“The stock market is never obvious. It is designed to fool most of the people, most of the time” Jesse Livermore

Technical Analysis

Technical analysis is a form of market analysis based on historic price patterns. The basic assumption of technical analysis is, that human behaviour does not change over time, and thus similar historic market behaviour will lead to similar future behaviour. Technical analysis is a predictive form of analysis, a technical analyst will try to estimate what the market might most probably do over the next period of time.

Technical analysis is using indicators and patterns. Some of these tools have been around for a couple of hundred years, e.g. candlestick patterns defined in Japan in the 17th century. Technical analysis also uses highly subjective graphical tools, like trend lines, support&resistance levels, head and shoulder patterns, Fibonacci numbers and more obscure tools like Elliot waves.

A technical analyst might have a certificate issued by IFTA or other private organisations.

Quantitative Analysis

Like technical analysis quantitative analysis is based on historic price data. Quantitative analysis is based on scientific / statistical principles. It might make use of the same indicators as technical analysts do. Moving averages, oscillators and all kind of trend, mean reverting based indicators, but it also might use machine learning, neural networks, genetic optimisation, in sample-out of sample tests, and all kind of state of the art tools of statistical research.

The main difference between quantitative analysis and technical analysis is, that quants are not focused on what the market will do in the future, but they will try to develop a trading – investing strategy which can be quantified.

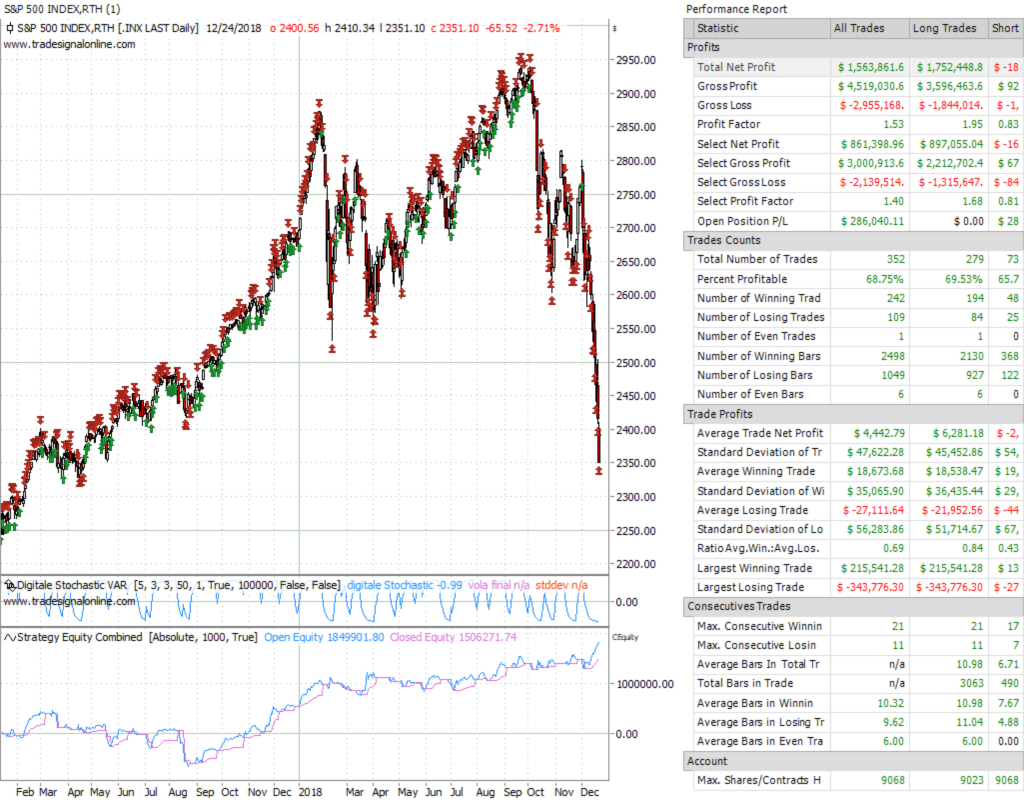

Quantitative analysts will not say “this candles stick pattern predicts a bullish move” or “the trendline break will lead to a bear market”, but they might use a candlestick pattern or a statistical trend definition to run a statistical test if it has got any significant edge and then design a hopefully profitable trading strategy. See some examples on how quantitative ideas can be tested in this or that article.

A trading strategy consists of an entry, an exit and a position sizing algorithm. Thus quantitative analysis can give you the expected risk, the expected return, the Sharpe ratio and other key statistical numbers to describe the outcome of a specific entry-exit-position sizing algorithm.

Therefore quants usually have a scientific background and a degree in maths or statistics.

Why technical analysis does not work

First of all I have to state that there are great technical analysts, who consistently generate excess returns. But most probably they do not do this because of the tool set of technical analysis, but because they followed the market for a long time and somehow got a deep insight into the behaviour of a specific market.

Unfortunately the hundreds of tools of technical analysis are mostly used to confirm the analysts opinion about the market, but they are not able to form this opinion in a scientifically sound way and override a predisposition of the analyst.

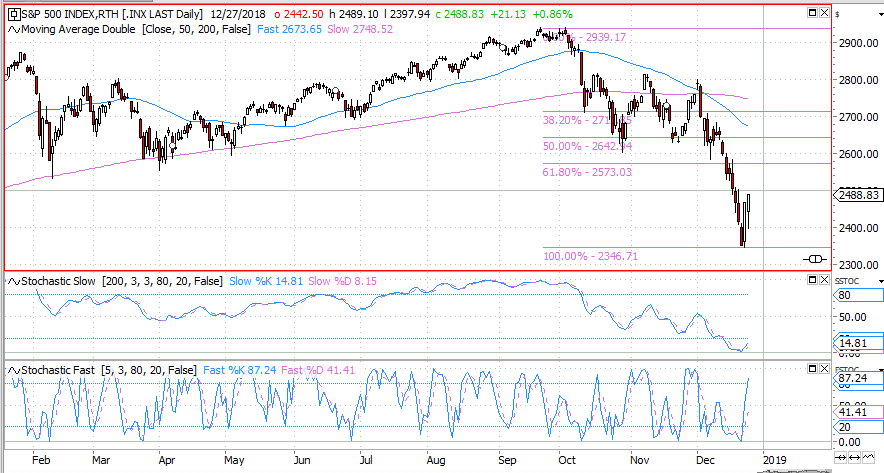

A technical analyst might say that that slow stochastic is oversold and thus it might be a good time to buy, or he might say that the fast stochastic is overbought and thus it is good to sell.

He might say that the market is trading below the golden cross and thus it is a good time to be bearish. Or he is hopes for a retracement to the nearest Fibonacci level an thus be bullish. It all depends on his preconceived opinion, not on what the indicators tell.

A quantitative analyst might also use stochastic and moving averages, but most probably won’t care at at all where the market might head tomorrow. He will have a statistical back test of his strategy, giving him performance and risk figures. And he will let the strategy trade as long as these figures are met in real time.

By not giving clear signals which can not be overridden by personal views of the current state of the market, technical analysis renders itself as useful as homeopathy.

The lucky ones will make money and boost about the achievements of technical analysis, the unlucky ones will be trying one indicator after the other, until their broker closes the account.

Not convinced yet? Then have a look at this great study done on the “Magic numbers in the Dow“. After reading you will not be tempted to use trend lines, support and resistance and Fibonacci levels any more.

So better do a basic course in statistics, learn how to program and interpret a backtest and turn your portfolio into a winning one.

Wish you a profitable 2019!

The analysis has been done using the tradesignal software suite.