(1) You shall only trade when the chances are on your side

Comparing implied and realised volatility

Selling volatility can be a profitable game, but only if you sold a higher volatility than the market realises later on. Comparing realised and current implied volatility gives you an idea if the chances are on your side.

We already had a look at realised volatility and what the fair price for a straddle might be. Have a look at the kvol–fair bet articles. These articles present a way to calculate the historically correct price for a straddle. Whenever you sell a straddle (to sell volatility), implied volatility should be higher than the fair bet price. Only then you will win on a statistical basis. Also have a look at the statistics of VIX, to get a clue when a downturn in volatility can be expected.

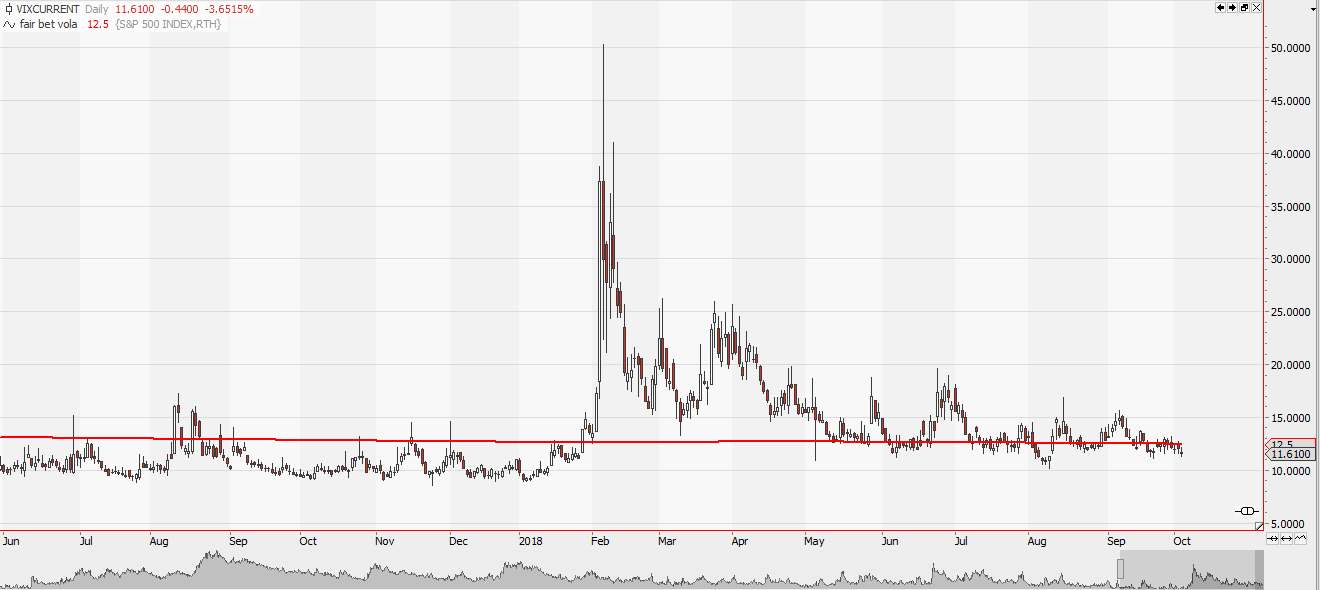

VIX and fair bet volatility

The chart above shows the S&P500 implied volatility index VIX and the long term fair bet volatility. Right now VIX is below the 12.5% fair bet yearly volatility, suggesting that it might not be the right time to sell volatility in the S&P500 without further analysis. Statistically, selling such a low implied volatility will not be a profitable game.

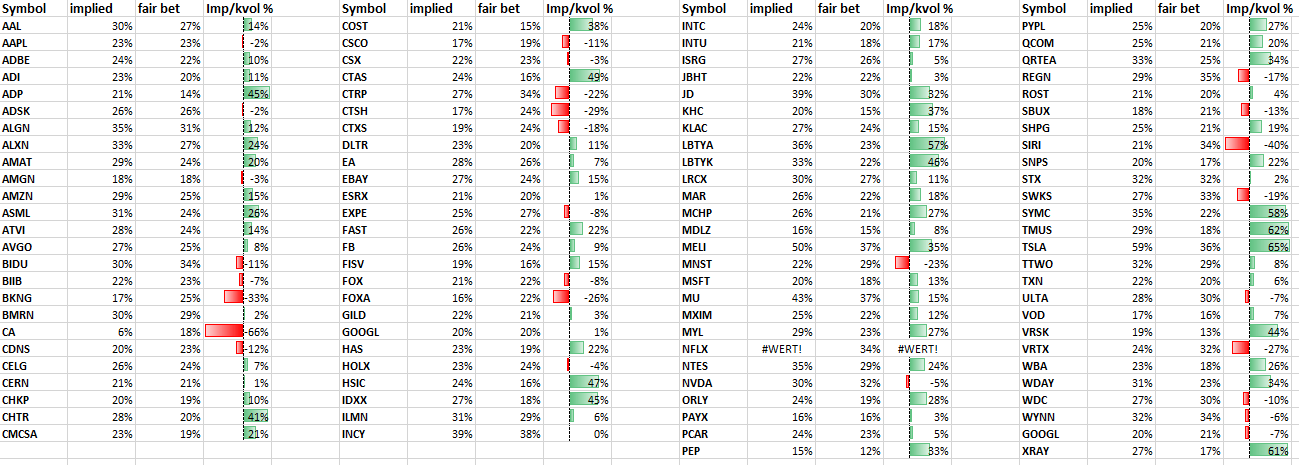

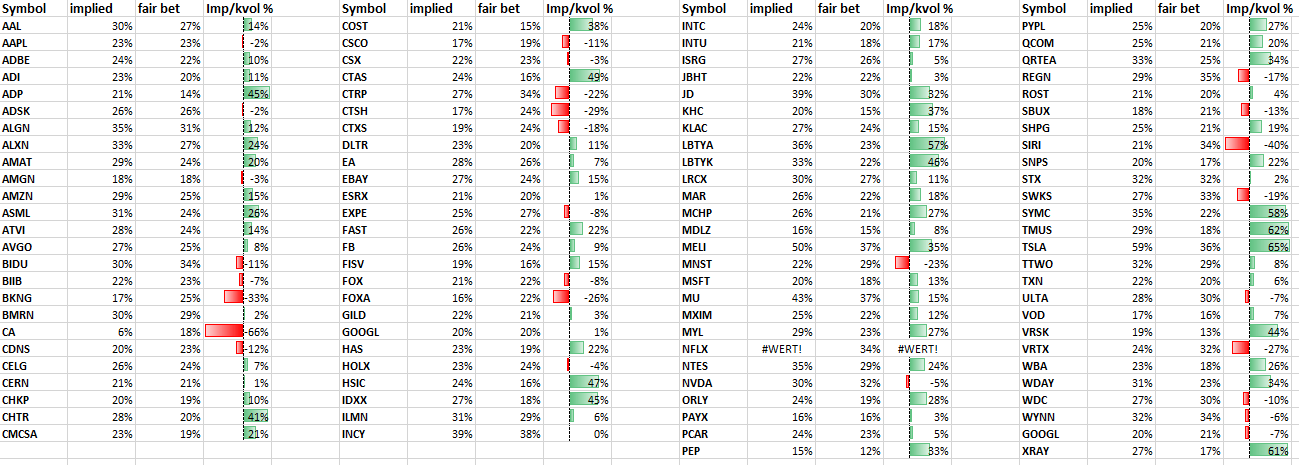

NASDAQ 100 stocks implied vs. realised volatility

As it seems that current VIX is too low to sell, let`s have a look at the implied vs. realised volatility of the NASDAQ100 stocks. The table below gives the implied volatility (Sep. 30th.2018) and the long term fair bet price for volatility. To calculate this comparison I analysed 10 years of daily data per single stock.

The higher the ratio of fair bet kvol vs implied volatility, the better the chances are that volatility selling is profitable. TSLA, XRAY, COST and CTAS are some of the stocks you might have a look on, CA, SIRI, FOX are some of the stocks I would not think about when setting up the next short straddle.

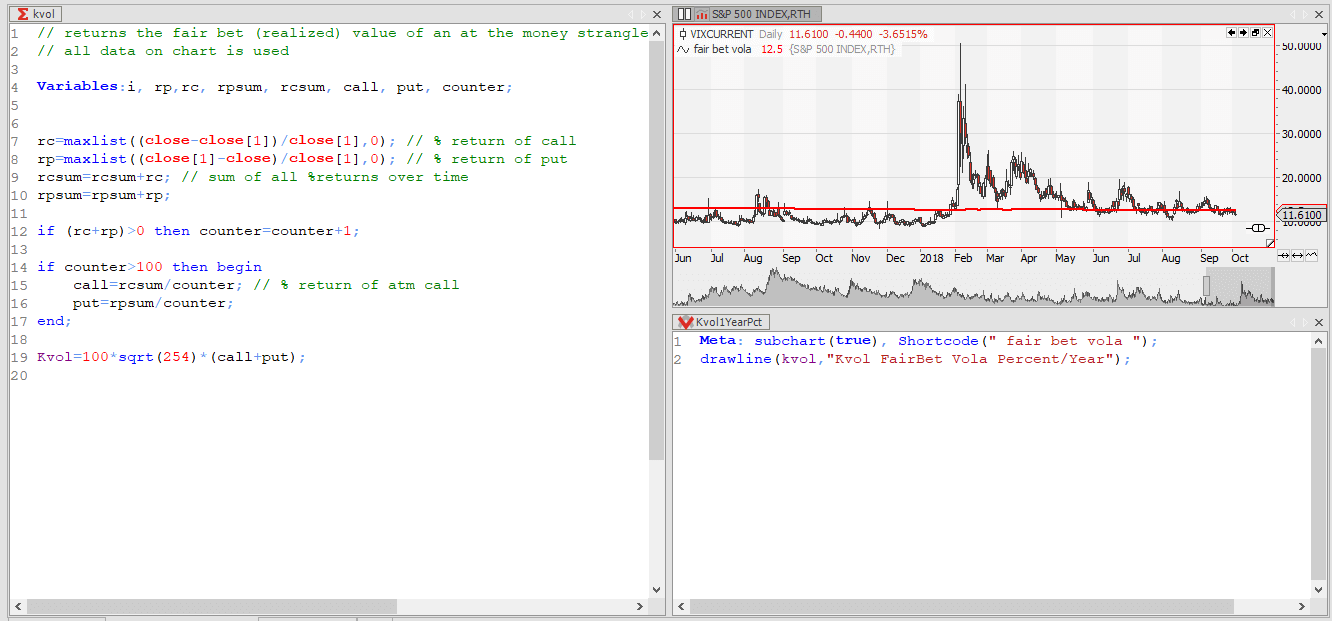

Calculation of fair bet volatility

The data for implied volatility is freely available on the optionstrategist website. The fair price for volatility can be calculated in Tradesignal using the indicator and function given below.