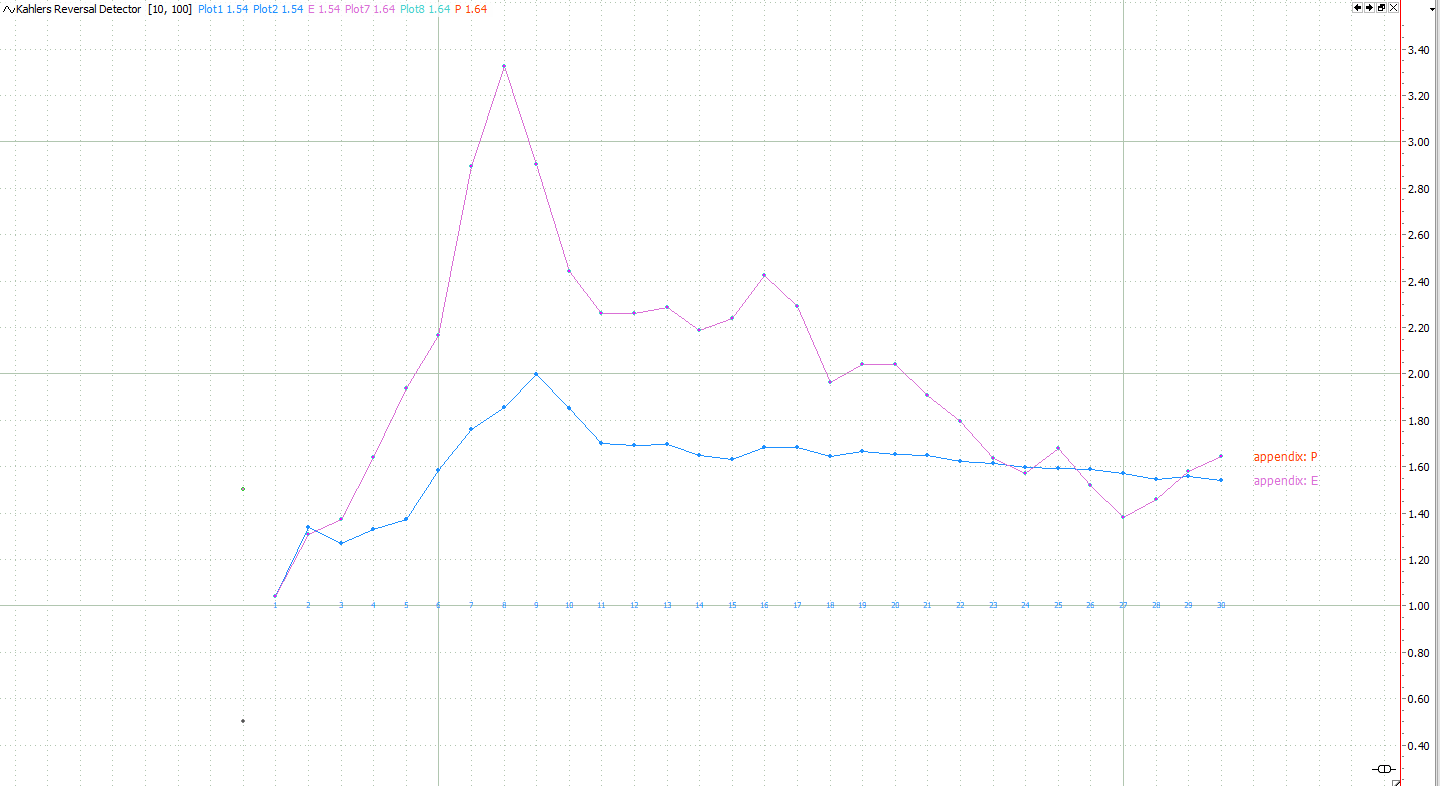

Kahler’s fair bet volatility

Volatility is a measure of risk. It describes how far a commodity will most probably move within a given period of time. The most common measure for volatility is historical volatility. But I do not like the complicated formula for standard deviation. There has to be a better way to explain and calculate volatility…. Implied… Continue reading Kahler’s fair bet volatility

A graphical approach to indicator testing

Scatter charts are a great tool to test the prognosis quality of your indicators. A visual approach on indicator quality can help you to get rid of curve fitting when using classical or machine learning trading strategies.

Machine learning: kNN algorithm explained

Can inspiration be replaced by brute force? This article shows how to program and possibly use a simple kNN algorithm to trade Brent. A two dimensional data set will be used. RSI will determine if tomorrows market will move up or down.

Ranking: percent performance and volatility

When ranking a market analysts usually pick the percent performance since a given date as their key figure. If a stock has been at 100 last year and trades at 150 today, percent performance would show you a 50% gain (A). If another stock would only give a 30% gain (B), most people now would… Continue reading Ranking: percent performance and volatility

EEX Phelix Base Yearly – Buy Wednesday, short Thursday?

When it comes to simple trading strategies, the day of the week is surely one of the best things to start with. That’s nothing new when it comes to equity markets. Everybody knows about the calendar effects, based on when the big funds get and invest their money. I do not know about any fundamental… Continue reading EEX Phelix Base Yearly – Buy Wednesday, short Thursday?

Digitale Stochastic

Digitale Stochastic: die slow Stochastic mit digitaler Glättung

Ichimoku Scanner

Der Ichimoku Kinko Hyo ist in Japan einer der beliebtesten Indikatoren. Es ist ein Indikator der Informationen über Trendrichtung und Trendstärke kombiniert. Zudem gibt er schon heute seinen zukünftigen Wert an. Damit ist er ein Unikum unter den Chart Indikatoren. Wie dieser großartige Indikator interpretiert wird, habe ich hier aus der gestrigen DAX Tagesanalyse… Continue reading Ichimoku Scanner

Opening Range Breakout

Opening Range Breakout Strategie von Perry Kaufmann aus “Technical Analysis of Stocks & Commodities”

DAX Marktbreite und 200 Tage Linie

Bald ist es wieder so weit und der DAX steigt über seine 200 Tage Linie. Das wäre an und für sich nichts Besonderes, steigt oder fällt der DAX doch jeden Tag über irgendeinen gleitenden Durchschnitt, doch ist die 200 Tage Linie etwas besonders an sich: Sie ist ein selbst erfüllender Indikator! Bankberater, Bild, Hausfrauen Wenn jemand… Continue reading DAX Marktbreite und 200 Tage Linie