As an option seller you want the market to stay within the range prognosticated by implied volatility. But what is the historic probability that markets behave as expected? And what other analysis could be done to enhance your chances?

Tag: Speculation

Daily Extremes – Significance of time

Analysing at which time daily market extremes are established shows the significance of the first and last hours of market action. See how different markets show different behaviour and see what can be learned from this analysis.

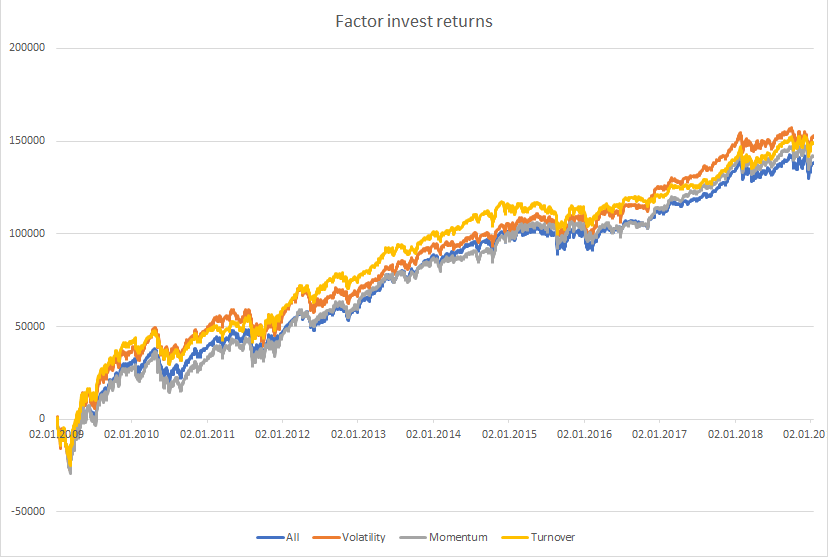

Factor investing in portfolio management

Factor investing has been around in portfolio management for some years. Based on algorithmic rules it became the big thing in trading and the ETF industry. But is there still some money to be made? Is small beta still smart or just beta? This article will give you a Tradesignal framework to test the factor… Continue reading Factor investing in portfolio management

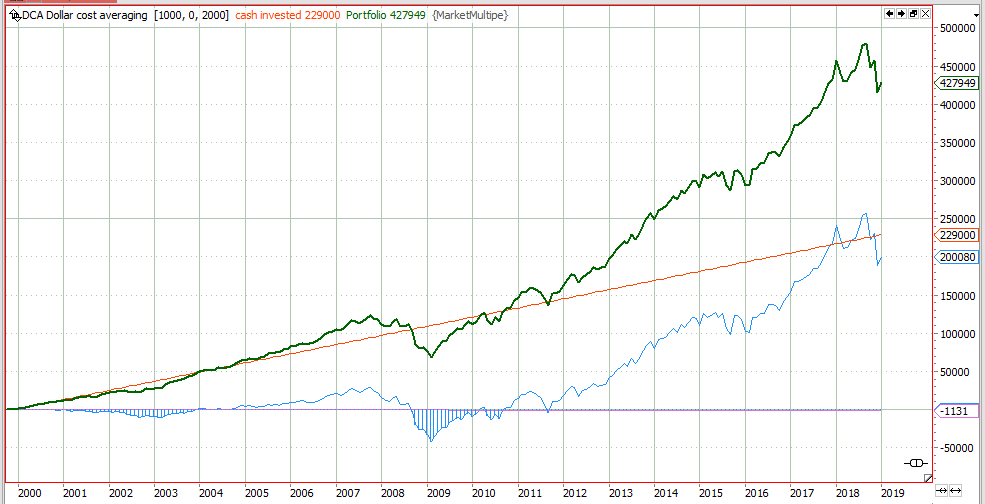

Dollar Cost Averaging Investment Strategy – success based on luck?

The dollar cost averaging investment strategy doubled your savings over the last 20 years, but will it continue to perform? See the facts.

Historic Bear Markets & Crashes (business as usual)

Since S&P500 has lost 20% from its top in 2018 and everybody is talking about bear markets. See what has happened in history.

Pears Global Real Estate – calling the devil by its name

Maximising the net yield for the Pears family, 33 Cavendish Square, London, W1G 0LB, United Kingdom, is destroying local neighbourhoods. May they choke on their money!

Bullish? Buy stock or sell put option?

Is it more favourable to buy shares directly or to get assigned from a short put position. See the arguments and learn how to decide this question.

The average move of a market

Markets have a high degree of randomness (and madness), but there are some things which hardly change over time. One is the width of an average market move before a counter-move can be observed.

Market crash or market correction?

The difference between a crash and a market correction. VIX and realized volatility give the answer

IV Percentile – when to sell volatility

IV percentile and IV rank both describe implied volatility. Which one is better in finding out if it is time to sell volatility? Read the answer in this article

Bet on Bollinger

Ever since John Bollinger introduced his Bollinger Bands in the early 1980s the bands have been a favourite indicator to all technical trades. This article is about the prediction capabilities of Bollinger bands.

Scanning for Support and Resistance Probabilities

Scanning a market for support and resistance levels which will most likely not be penetrated in the near future is key for strategies like short options or vertical spreads. This article hows how RSI can be used to solve this problem.

Backtesting Market Volatility

Backtesting if historical volatility or Kahler’s volatility gives a better prognosis for future volatility. Calculating the average prediction error of these two volatility indicators. Testing for the influence of data points used on the quality of the prediction. Comparing the findings to implied volatility to generate a trade idea.

Demystifying the 200 day average

The 200 day moving average is a classic of technical analysis. but is there any edge or statistical significance in it? How do equity and Forex market differ when it comes to this indicator? See the analysis and the answer to these questions.

Money for nothing

We already had a post regarding the mean reverting tendency of Volatility, now it`s time to make some money using this information.

Seasonal trouble ahead

Seasonal Projection and Volatility prognosis for german DAX. Trouble ahead…

KVOL Volatility part 2

How to calculate volatility based on the expected return of a straddle strategy has been shown in part 1 of fair bet volatility KVOL. Using and Displaying K-Volatility: KVOL uses the given amount of historic returns to calculate an expected value of an at the money put and call option. The sum of these prices are… Continue reading KVOL Volatility part 2

Statistics of VIX

This article is about the statistics of VIX. What determines if it is better to sell or to buy volatility. Some simple statistics can provide the answer and also show the dangers of this kind of volatility trade.

A graphical approach to indicator testing

Scatter charts are a great tool to test the prognosis quality of your indicators. A visual approach on indicator quality can help you to get rid of curve fitting when using classical or machine learning trading strategies.

Machine learning: kNN algorithm explained

Can inspiration be replaced by brute force? This article shows how to program and possibly use a simple kNN algorithm to trade Brent. A two dimensional data set will be used. RSI will determine if tomorrows market will move up or down.