The stock market shows some astonishingly stable date based patterns. Using a performance heat map of the S&P500 index, these patterns are easily found.

Date based performance

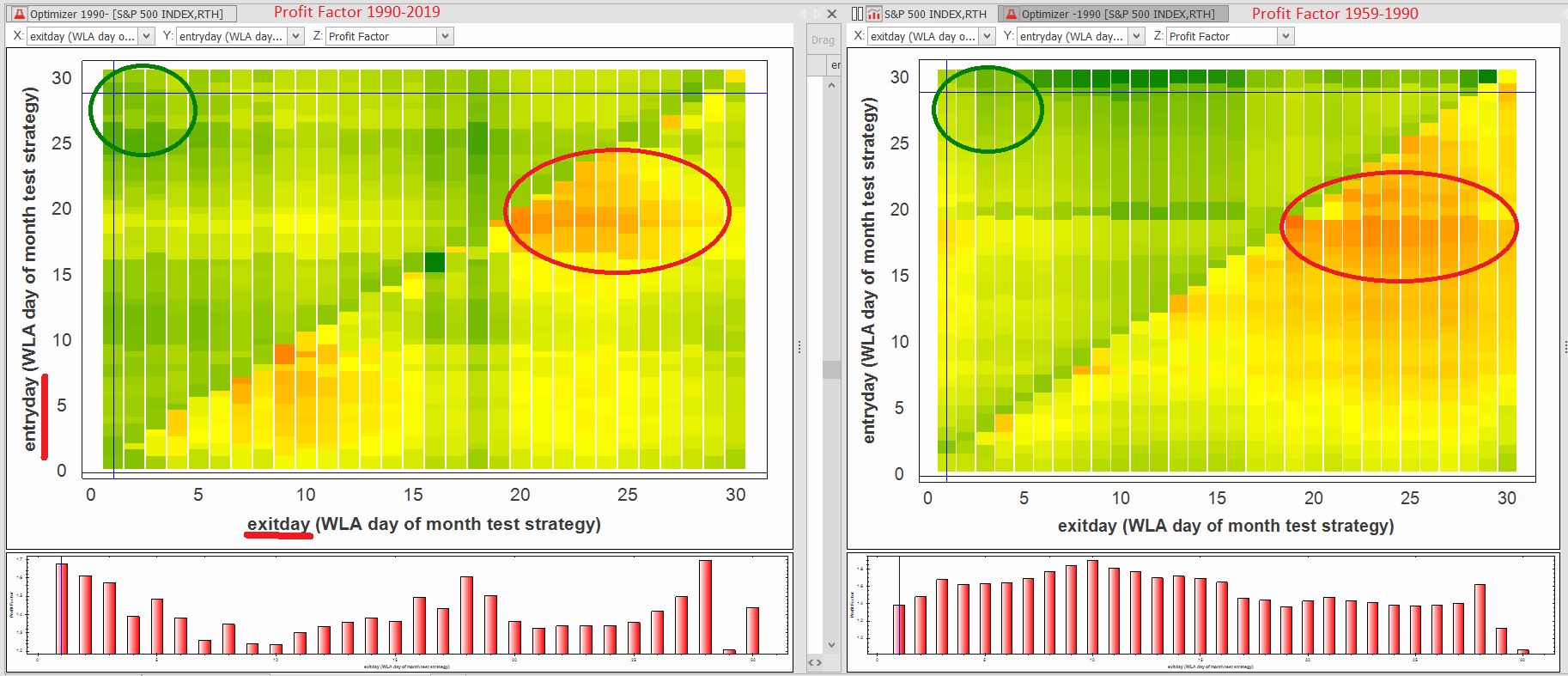

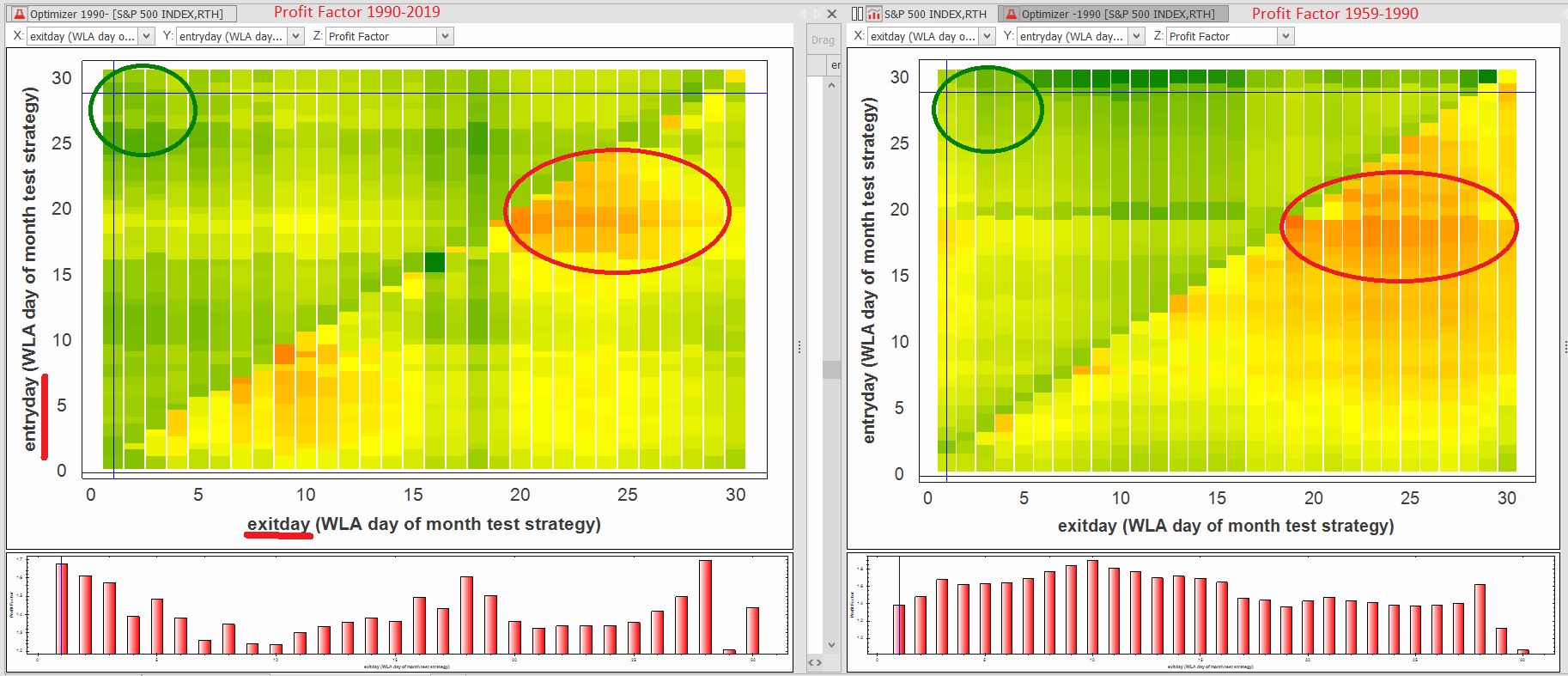

The chart below shows the profit factor of a long only strategy investing in the S&P500. Green is good, red is bad. The strategy is strictly date based. It always buys and sells on specific days of the month.

On the axis you see the entry and exit days. As an example, entering between the 25th and 30th and exiting between 1st and 5th (green circled area) would have been a profitable trading strategy.

This end-of-month effect has been a stable phenomena since the begin of this backtest in 1960. The left heat map on the left shows the profit factor of this long only trading strategy from 1960-1990, the right chart shows the profit factor from 1990-2019.

Days to invest, days to avoid

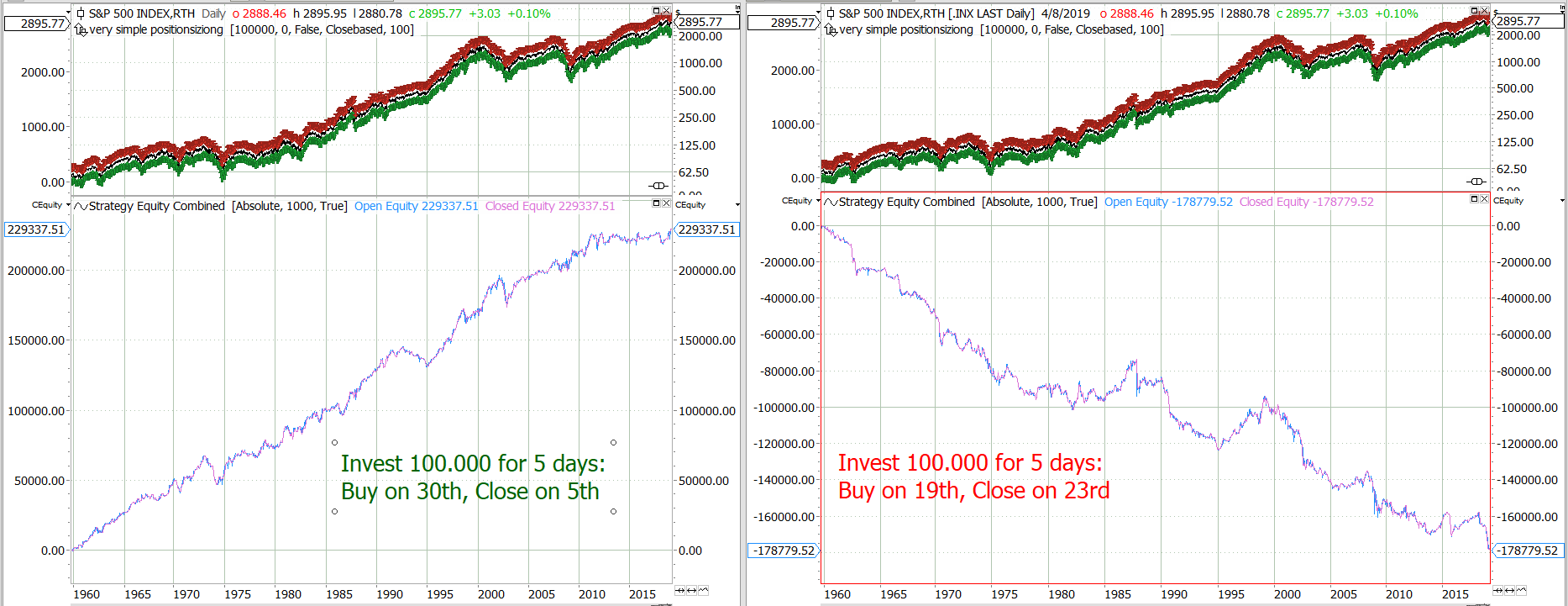

How severe the impact of the right holding dates can be, is shown on the next chart. It makes uses of the above heat map and shows the returns of a strategy investing 100.000$ for one week per month (no re-invest)

The chart shows the absolute return of this date bases strategy, depending on the dates chosen.

That picking the wrong week even leads to a loss (long-only strategy in bull a market!!) is really shocking. The positive news is, that the end-of-month effect shown on the left chart, has given stable results since the sixties.

so better test before you invest…

__

I originally posted this idea over here. Please see this article for further examples of date based patterns and the strategy codes. thank you!

The analysis has been done using the tradesignal software suite.

The text and orientation for the heatmaps do not match–they are reversed. Assuming the ‘Profit Factor…..’ overlays on the maps are correct, 1990-2019 is on the LEFT. Very nice demonstration of the phenomenom! Thank you!

oops, thanks for the feedback!