Analysing the market performance of the day session vs. the overnight movement reveals some interesting facts.

Daytime vs. Overnight Performance

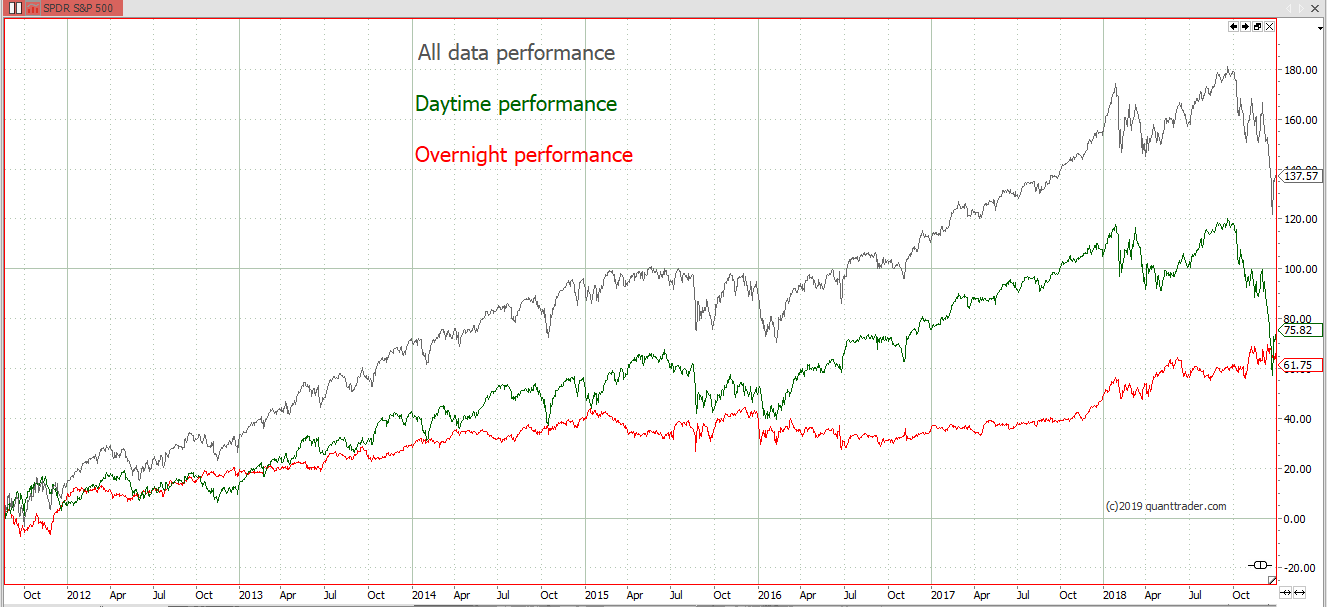

The chart below gives a visual impression on where the performance of the SPY ETF is coming from.

The grey line represents a simple buy and hold approach. The green line shows the performance if you would have held SPY only during daytime, closing out in the evening and re-opening the position in the morning.

The red line give the overnight-only performance.

Volatility and Performance of different sessions

As it can be seen, the overnight performance (red) has got a way lower volatility than the daytime session performance. Especially over the last weeks this effect has been dramatic. While the daytime performance has been clearly negative, the overnight movements have still got a positive tendency. Also the overnight volatility is way lower than the daytime volatility.

Weekend Performance of SPY

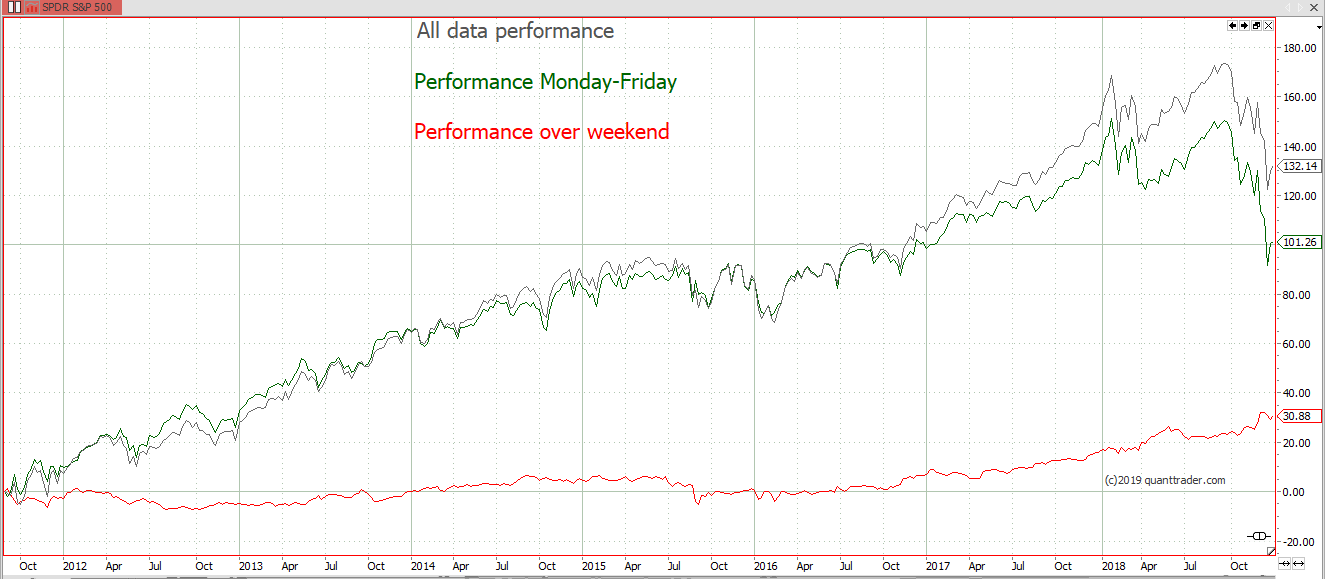

A similar effect can be seen when analysing the Monday-Friday performance versus the weekend performance. Over the last 2 years the weekend performance showed a nice upward trend, whereas the overall performance of SPY has been nearly zero.

Conclusion

Holding the SPY ETF only over night might not be practical for private investors, commissions and the short term profit taxes would kill any possible advantage. Holding the ETF just on the weekend seems to be a more favourable strategy, especially when thinking about the correlation between the Mon-Fri performance versus the weekend performance. It might be a useful hedge against itself, without using other instruments.

keep researching before you invest…

Daytime vs.Overnight Tradesignal Indicator Code

Inputs: select(daysession, overnight, daynight); Variables: price; if isbarone then price=0 else begin if select=daysession then price=price+(close-open); if select=overnight then price=price+(open-close[1]); if select=daynight then price=price+(close-close[1]); end; drawline(price,"Day-Night-All");

The analysis has been done using the tradesignal software suite.