Markets have a high degree of randomness (and madness), but there are some things which hardly change over time. One is the width of an average market move before a counter-move can be observed.

The average move of a market

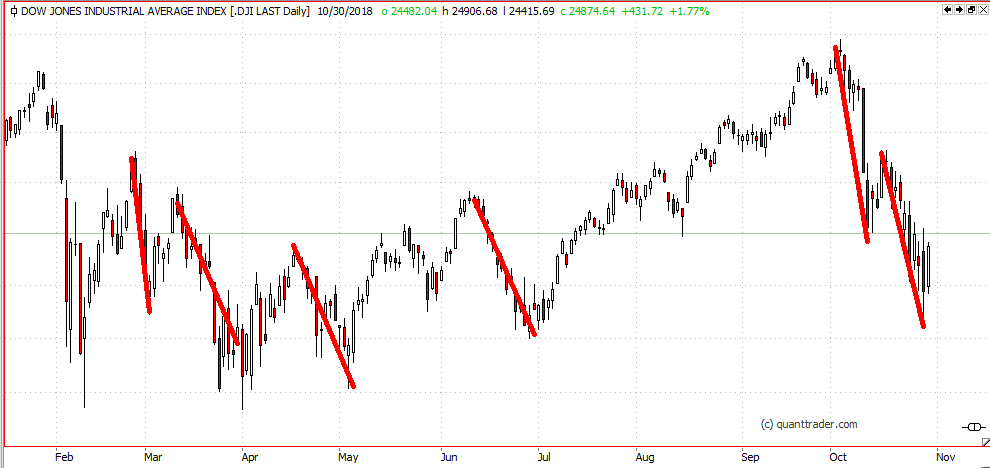

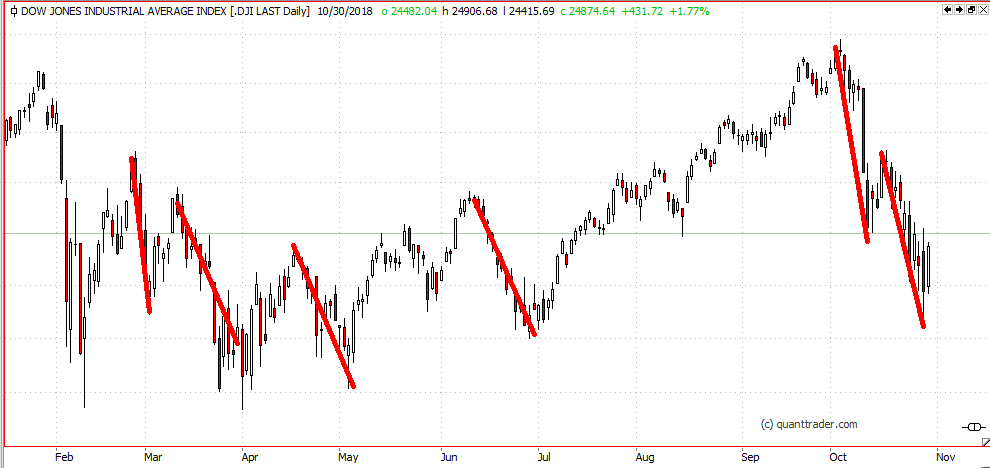

As shown on the screenshot above, the last major moves in Dow Jones all had about the same magnitude. I can not give a cause for this behaviour, it is just an observation.

Technical analysis has made use of this wisdom for the last 100 years, so let`s see if we can use this highly subjective measurement in a more standardised, algorithmic way.

Algorithmic test of wide of moves

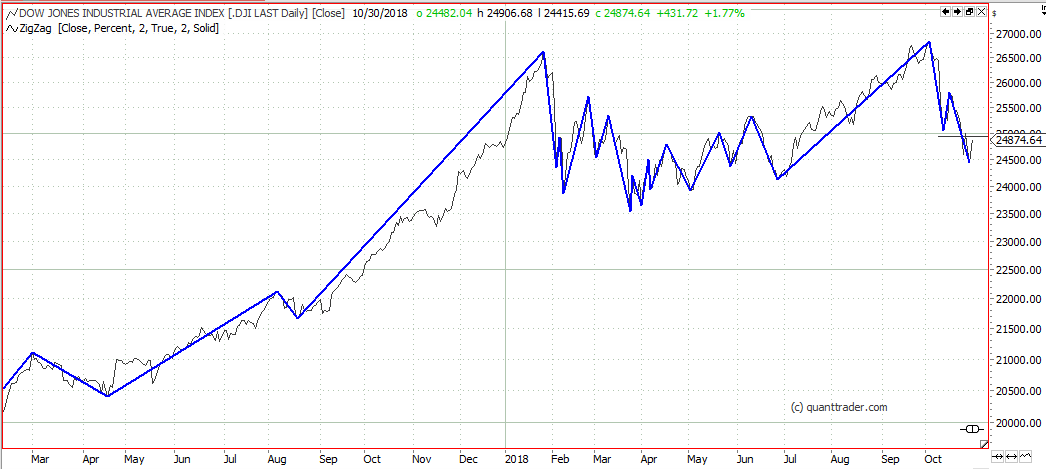

To do an algorithmic test of the average width of an up or down move, the Zig-Zag indicator is a fabulous starting point. This indicator is always drawn from a swing high to a swing low, and it has a filter setting to filter minor counter moves.

The chart below shows the Dow Jones Index with the Zig-Zag indicator, filtering all moves less than 2%. Filtering all minor moves shows the market structure. But unfortunately this also adds a significant delay to this indicator. It looks good in history, but is hardly useful in real time. As an example, the low shown at the end of the chart is not fixed by now. Only if the market moved up more than 2% (on close to close basis), the low around 24500 would be fixed. But then it is most probably too late to enter into a long trade…

The average down move of Dow Jones Index

So instead of asking myself what the current market structure might be, I will use this indicator to calculate the average length of a market move. A later post will show the distribution of the length of market moves.

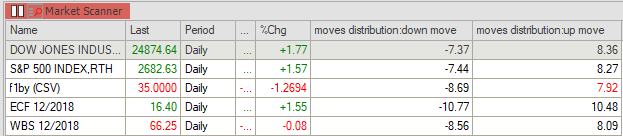

The screenshot above shows the average up and down move of the market, when the Zig-Zag noise filter is applied. The bottom line gives you the width of the average down move, if all moves less than 5% are removed.

On average, since 1897, the Dow Jones Index experienced a 13% down move, before an at least 5% up move could be expected.

If Dow Jones would be normal distributed, the average width of an up or down move would be equal. But as we had a strong up movement since 1897 (start of analysis) the average up moves are somewhat higher than the down moves.

Analysis of width of market moves

Knowing how far the market can travel without a significant reversal (the filter setting) helps in developing realistic scenarios for the future. Knowing these numbers for your market and time frame is key to placing appropriate stops and targets.

Below are the results for an average market move with a 3% noise filter applied for Dow, S&P, German Power, Emissions and WTI crude. I used 10 years of data for this analysis. Contact me for other market/counter move settings.

keep researching…

The analysis has been done using the tradesignal software suite.