A simple bitcoin Swing Trading strategy originally published in 2015. See the out of sample performance and how it is done.

Tag: Strategy

The Edge of Technical Indicators

Technical indicators are the basis of all algorithmic trading. But do these really give you an edge in your market? Are they able to define the times when you want to be invested? This article will show you a way to quantify and compare the edge of technical indicators.

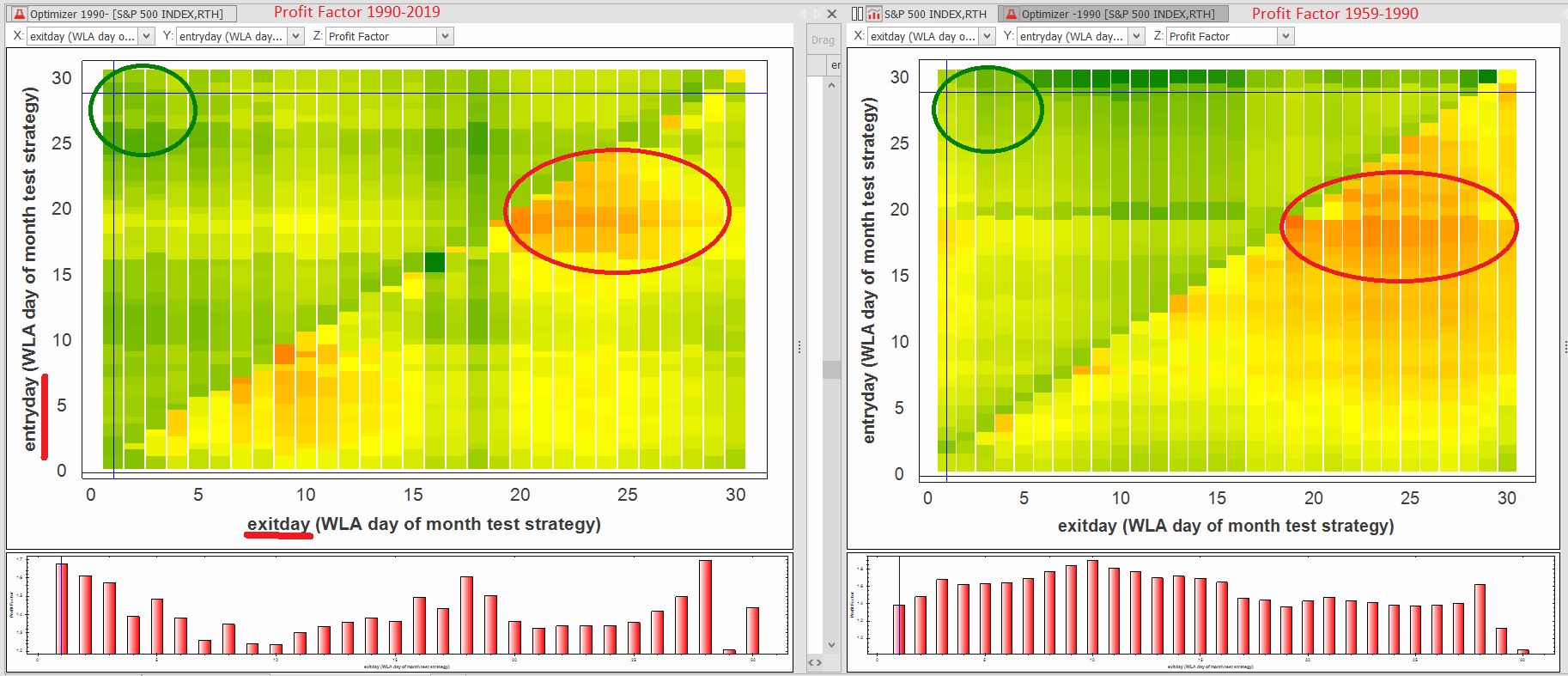

S&P500 – when to be invested

The stock market shows some astonishingly stable date based patterns. Using a performance heat map of the S&P500 index, these patterns are easily found. Date based performance The chart below shows the profit factor of a long only strategy investing in the S&P500. Green is good, red is bad. The strategy is strictly date based.… Continue reading S&P500 – when to be invested

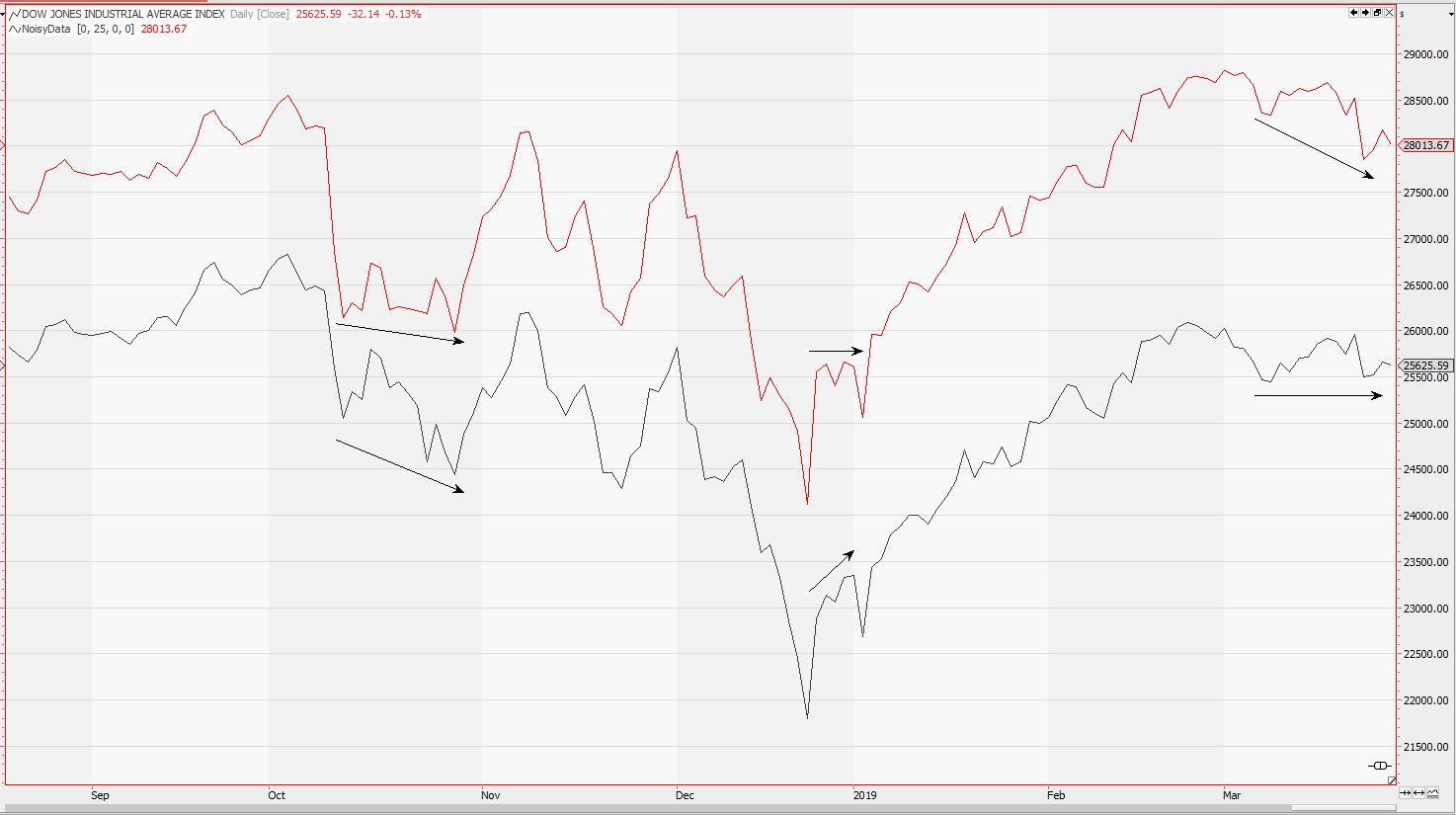

Noisy Data strategy testing

Algorithmic trading adds noise to the market we have known. So why not add some noise to your historic market data. This way you can check if your algorithmic trading strategies are fit for the future. Learn how to generate noisy data and how to test your strategies for stability in a noisy market.

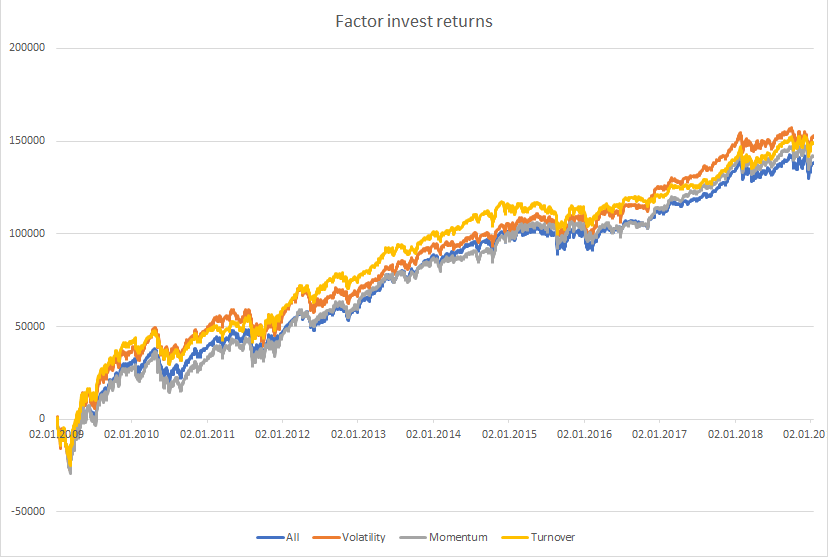

Factor investing in portfolio management

Factor investing has been around in portfolio management for some years. Based on algorithmic rules it became the big thing in trading and the ETF industry. But is there still some money to be made? Is small beta still smart or just beta? This article will give you a Tradesignal framework to test the factor… Continue reading Factor investing in portfolio management

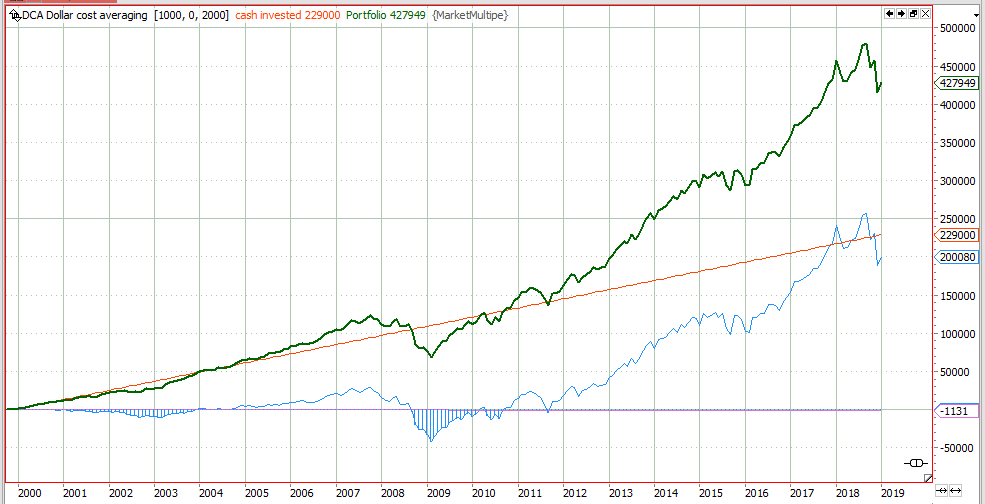

Dollar Cost Averaging Investment Strategy – success based on luck?

The dollar cost averaging investment strategy doubled your savings over the last 20 years, but will it continue to perform? See the facts.

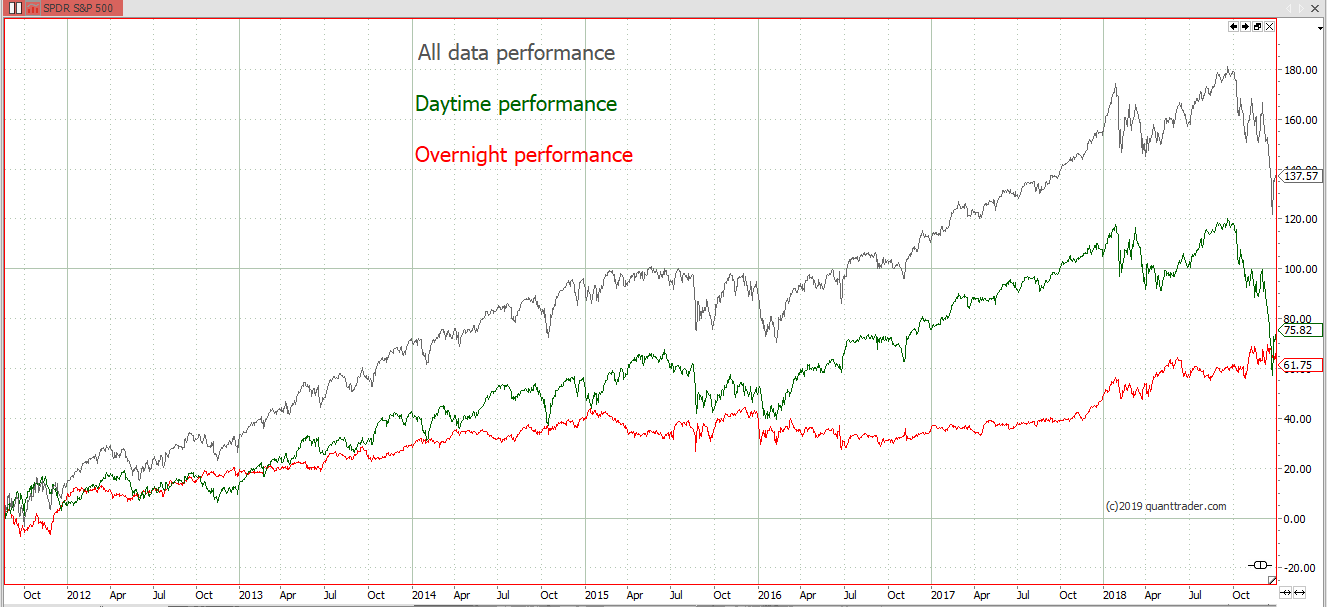

Overnight vs Daytime Performance & Volatility

Analysing the market performance of the day session vs. the overnight movement reveals some interesting facts. Daytime vs. Overnight Performance

Technical vs. Quantitative Analysis

Technical and quantitative analysis are two different types of market analysis. Both are based on price and historic market behaviour. Which is the one you should trust, which you should avoid?

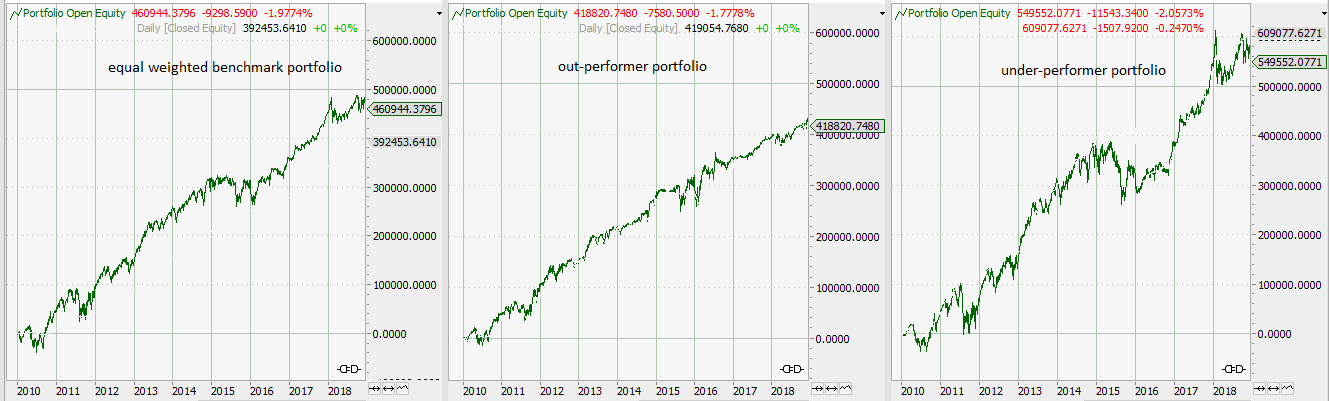

An Algorithmic Stock Picking Portfolio

A volatility and return based stock picking algorithm. Portfolio construction, picking criteria and the ideas behind this approach. Excess returns of your portfolio against an equally weighted index portfolio.

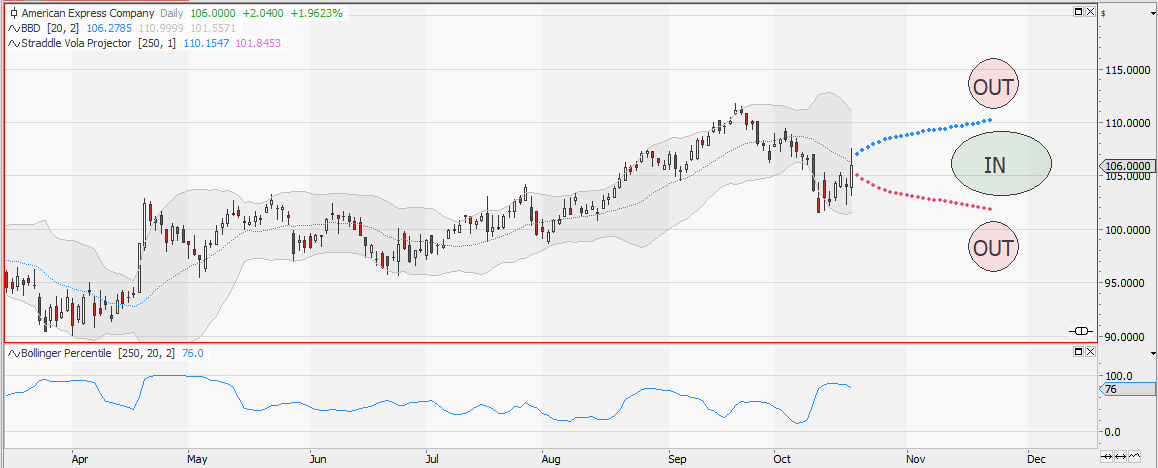

Bollingerband: The search for volatility

Will the market stay within it’s normal distribution range or will there be a breakout of this range? The Bollinger percentile indicator will give the answer.

Scanning for Support and Resistance Probabilities

Scanning a market for support and resistance levels which will most likely not be penetrated in the near future is key for strategies like short options or vertical spreads. This article hows how RSI can be used to solve this problem.

A graphical approach to indicator testing

Scatter charts are a great tool to test the prognosis quality of your indicators. A visual approach on indicator quality can help you to get rid of curve fitting when using classical or machine learning trading strategies.

Machine learning: kNN algorithm explained

Can inspiration be replaced by brute force? This article shows how to program and possibly use a simple kNN algorithm to trade Brent. A two dimensional data set will be used. RSI will determine if tomorrows market will move up or down.

Using Autocorrelation for phase detection

Autocorrelation is the correlation of the market with a delayed copy of itself. Usually calculated for a one day time-shift, it is a valuable indicator of the trendiness of the market. If today is up and tomorrow is also up this would constitute a positive autocorrelation. If tomorrows market move is always in the opposite… Continue reading Using Autocorrelation for phase detection

Ranking: percent performance and volatility

When ranking a market analysts usually pick the percent performance since a given date as their key figure. If a stock has been at 100 last year and trades at 150 today, percent performance would show you a 50% gain (A). If another stock would only give a 30% gain (B), most people now would… Continue reading Ranking: percent performance and volatility

Position sizing – the easy way to great performance

Working on your position sizing algorithm is an easy way to pimp an existing trading strategy. Today we have a look at an energy trading strategy and how the position sizing can influence the performance of the strategy. The screenshot shows you the returns of the same trading strategy, trading the same markets, the same… Continue reading Position sizing – the easy way to great performance

EEX Phelix Base Yearly – Buy Wednesday, short Thursday?

When it comes to simple trading strategies, the day of the week is surely one of the best things to start with. That’s nothing new when it comes to equity markets. Everybody knows about the calendar effects, based on when the big funds get and invest their money. I do not know about any fundamental… Continue reading EEX Phelix Base Yearly – Buy Wednesday, short Thursday?

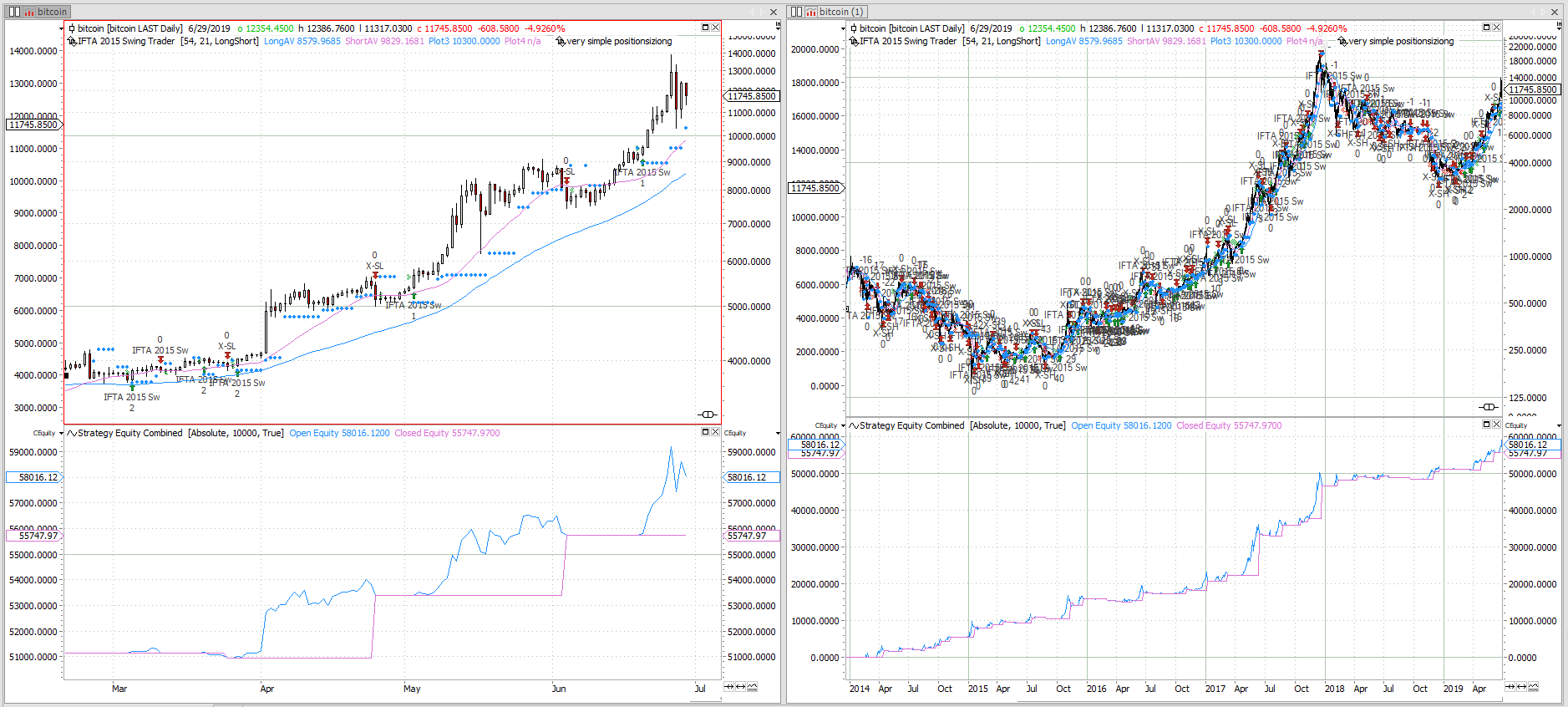

Bitcoin Trading Strategy – review of returns

Bitcoin is not as bullish as it used to be. May it be due to fundamental reasons like transaction cost and slow speed, or maybe the herd found a new playground, whatever it might be, it is a good time to have a look how my bitcoin trading strategy performed. The bitcoin trading strategy uses… Continue reading Bitcoin Trading Strategy – review of returns

The rhythm of the market

Usually we chart the market at it’s absolute level. But what, if we would just chart the net daily, weekly, monthly movement? Would this be an advantage? Would this show us new trading opportunities? The short answer is: Yes! The trend is not everything, and it seems to be of some significance for further movements,… Continue reading The rhythm of the market

Opening Range Breakout

Opening Range Breakout Strategie von Perry Kaufmann aus “Technical Analysis of Stocks & Commodities”