So you are bullish on a specific stock, but you also have realised that timing is major problem? So what would be the best strategy to implement your bullish opinion but avoid the problems of any timing strategy?

Selling a put option might be the answer.

Bullish probability

For discussing this question let’s use the current Apple chart as an example. The question is, if you are bullish on apple, should you buy 100 Apple stocks right away or should you sell an at-the-money put option. To find the pros and cons of these two possibilities let’s have a look at some charts.

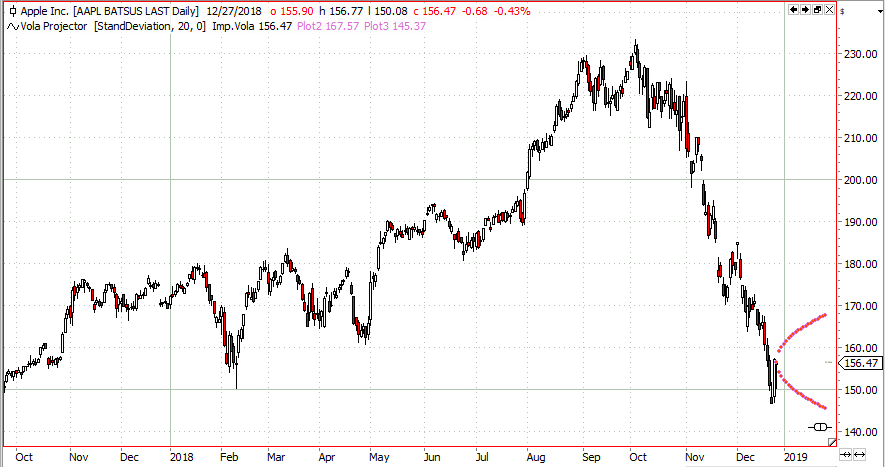

First have a look at the apple chart itself and get an idea what might happen within the next two weeks: ( I will use an option with 2 weeks to expiry for this example)

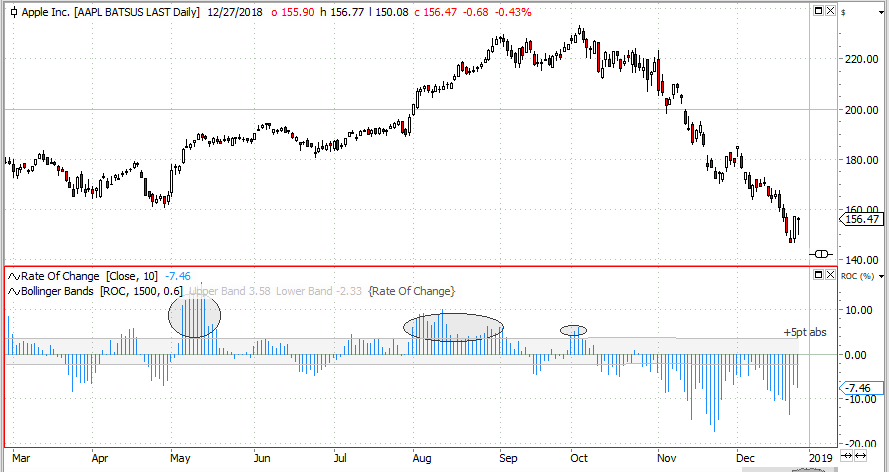

The chart above shows a daily Apple chart, and the rate of change over 10 business days underneath. On top of the rate-of-change I put a Bollinger Band with 0.6 standard deviations. This currently represents about a 5 points absolute move.

As you can see, most of the time Apple moves less than these 5 points within 2 weeks. This information will be the starting point for our further thoughts about the perfect strategy to enter into a bullish position.

( beside this crude graphic approach you could also use kvol to find the right probabilities/prices)

Selling a put option

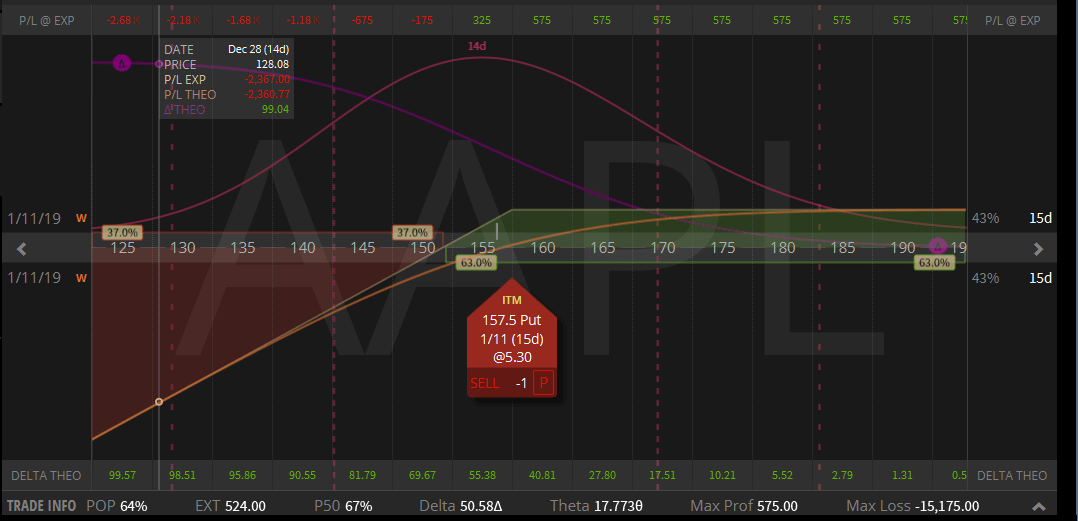

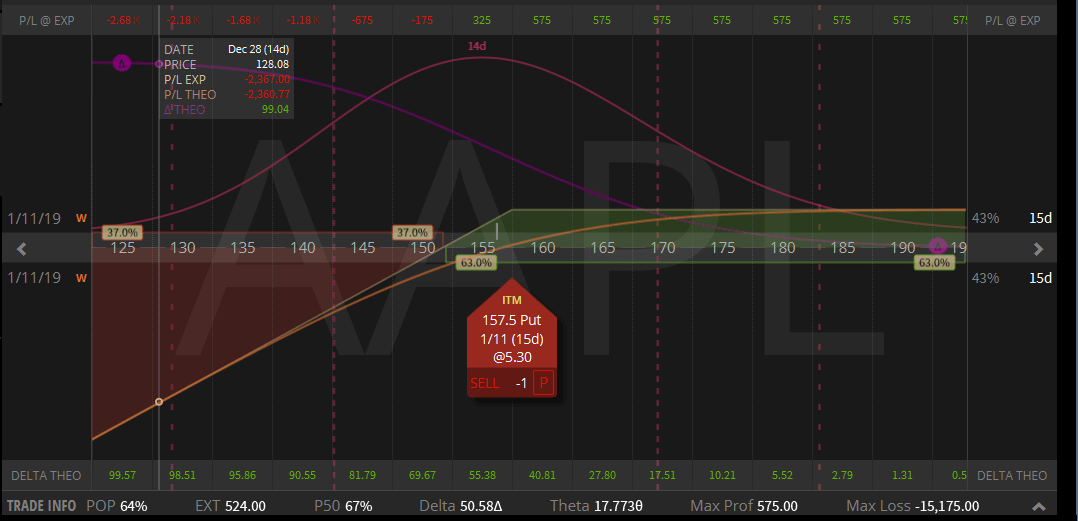

If you would sell put option on apple, you could do this right now for 5.75$, using a slightly in the money option with an expiry 14 days from now. (= about 10 business days) The chart above gives you the risk-reward profile for this trade at expiry. Implied volatility changes over time, so these 5.75$ might be more or less in the future.

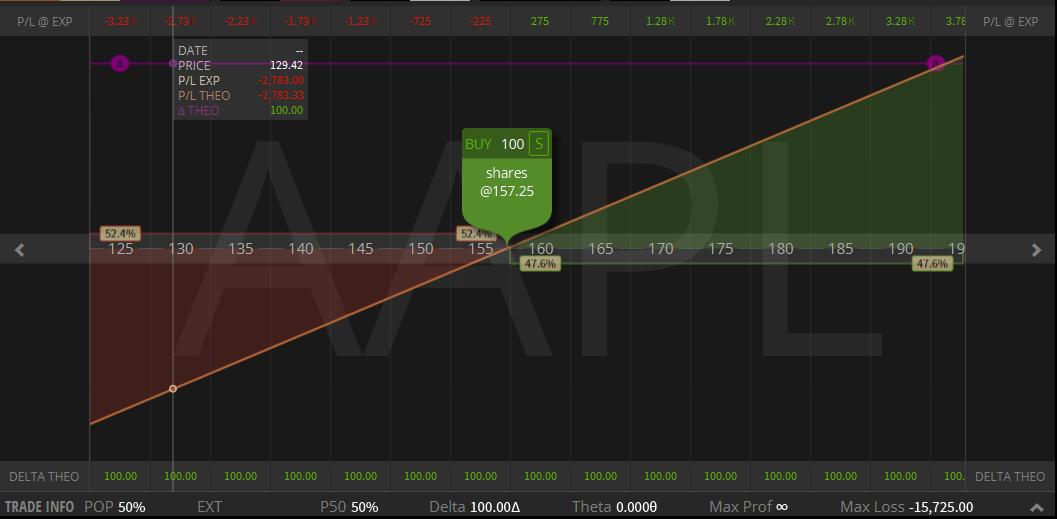

Buying 100 shares of Apple stock

Let’s compare this short put risk-reward chart to the risk-reward chart of a long stock position. This is a no brainer, with every dollar Apple rises or falls, you will earn/lose 100$. You will have a probability of success of 50%, risk and reward are in balance.

Sell put option or buy stock shares?

By comparing the three charts above you got all the information needed to find out the perfect strategy to go long on Apple.

First have a look at the apple chart on top and think about the probability that Apple will rise more than 5.75 pts within the next 10 business days. This would be major move, but it also is quite unlikely to happen. And only in this case the stock position would give you a higher payout than the option position.

Next have a look at the option pay off chart. As long as Apple stays above the current price minus the credit received for selling the put option, you would be in a winning position. This results in a probability of success of 64%, better than the 50:50 of the stock position.

Then compare this to the payoff chart of a long position.

Surely you would make more with the long stock position if Apple rises more than 5.75 points, but therefore you would also have no buffer to the downside.

If you would have the magic glass ball and would know that today is the low and Apple will start to rise massively without ever looking back, you should go with the long stock position.

But if you have not got this magic insight, you clearly should go with the short put strategy. It gives you a buffer to the downside but also a good potential to the upside. As a big upside move is unlikely (see the first chart) this is a risk I would take. On average the short put, on expiry in 2 weeks, gives you a higher pay-off than the long stock.

If Apple is down at expiry, both strategies have about the same risk-reward profile. Your put will get assigned 100 Apple stocks, resulting in a long position with an entry price of 157.5$. But you still have the 575$, and therefore have out performed the buy-immediately strategy.

Conclusion:

If you are not absolutely sure where the market will go, better do not fight against normal distribution. Timing is tricky, but this simple put-write strategy can help a lot to overcome these problems.

btw, due to missing product diversity I am not (long term) bullish for apple, I just used this company as an example stock to show you the merits of the put write strategy…