The 200 day average is considered as a key indicator in everyday technical analysis. It tells us if markets are bullish or bearish. But can this claim be proved statistically, or is it just an urban legend handed down from one generation of technical analysts to the next? Let’s find out and demystify the 200 day moving average.

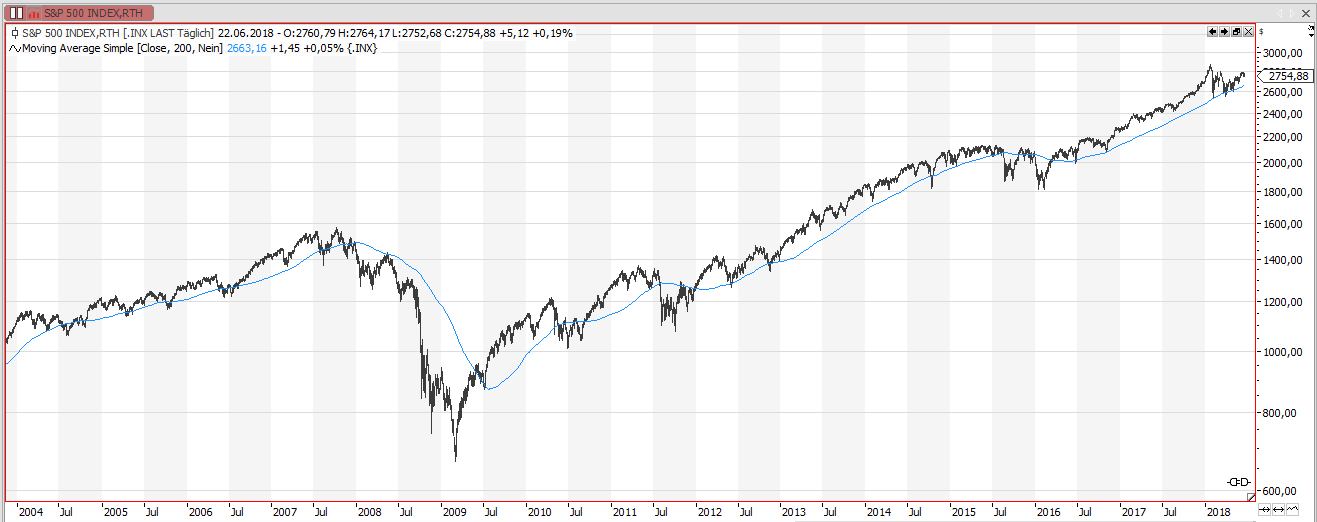

The 200 day moving average

Looking at the chart of the S&P500 index and its 200 day average let’s me think that the 200 day average is actually a useful indicator to separate the bull and bear phases of the market. But the eye tends to see what the brain is looking for and thus wishful thinking is always a trap around the corner.

I might have focused my thoughts on the crash 2008 and the bull market afterwards, and unintentionally have ignored all these little breaches below the 200 day moving average which have happened in between and actually resulted in a bullish move afterwards.

So is there a statistical proof that the average returns above the 200 day average are higher than the ones below the 200 day average? Is there any edge in this indicator? The answer is given below.

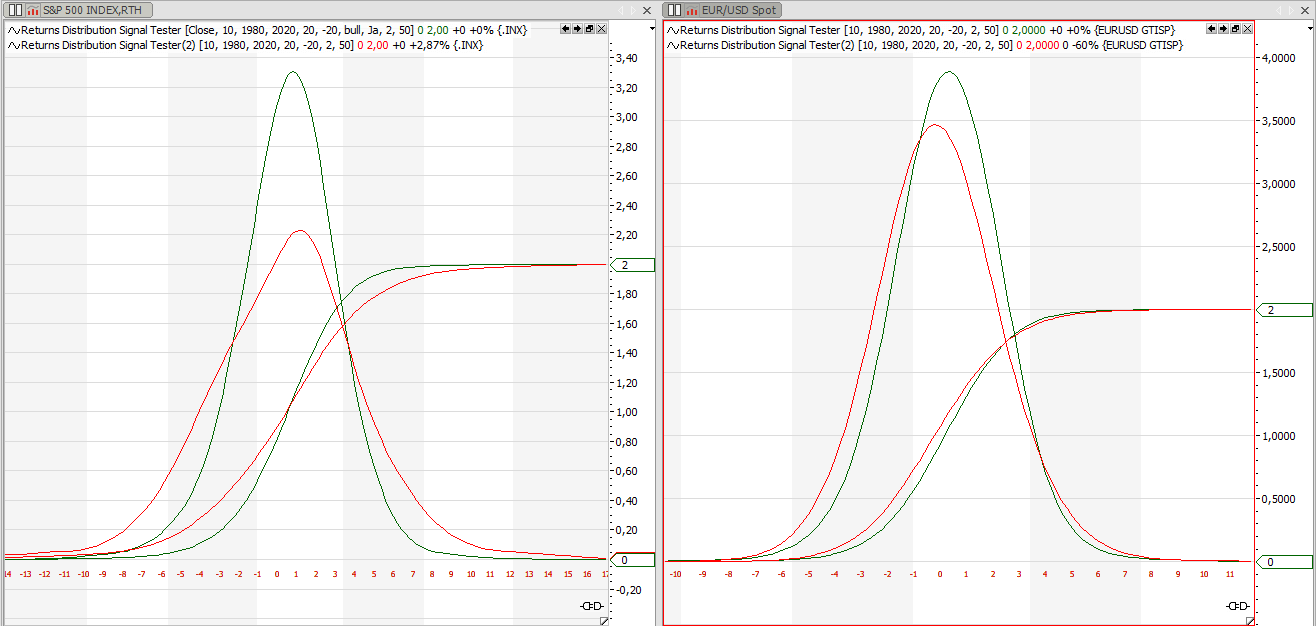

Distribution of returns above and below the 200 day moving average

The chart above (on the left side) shows the returns distribution of all 10 day returns of S&P500.

The green distribution represents the 10 day returns if S&P500 is trading above its 200 day moving average, the red line represents the 10 day returns returns if the market is trading below its 200 day moving average. Daily index data from 1980 up to 2018 has been used for this analysis.

What are the curves telling us?

The first thing to notice is, that the red line distribution, representing the S&P returns below the 200 day average, is wider than the distribution of returns above the 200 day moving average. This means that the 10 day returns below the 200 have had a higher volatility than the returns above the 200 day moving average.

The second thing to notice is the sum of probabilities lines. As you can see both cross 1 at the same place. This means, that there is no higher probability for a positive 10 day return if the market is above the 200 day moving average than it would be if the market traded below the 200 day average. For me this result came quite unexpected!

The only thing which is different below or above the average is volatility! If the market trades below the 200 day line there will be bigger swings for 10 day returns, but the chance of a positive or negative 10 day return stays the same, regardless if the market trades above or below the 200 day average!

Equity vs. Forex markets

As this finding has been quite surprising for me, I tested it with several equity indices and single stock data. The analysis showed, that this shape of distribution seems to be an universal characteristic to equities.

A different picture can be seen when testing Forex data.

On the right side of the chart above, one can see some quite different behaviour. It is based on EURUSD data since 1980 (German Mark data before 2000).

EURUSD shows the behaviour I would have expected for equities. The returns below the 200 day moving average are shifted to the left, like the sum of probabilities is. The curve looks similar with other Forex data. It means, that with Forex the average returns below the 200 day average are smaller than the average returns above the 200 day average. This is a significantly different finding than that with equities data. With Forex the 200 day average seems to have some edge.

Conclusion

Better test, as it can reveal some unexpected results. In Equities the 200 day average seems to be a good indicator for volatility, not for direction. With Forex it seems to predict direction, not volatility.

I used the tradesignal platform to run the tests, a basic code to calculate the returns distribution indicator can be found here

Link: an article by Ben Carlson about a similar theme.