When developing a new trading strategy you are usually confronted with multiple tasks: Design the entry, design the exit and design position sizing and overall risk control. This article is about how you can test the edge of your entry signal before thinking about your exit strategy. The results of these tests will guide you… Continue reading The Edge of an Entry Signal

Tag: Indicator

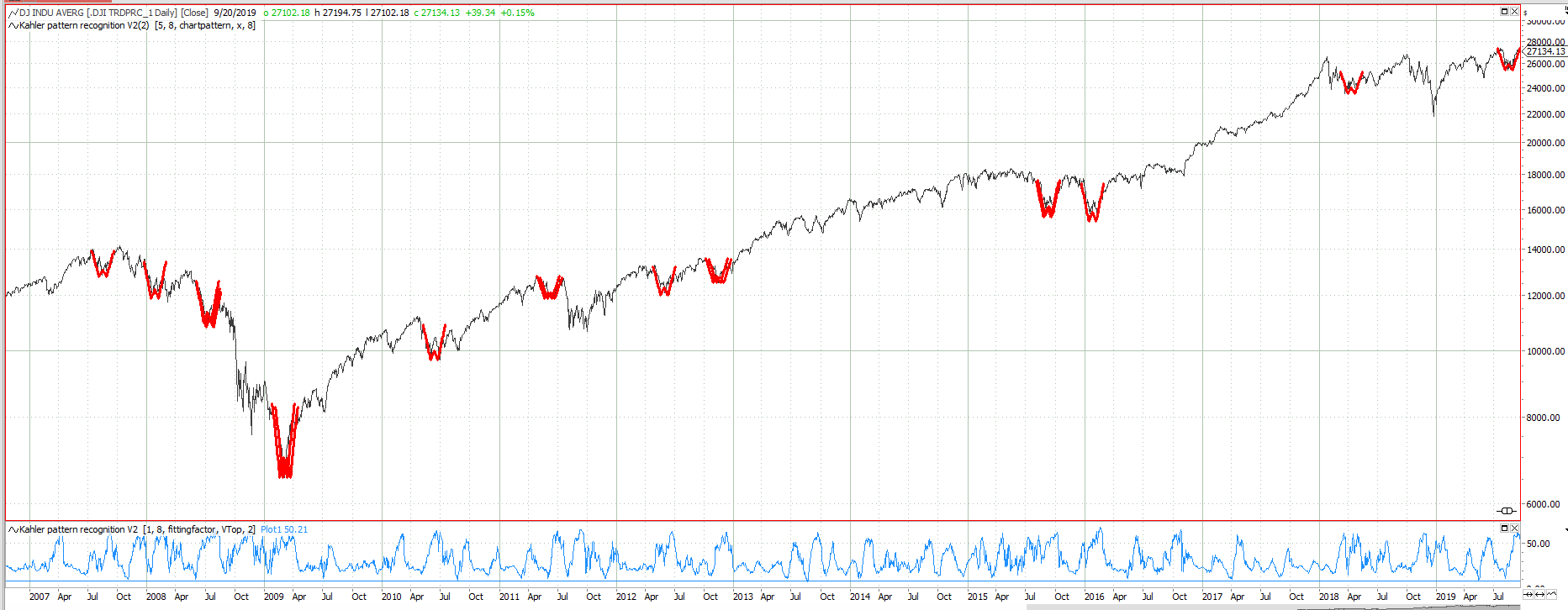

A simple algorithm to detect complex chart patterns

How to detect complex chart patterns in Tradesignal. See how a chart pattern is defined and how the pattern recognition algorithm is working. A free indicator code is provided.

The Edge of Technical Indicators

Technical indicators are the basis of all algorithmic trading. But do these really give you an edge in your market? Are they able to define the times when you want to be invested? This article will show you a way to quantify and compare the edge of technical indicators.

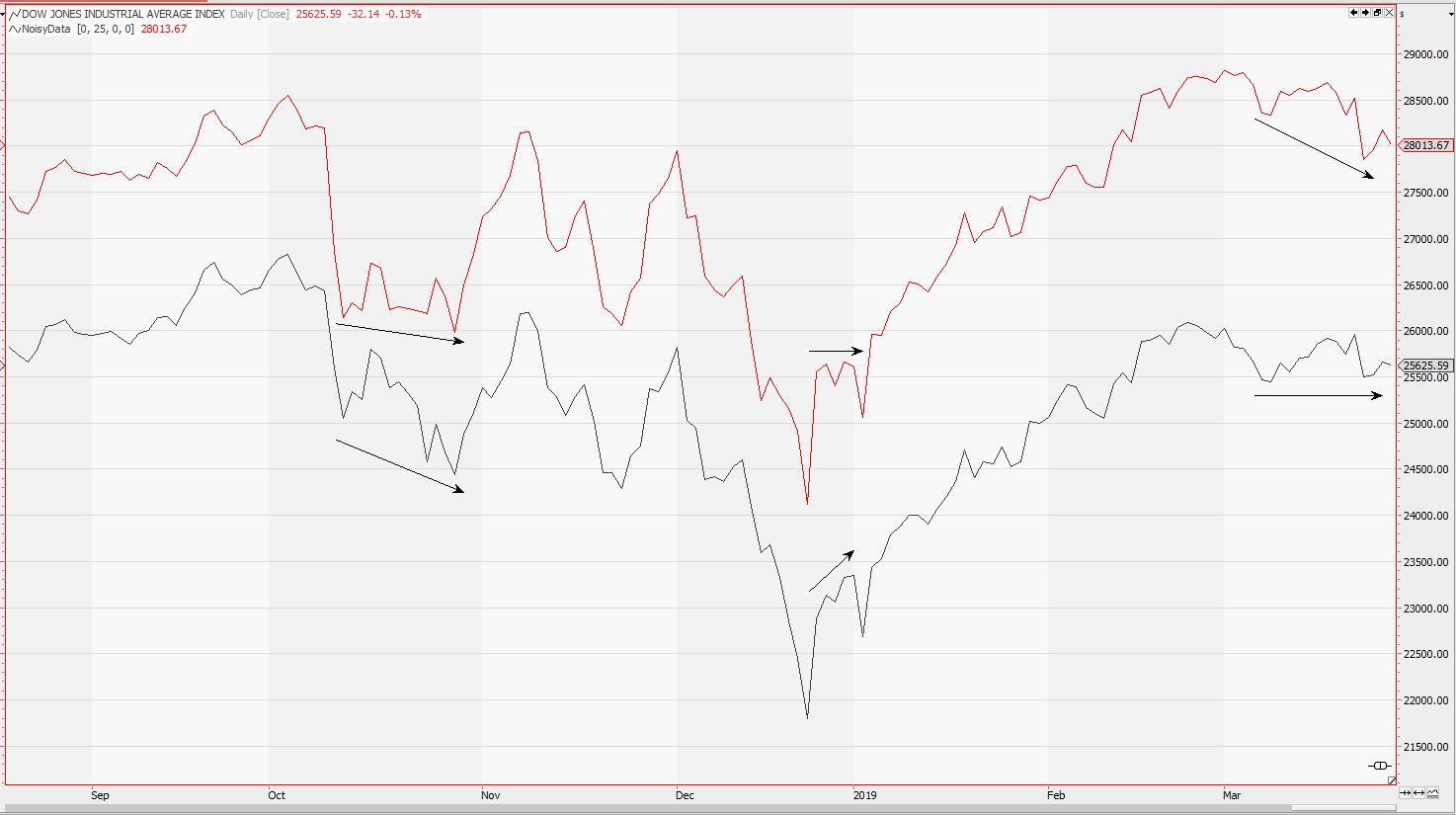

Noisy Data strategy testing

Algorithmic trading adds noise to the market we have known. So why not add some noise to your historic market data. This way you can check if your algorithmic trading strategies are fit for the future. Learn how to generate noisy data and how to test your strategies for stability in a noisy market.

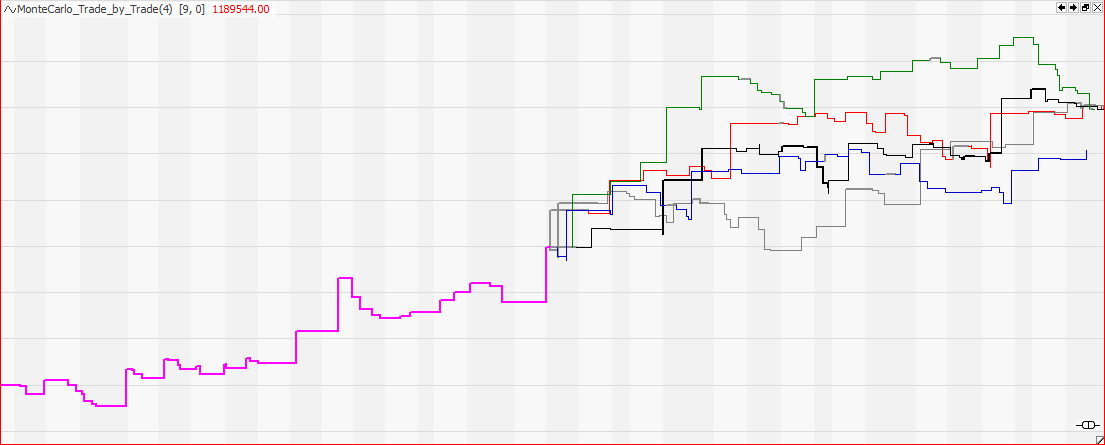

Monte Carlo Simulation of strategy returns

Monte Carlo Simulation uses the historic returns of your trading strategy to generate scenarios for future strategy returns. It provides a visual approach to volatility and can overcome limitations of other statistical methods. Monte Carlo Simulation

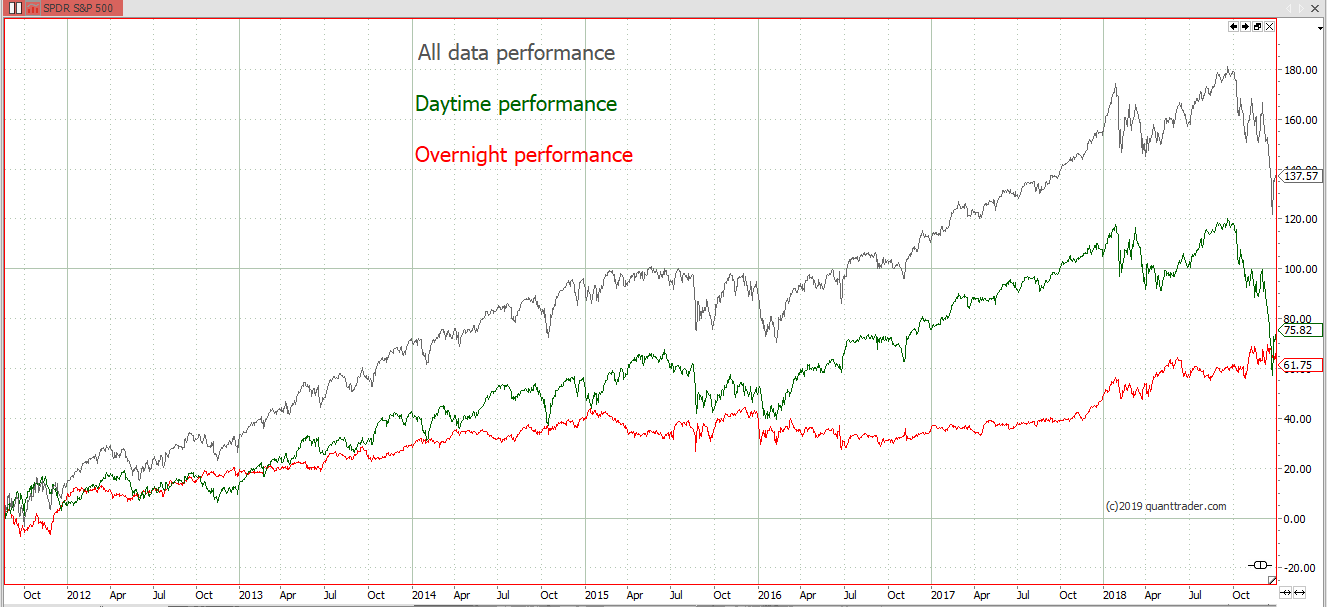

Overnight vs Daytime Performance & Volatility

Analysing the market performance of the day session vs. the overnight movement reveals some interesting facts. Daytime vs. Overnight Performance

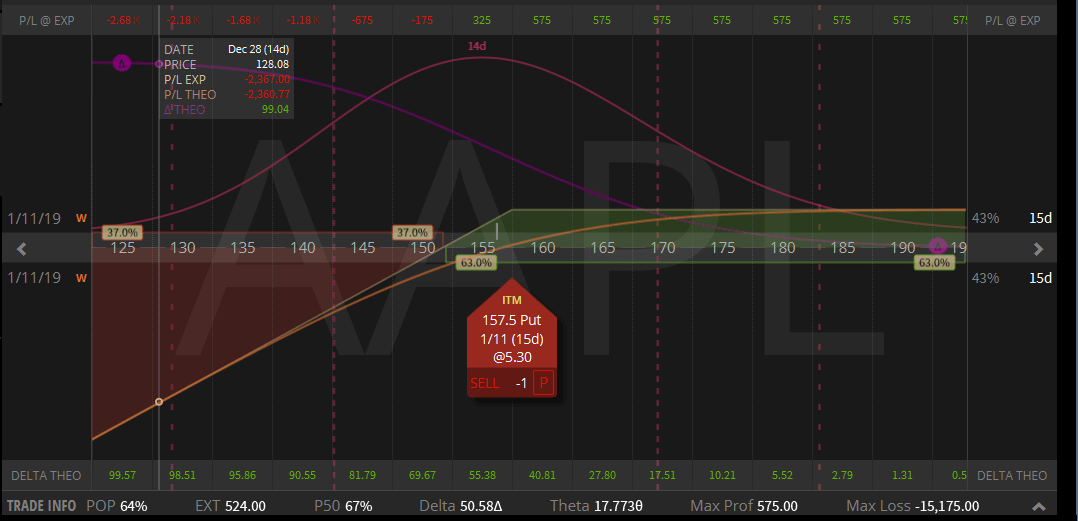

Bullish? Buy stock or sell put option?

Is it more favourable to buy shares directly or to get assigned from a short put position. See the arguments and learn how to decide this question.

Technical vs. Quantitative Analysis

Technical and quantitative analysis are two different types of market analysis. Both are based on price and historic market behaviour. Which is the one you should trust, which you should avoid?

Market crash or market correction?

The difference between a crash and a market correction. VIX and realized volatility give the answer

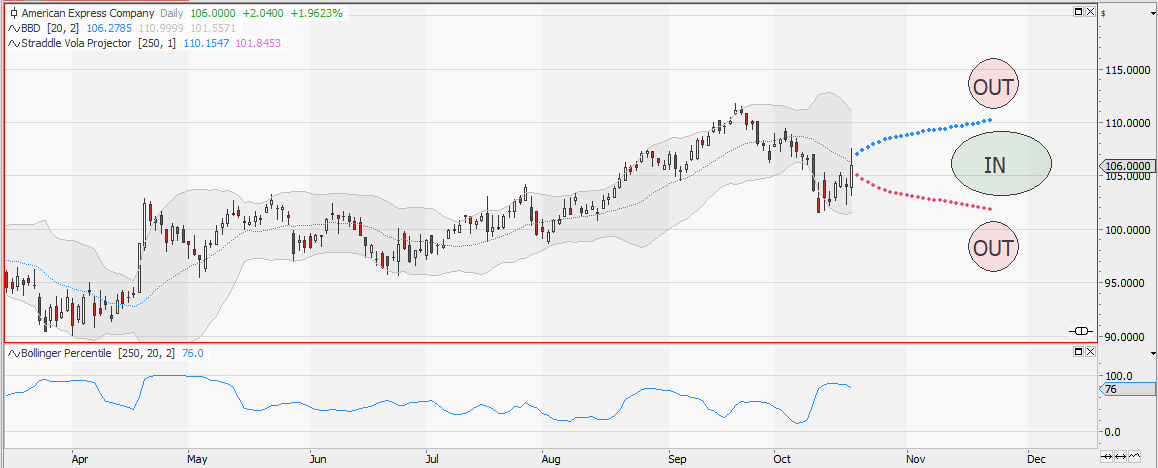

Bollingerband: The search for volatility

Will the market stay within it’s normal distribution range or will there be a breakout of this range? The Bollinger percentile indicator will give the answer.

Weis Wave indicator code for Tradesignal

The Weis Wave indicator for Tradesignal combines volume and trend information to detect turning points of the market.

Tradesignal Implied Volatility and IV Percentile Scanner

Use free data from the web and load it into Tradesignal to scan for implied volatility and IV percentile. Full code given for free

IV Percentile – when to sell volatility

IV percentile and IV rank both describe implied volatility. Which one is better in finding out if it is time to sell volatility? Read the answer in this article

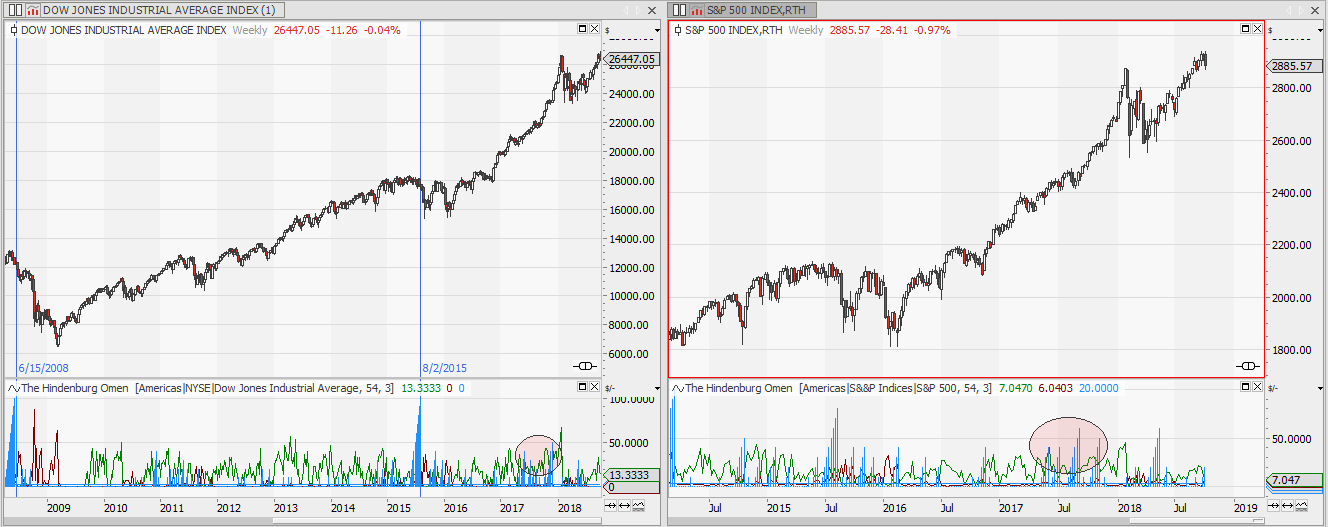

The Hindenburg Omen – Stock Market Crash Ahead?

The Hindenburg Omen is a market breadth indicator analyzing new highs and lows on the market. It signals the end of the current bull market. Tradesignal Indicator Code is provided

Distribution of Returns

“Tomorrow never happens. It’s all the same fucking day, man. ” Janis Joplin

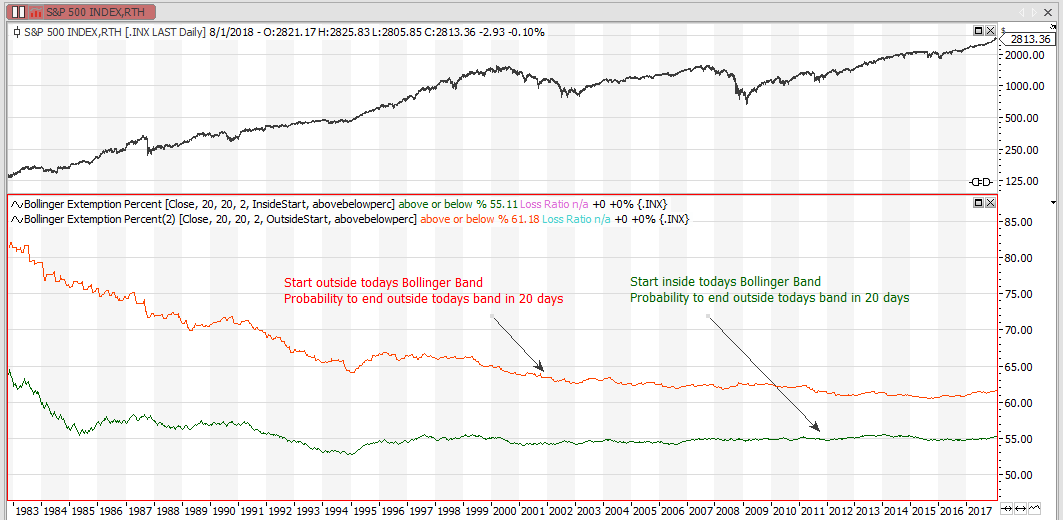

Bet on Bollinger

Ever since John Bollinger introduced his Bollinger Bands in the early 1980s the bands have been a favourite indicator to all technical trades. This article is about the prediction capabilities of Bollinger bands.

Scanning for Support and Resistance Probabilities

Scanning a market for support and resistance levels which will most likely not be penetrated in the near future is key for strategies like short options or vertical spreads. This article hows how RSI can be used to solve this problem.

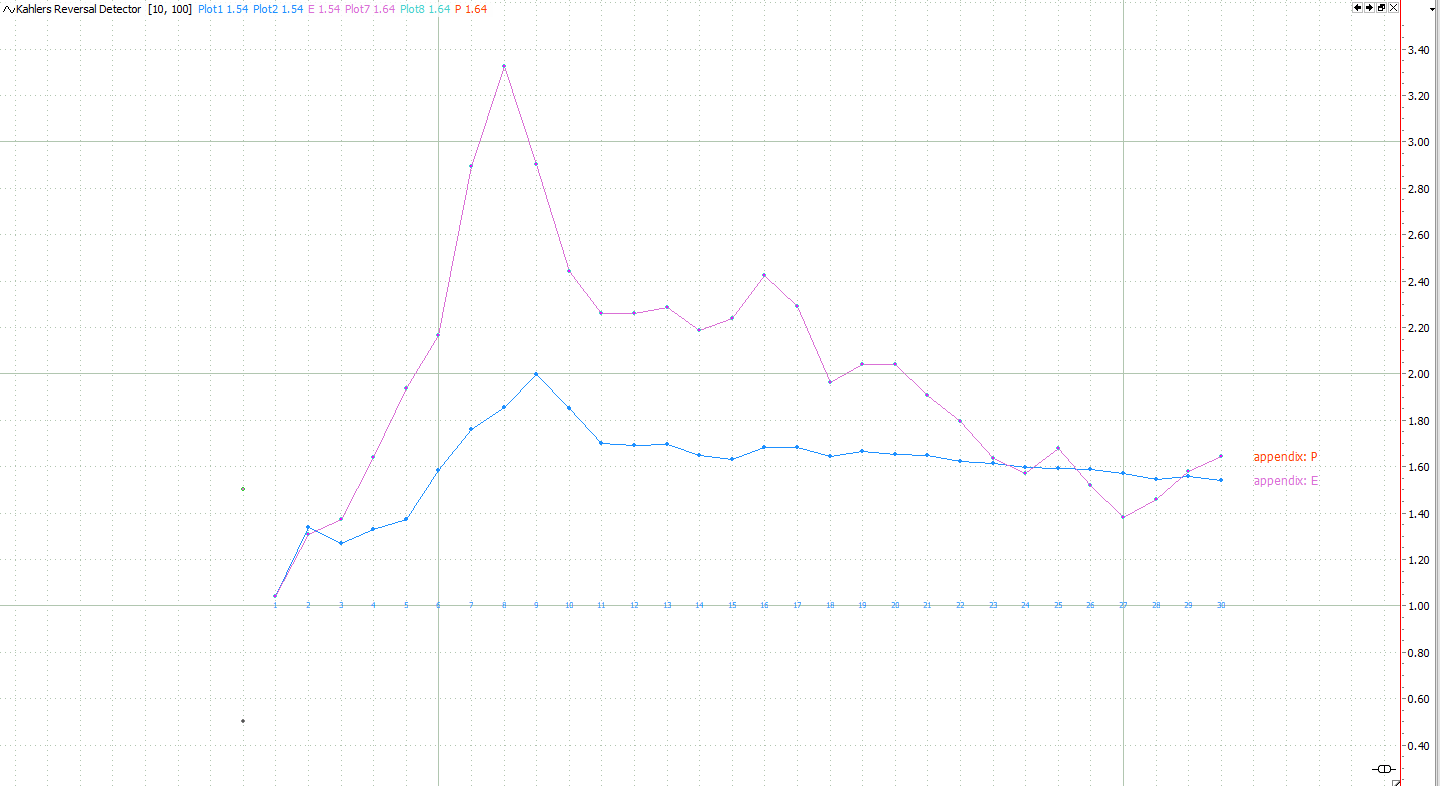

Backtesting Market Volatility

Backtesting if historical volatility or Kahler’s volatility gives a better prognosis for future volatility. Calculating the average prediction error of these two volatility indicators. Testing for the influence of data points used on the quality of the prediction. Comparing the findings to implied volatility to generate a trade idea.

Demystifying the 200 day average

The 200 day moving average is a classic of technical analysis. but is there any edge or statistical significance in it? How do equity and Forex market differ when it comes to this indicator? See the analysis and the answer to these questions.

Seasonal trouble ahead

Seasonal Projection and Volatility prognosis for german DAX. Trouble ahead…