When developing a new trading strategy you are usually confronted with multiple tasks: Design the entry, design the exit and design position sizing and overall risk control. This article is about how you can test the edge of your entry signal before thinking about your exit strategy. The results of these tests will guide you… Continue reading The Edge of an Entry Signal

Category: Trading Strategies

The Probability of Normality

As an option seller you want the market to stay within the range prognosticated by implied volatility. But what is the historic probability that markets behave as expected? And what other analysis could be done to enhance your chances?

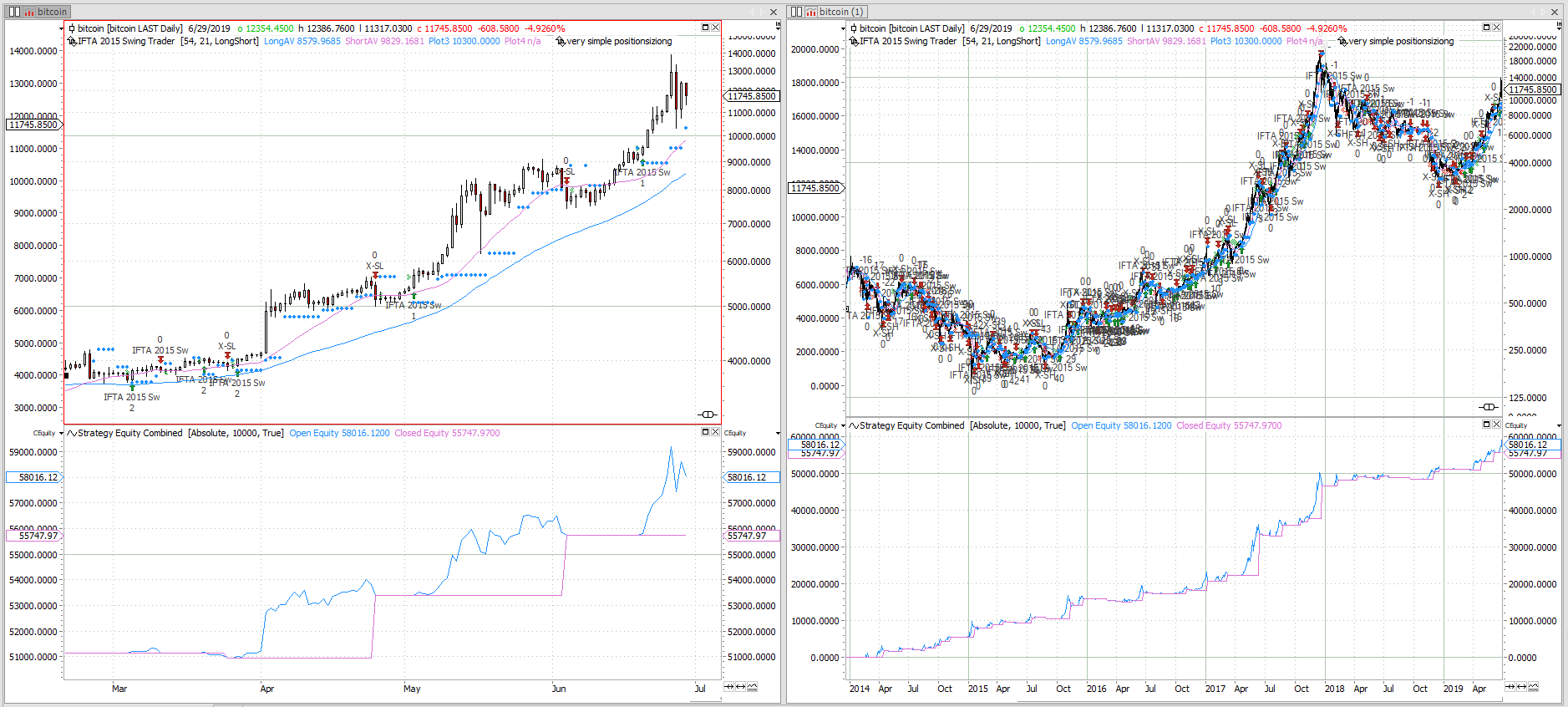

Bitcoin Swing Trading

A simple bitcoin Swing Trading strategy originally published in 2015. See the out of sample performance and how it is done.

The Edge of Technical Indicators

Technical indicators are the basis of all algorithmic trading. But do these really give you an edge in your market? Are they able to define the times when you want to be invested? This article will show you a way to quantify and compare the edge of technical indicators.

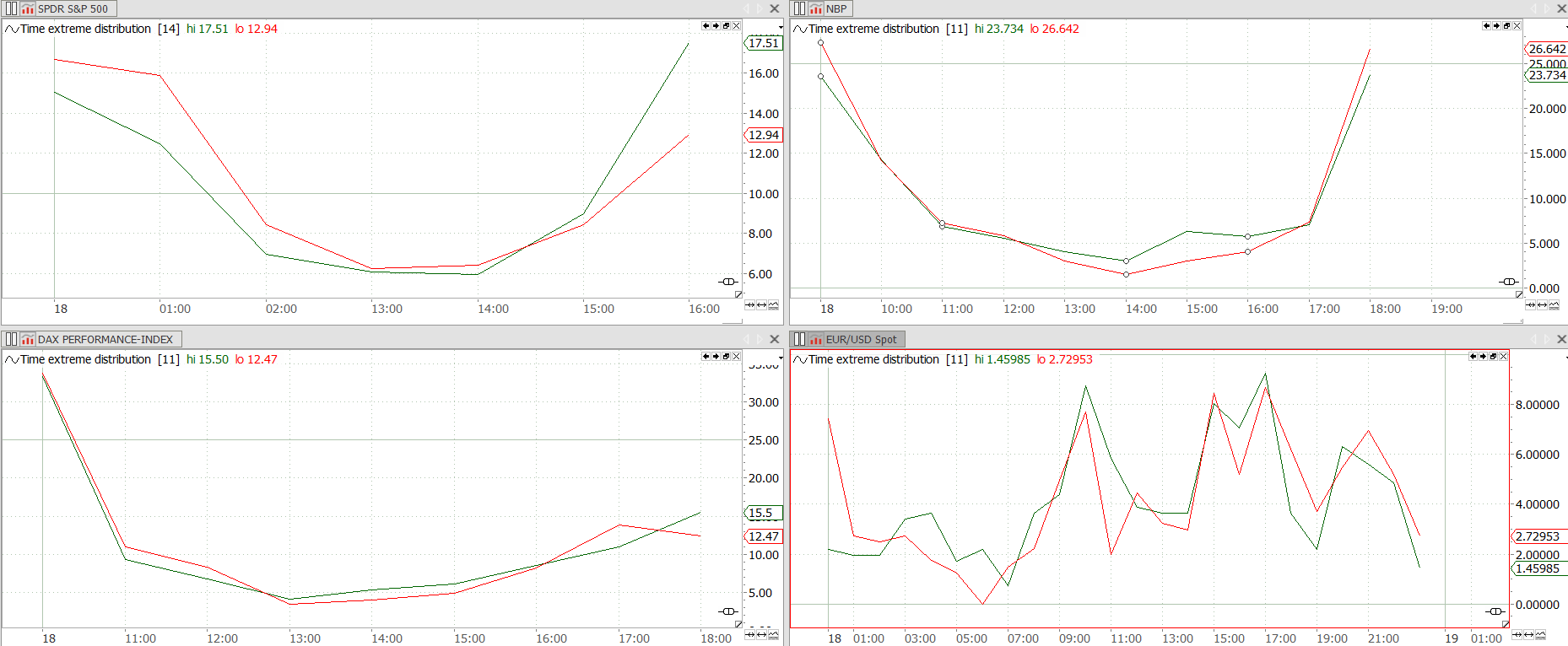

Daily Extremes – Significance of time

Analysing at which time daily market extremes are established shows the significance of the first and last hours of market action. See how different markets show different behaviour and see what can be learned from this analysis.

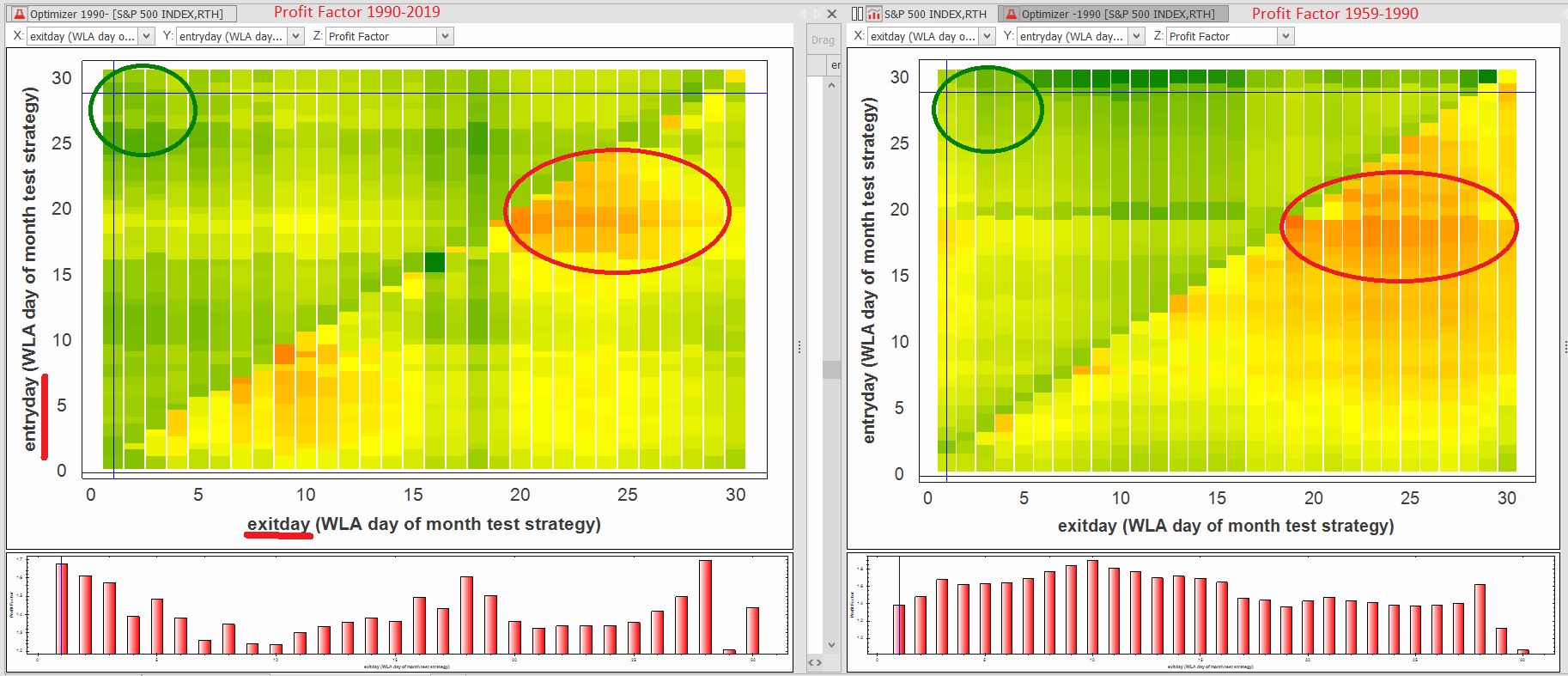

S&P500 – when to be invested

The stock market shows some astonishingly stable date based patterns. Using a performance heat map of the S&P500 index, these patterns are easily found. Date based performance The chart below shows the profit factor of a long only strategy investing in the S&P500. Green is good, red is bad. The strategy is strictly date based.… Continue reading S&P500 – when to be invested

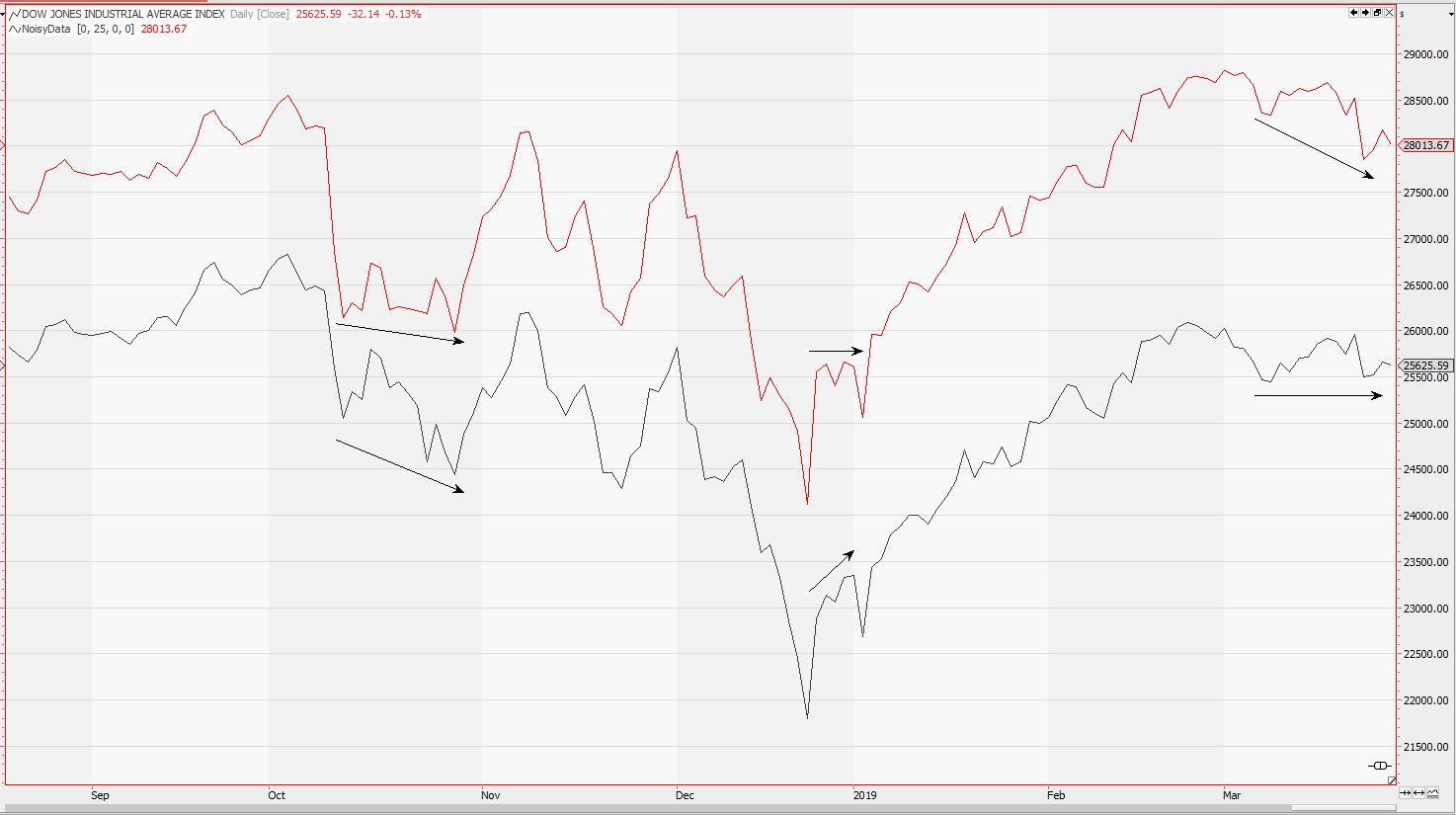

Noisy Data strategy testing

Algorithmic trading adds noise to the market we have known. So why not add some noise to your historic market data. This way you can check if your algorithmic trading strategies are fit for the future. Learn how to generate noisy data and how to test your strategies for stability in a noisy market.

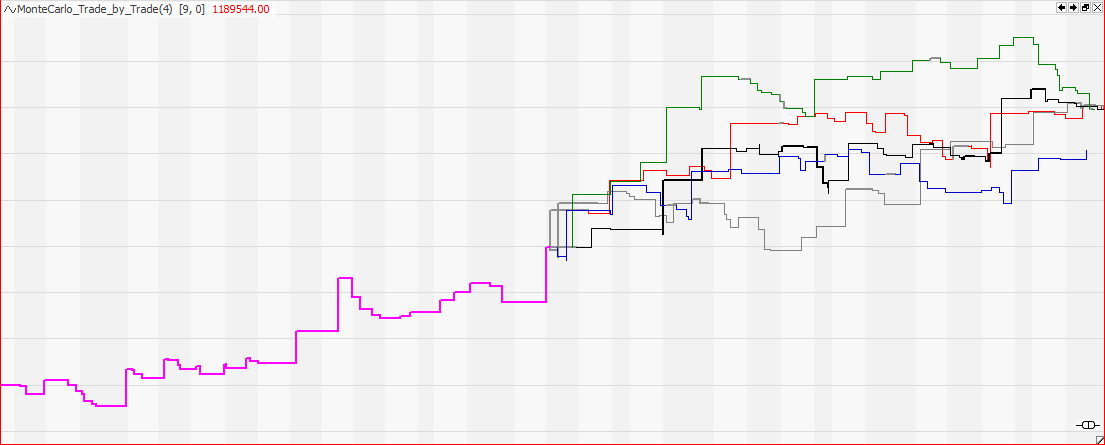

Monte Carlo Simulation of strategy returns

Monte Carlo Simulation uses the historic returns of your trading strategy to generate scenarios for future strategy returns. It provides a visual approach to volatility and can overcome limitations of other statistical methods. Monte Carlo Simulation

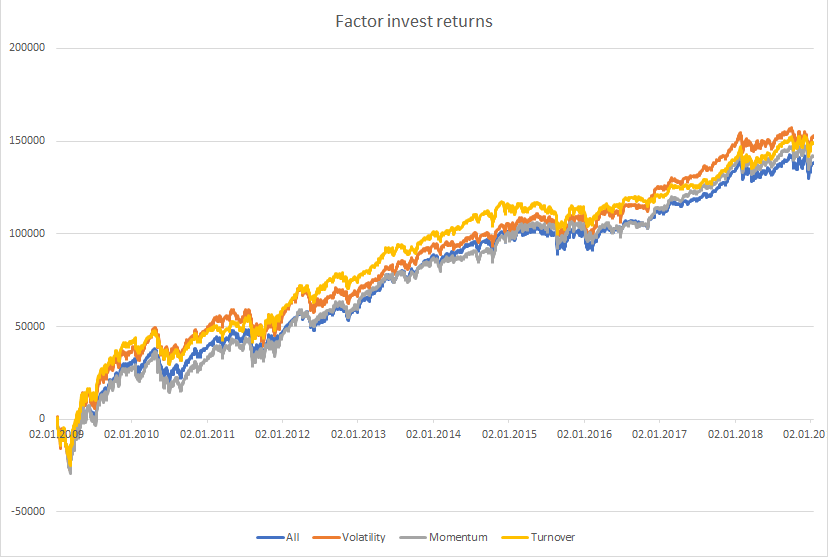

Factor investing in portfolio management

Factor investing has been around in portfolio management for some years. Based on algorithmic rules it became the big thing in trading and the ETF industry. But is there still some money to be made? Is small beta still smart or just beta? This article will give you a Tradesignal framework to test the factor… Continue reading Factor investing in portfolio management

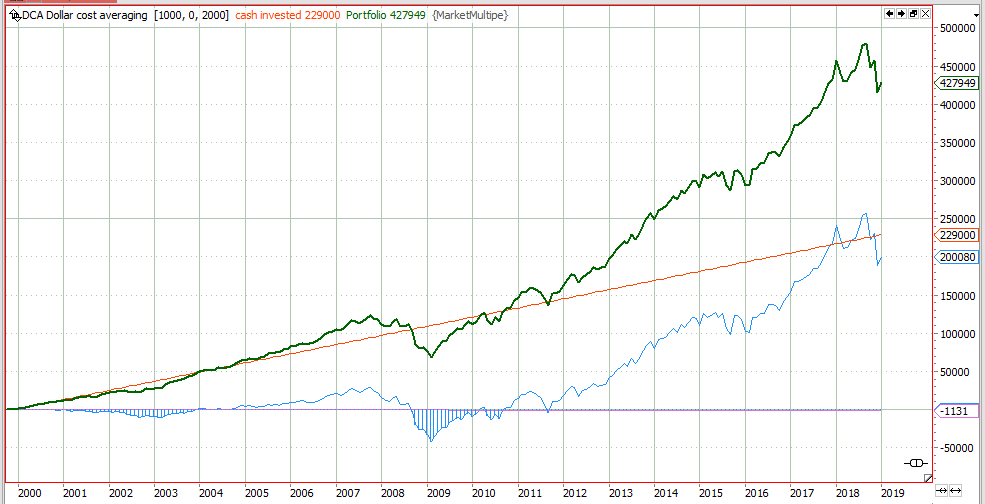

Dollar Cost Averaging Investment Strategy – success based on luck?

The dollar cost averaging investment strategy doubled your savings over the last 20 years, but will it continue to perform? See the facts.

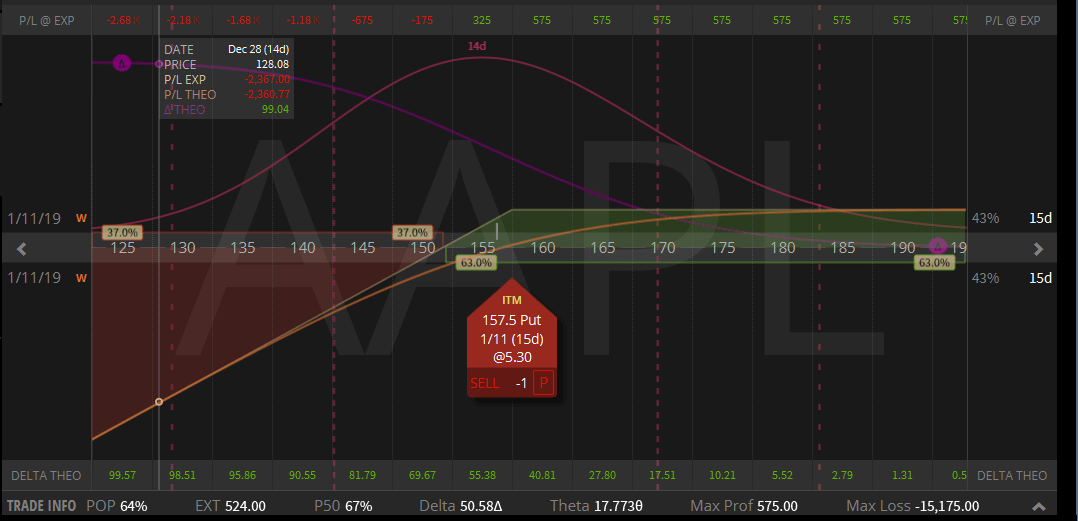

Bullish? Buy stock or sell put option?

Is it more favourable to buy shares directly or to get assigned from a short put position. See the arguments and learn how to decide this question.

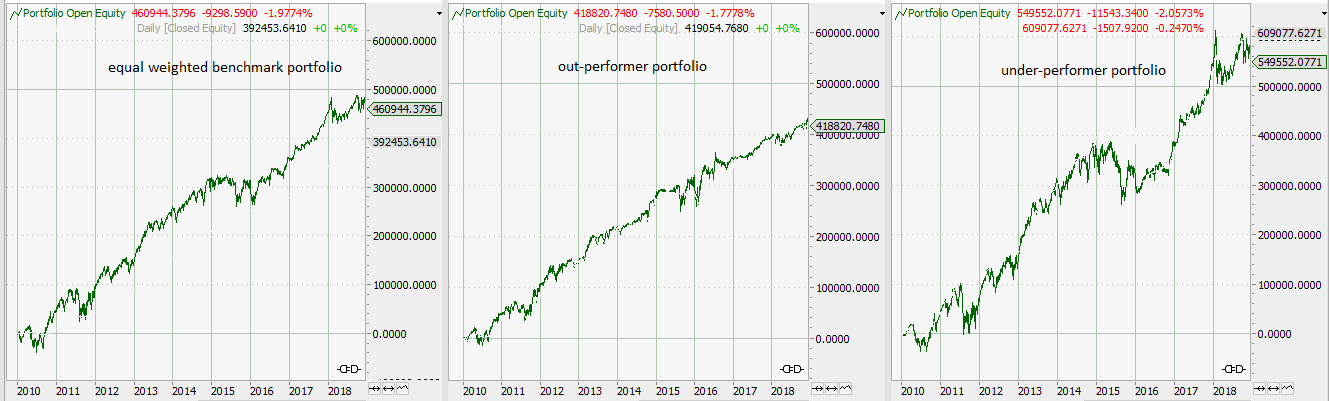

An Algorithmic Stock Picking Portfolio

A volatility and return based stock picking algorithm. Portfolio construction, picking criteria and the ideas behind this approach. Excess returns of your portfolio against an equally weighted index portfolio.

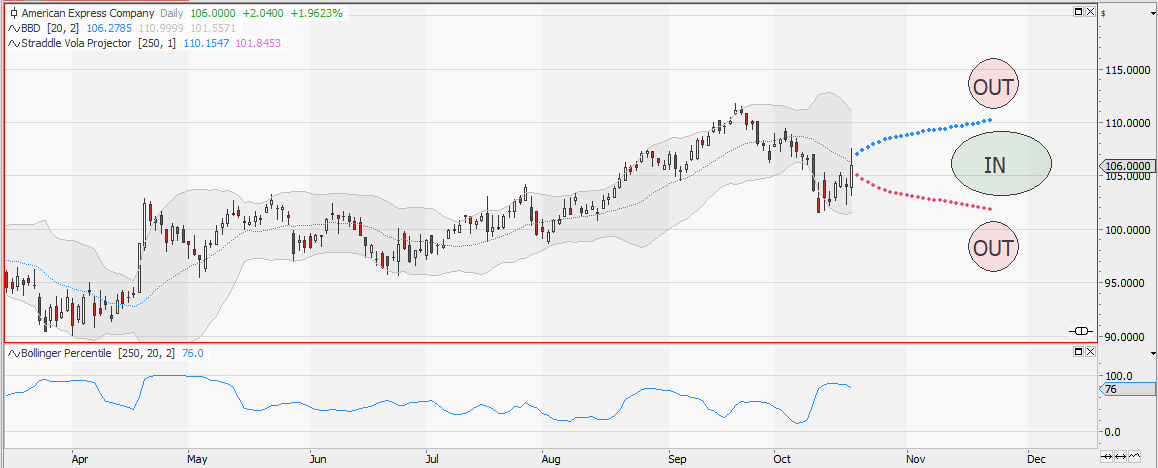

Bollingerband: The search for volatility

Will the market stay within it’s normal distribution range or will there be a breakout of this range? The Bollinger percentile indicator will give the answer.

Tradesignal Implied Volatility and IV Percentile Scanner

Use free data from the web and load it into Tradesignal to scan for implied volatility and IV percentile. Full code given for free

IV Percentile – when to sell volatility

IV percentile and IV rank both describe implied volatility. Which one is better in finding out if it is time to sell volatility? Read the answer in this article

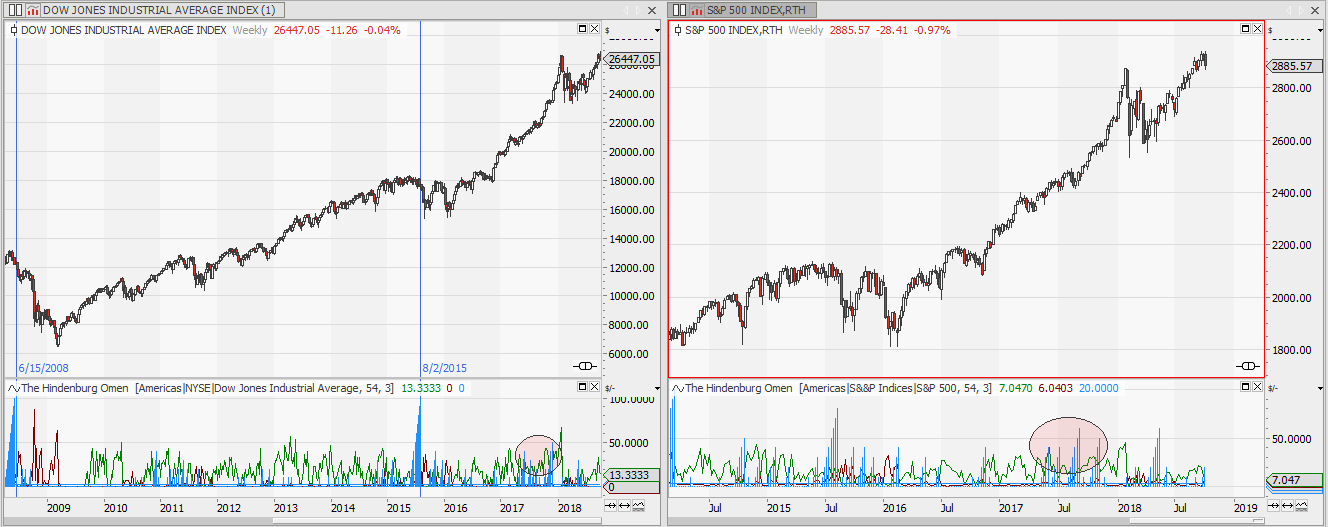

The Hindenburg Omen – Stock Market Crash Ahead?

The Hindenburg Omen is a market breadth indicator analyzing new highs and lows on the market. It signals the end of the current bull market. Tradesignal Indicator Code is provided

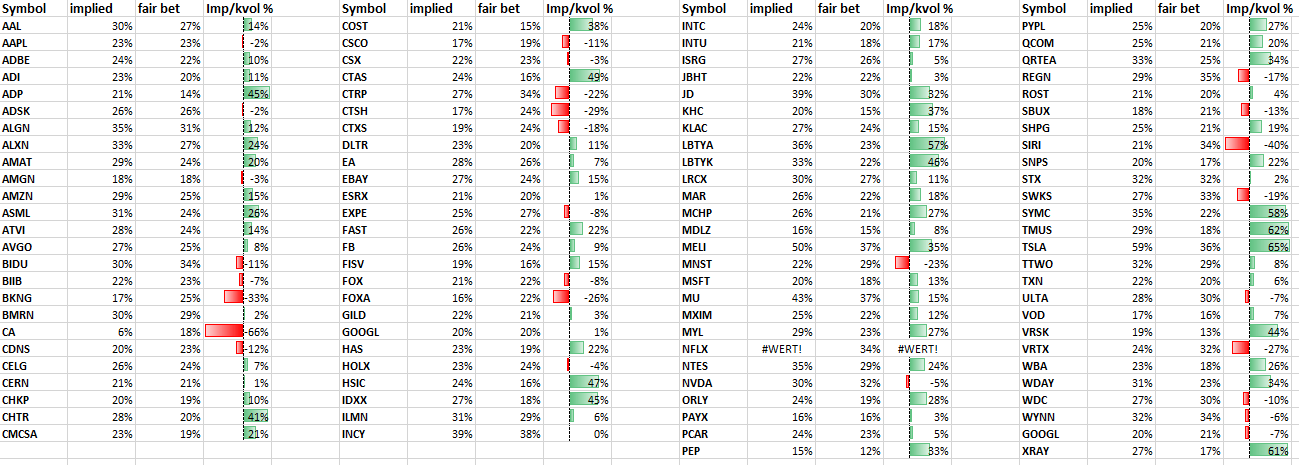

Implied vs. Realized Volatility for NASDAQ100 stocks

Comparing implied volatility to realized volatility can show you the right stocks to sell volatility. An overview over the implied and long term realized volatility of NADAQ100 stocks is given.

Scanning for Support and Resistance Probabilities

Scanning a market for support and resistance levels which will most likely not be penetrated in the near future is key for strategies like short options or vertical spreads. This article hows how RSI can be used to solve this problem.

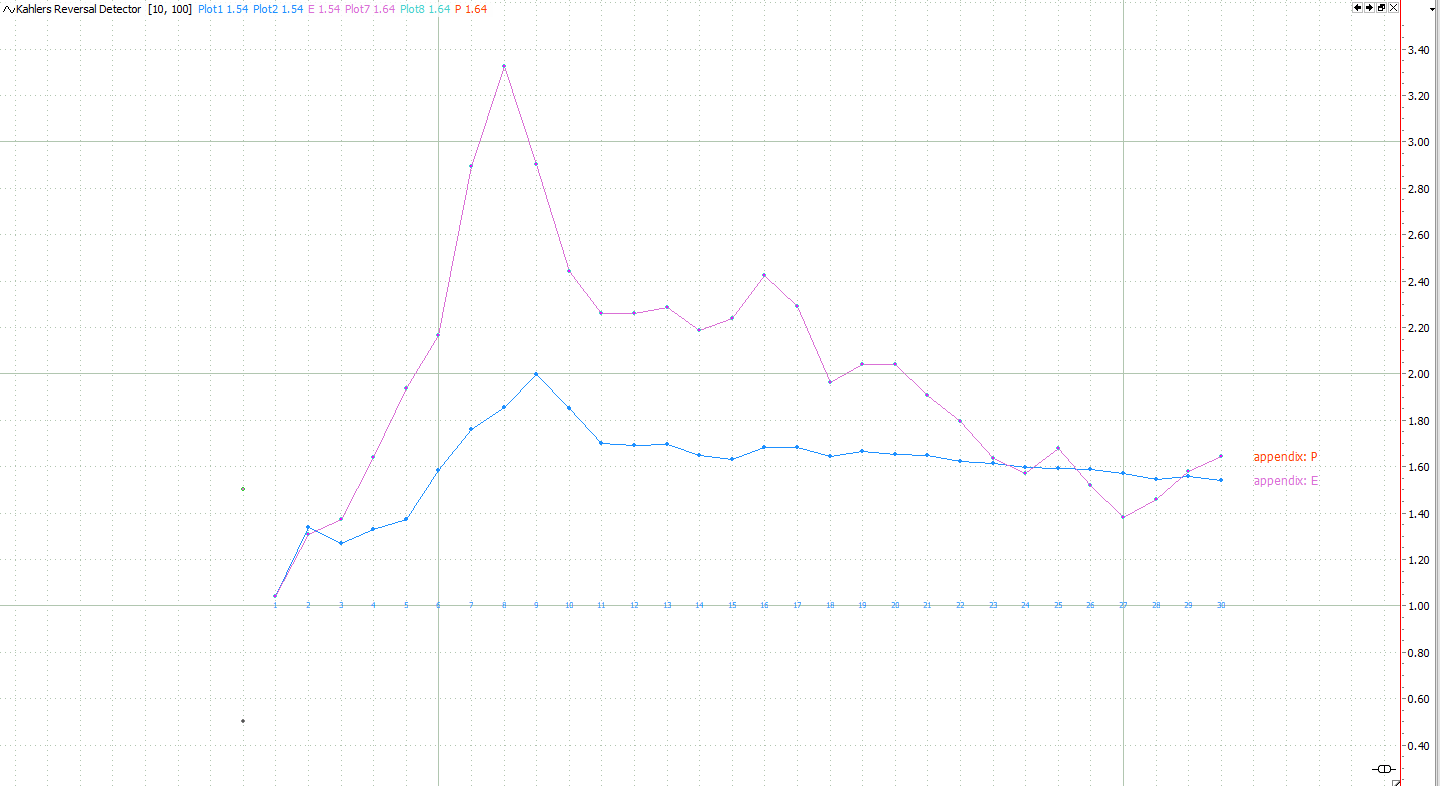

Backtesting Market Volatility

Backtesting if historical volatility or Kahler’s volatility gives a better prognosis for future volatility. Calculating the average prediction error of these two volatility indicators. Testing for the influence of data points used on the quality of the prediction. Comparing the findings to implied volatility to generate a trade idea.

Demystifying the 200 day average

The 200 day moving average is a classic of technical analysis. but is there any edge or statistical significance in it? How do equity and Forex market differ when it comes to this indicator? See the analysis and the answer to these questions.