The CBOE volatility index VIX measures the market’s expectation of future volatility. This article will show you some key statistics of VIX and help you to decide if it is better to buy or to sell volatility.

Statistics of VIX

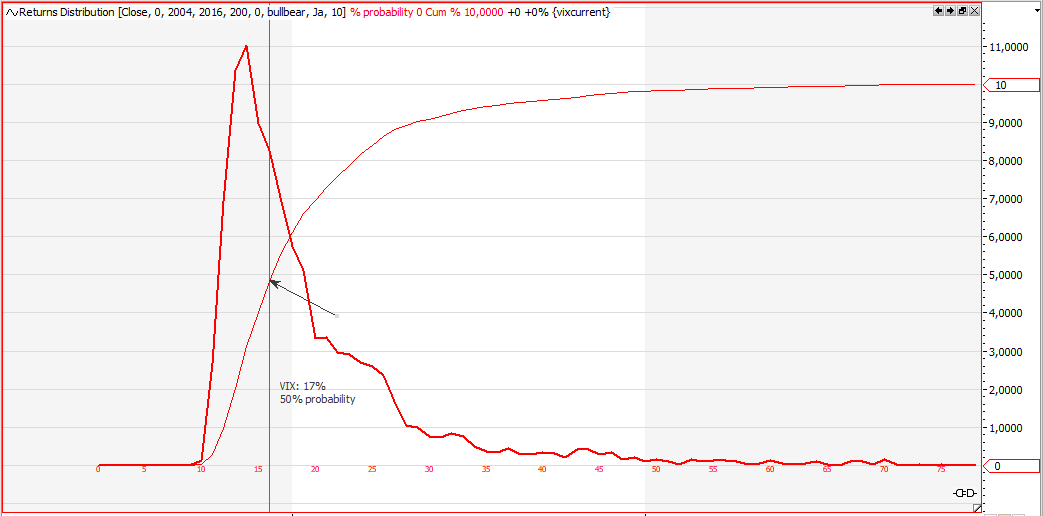

The spikes to the top and the long phases of relatively low volatility are reflected in a left-leaning distribution diagram and a long tail towards the higher levels. The median value is 17%, meaning 50% of the prices are above (below) this level.

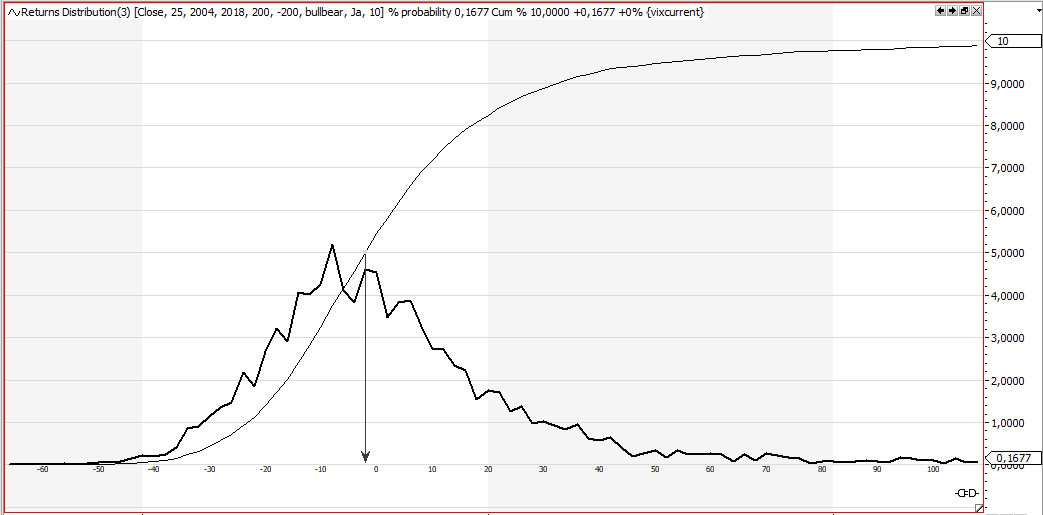

The next chart shows the distribution of returns over 25 trading days. The median price movement being slightly shifted to the negative area shows the mean reverting characteristics of volatility.

Buy or sell volatility?

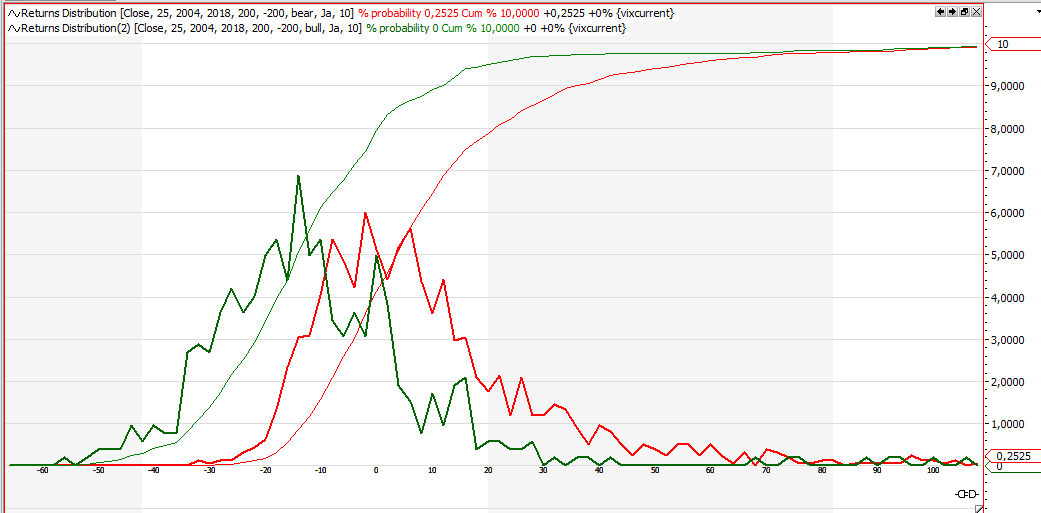

Analysing the level of VIX and the returns afterwards yields an even more interesting picture:

The green line gives the 25 bar percentage returns of VIX, with VIX noting above 25, the red line gives the returns with VIX below 15. Observe the median of the two lines:

The median 25 bar return with VIX above 25 (green) is around -15%, only 20% of the returns are positive when VIX is currently above 25. Sell volatility.

The median returns with VIX currently below 15 (red) is above 0% and with a fat tail to positive returns. Buy volatility. (data from 2004-2018)

Adverse movement of VIX

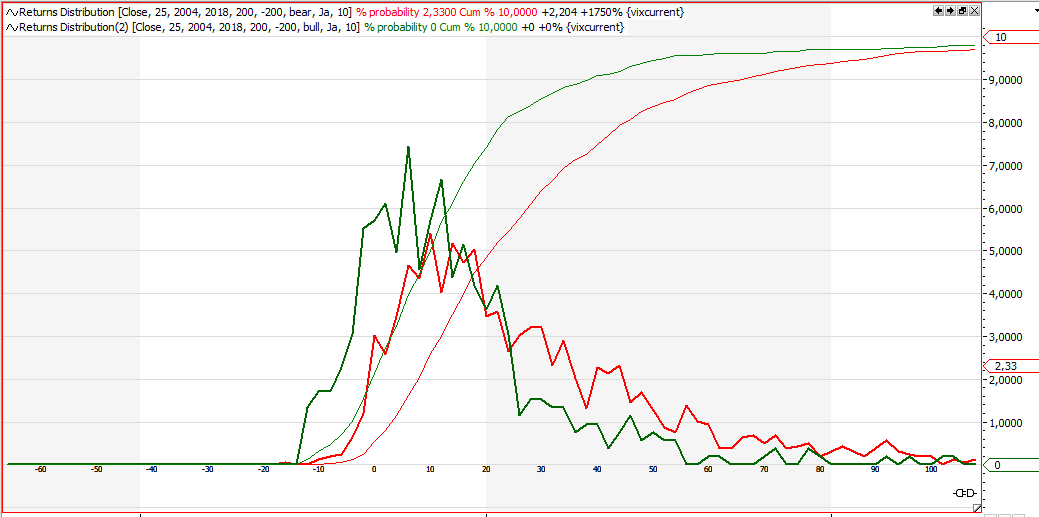

The above chart suggests that going short on volatility, if VIX is above 25, seems to be a good idea. But it is not without risk. The chart below shows what can go wrong during the next 25 days. The distribution diagram gives the maximum adverse movement of the VIX, with VIX currently trading above 25.

The green line, VIX currently above 25, shows a +10% median maximum up movement over the next 25 days. So do not expect a short vola position to be without risk. Some adverse movement has to be expected.

On the other side, the distribution of the maximum loss of the VIX during a 25 day period shows a median of below -20%. This represents the profit potential of a short volatility position.

Conclusion of VIX statistics:

If you plan to short volatility wait until VIX is trading above 25. If you want to buy volatility, do so if VIX is trading below 15.

The analysis has been done using the tradesignal software suite.

Great article, could you please explain the “above 25” and “below 15” from:

“The median 25 bar return with VIX above 25 (green) is around -15%, only 20% of the returns are positive when VIX is currently above 25. Sell volatility.

The median returns with VIX currently below 15 (red) is above 0% and with a fat tail to positive returns. Buy volatility.”

I don’t see where those values of 25 and 15 are derived from?

Cheers.

Ps/

I meant to say: I don’t see where those values of 25 and 15 are derived from on the chart you’re referring to although I know these are VIX values but they’re not referenced on that chart?

Hi Ian,

you are right, the values of 25 and 15 are not shown on the chart. I hard coded them in the returns distribution indicator. (not an input value like the 25 days…)

If you are a user of the Tradesignal software I can send you the workspace and indicator for free and you can re-do and verify the results by your own…

cheers, philipp