Analysing at which time daily market extremes are established shows the significance of the first and last hours of market action. See how different markets show different behaviour and see what can be learned from this analysis.

Probability of Extremes

A day of trading usually starts with a lot of fantasies for the future, then we try to survive the day and end it with a lot of hope for tomorrow. This psychological pattern can also be shown when analysing intraday market data. A high level of fantasies usually leads to a strong market movement, and thus market extremes can often be seen near the beginning or the end of the trading session.

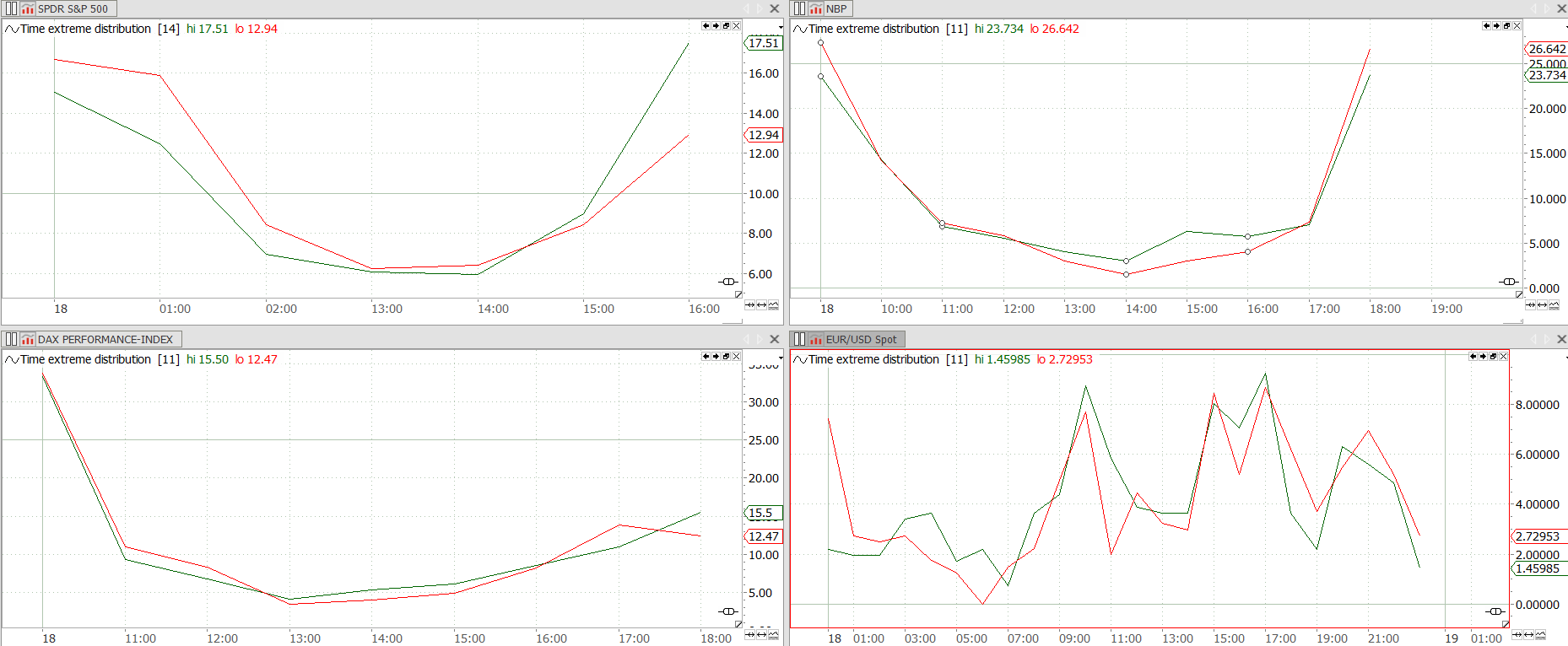

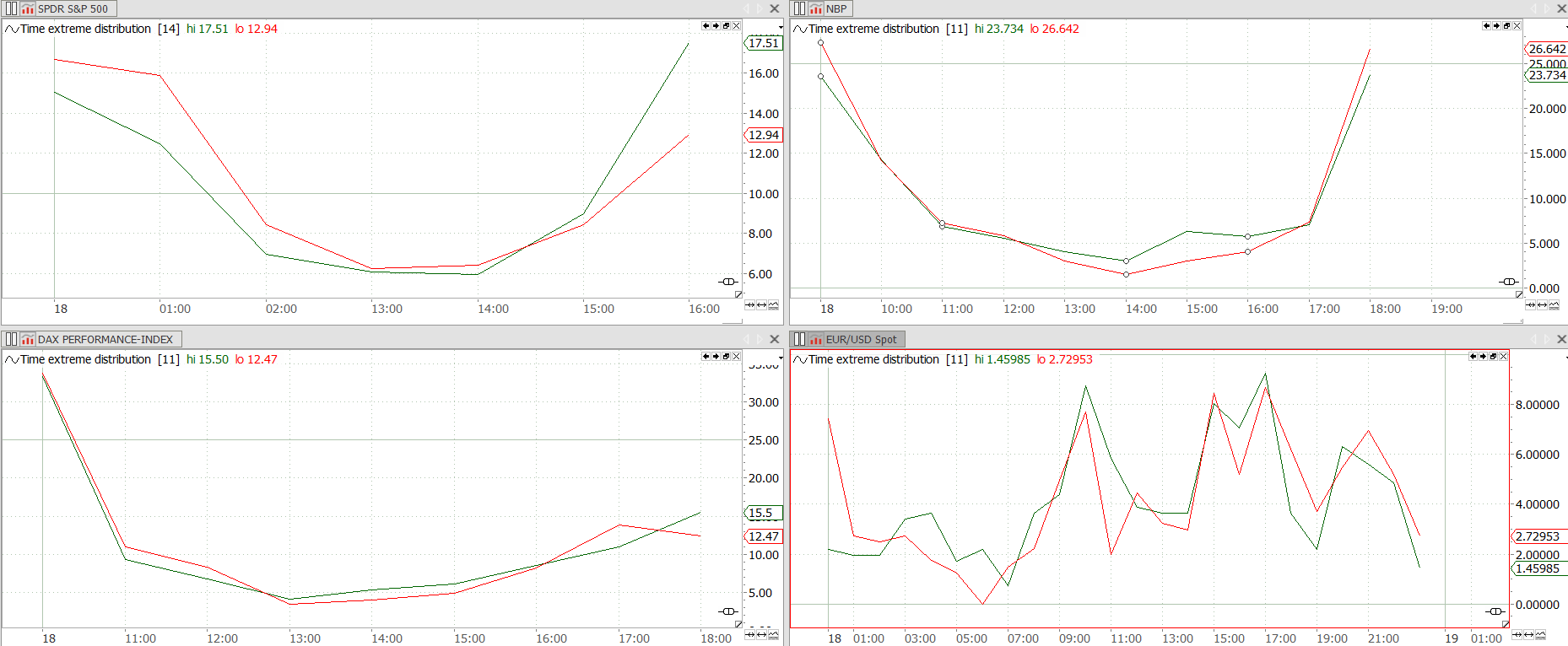

The chart above shows the probability of making the daily high or low at a specific hour of trading. All analysis is done in German timezone.

The top left chart shows the time-extreme distribution for the SPY. It can clearly been seen, that the probability of marking the daily high or low is highest in the first and last hours of trading. The same is true for NBP, the chart on the upper right. Like SPY NBP shows a great likelihood to mark the daily high or low in the first or last hour of trading. Thus, if a new extreme value is shown later in the trading session, this will likely end in an extreme opposite the one build in the morning. A new high in the afternoon, after a weak start, leads to a higher high. This can be used for trading.

Trading the Time Probabilities

German DAX Index, the chart in the lower left corner, shows a different behaviour. It basically catches up with the late night American and overnight Asian movement in the morning, and then keeps within it’s firs hours range. No big hope at the end of the index session, as the american markets usually just open where the Europeans close. The DAX futures will show a different behaviour, as their trading time also incorporates the american trading.

EURUSD, the chart in the lower right corner, shows a different pattern. As it trades 24 hours a day, the significance of the different session can be seen on the chart. Over night only a few new highs or lows are marked. They are marked between 8 and 9 in the morning, when the European traders come into office, and in the afternoon between 3 and 5, when economic data is released.

Opening Range breakout trading

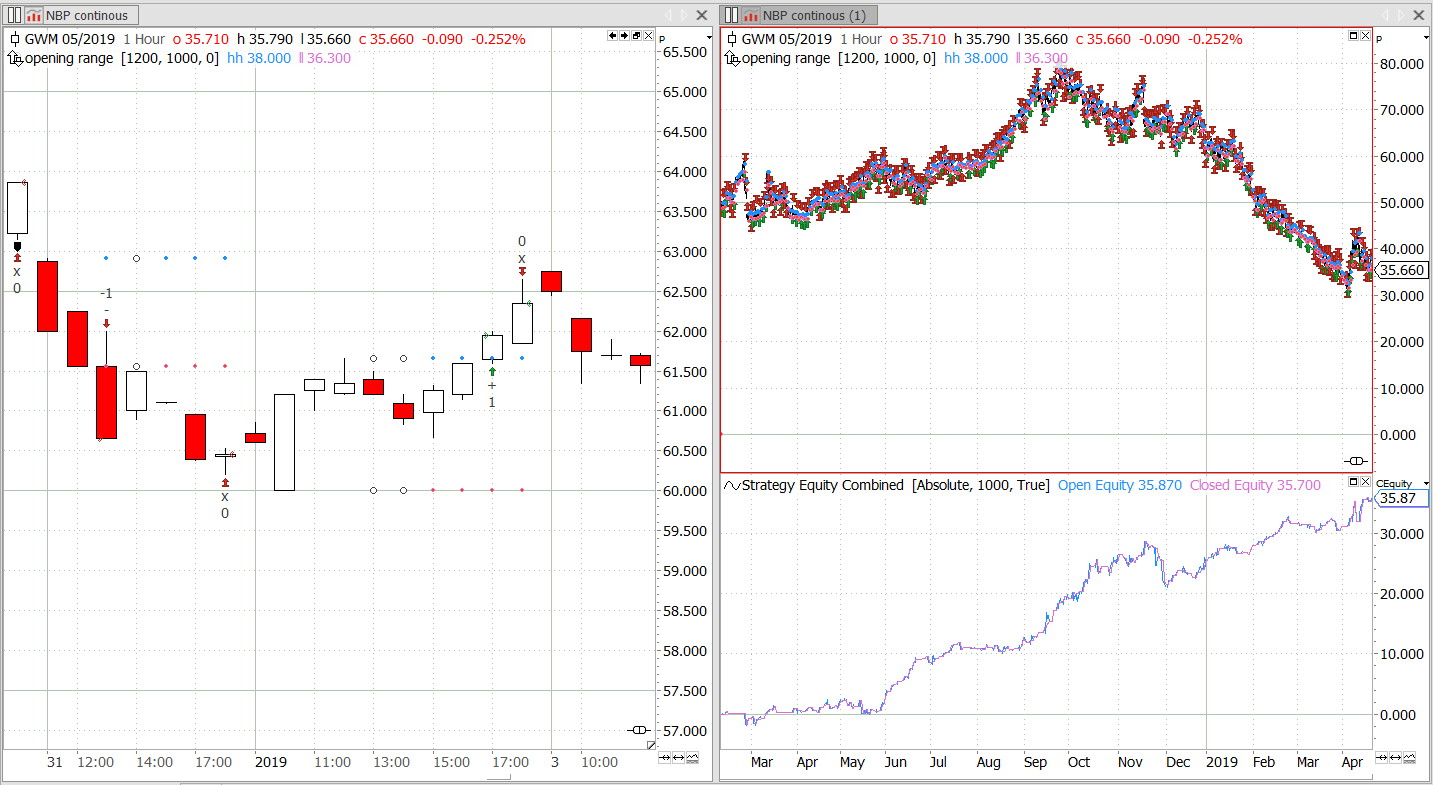

A simple opening range breakout strategy makes uses of the pattern shown above. It waits for the first third of the session, and takes a position if a new high or low is build afterwards.The trade is closed at the end of the day.

As NBP has a high probability of closing either at the high or low of the day an exit at the end of the session makes sense. Also waiting until the first third of the session is over is useful, as there is a high probability that either the high or the low has been established. If one of these points is crossed in the second part of the session, the probability is high that the market will keep it’s direction. Both observations are made on the time distribution diagram and translated into a trading strategy.

A link to a Tradesignal implementation of a time based breakout strategy for SPY: https://bit.ly/2PDkfmH

A link to a different opening range breakout strategy from Perry Kaufmann (in German): opening range breakout strategy

The analysis has been done using the tradesignal software suite.

1 comment

Comments are closed.