Ever since John Bollinger introduced his Bollinger Bands in the early 1980s the bands have been a favourite indicator to all technical trades. This article is about the prediction capabilities of Bollinger bands.

How good are the chances to be outside or inside of the bands in the future? How do these probabilities relate to the current position the market has got relative to today’s Bollinger band? What impact has overall volatility on these statistics? These questions will be answered below.

Bollinger Bands Breakout Probability

By definition of the indicator most of of the times the market will trade inside the Bollinger band. But this is only of minor interest to me. As a trader I am more interested on what will happen in a few days from now. Where will the future market be? Shall I bet on a breakout or sell a straddle?

So I did some tests on the forward prediction qualities of the Bollinger band indicator.

For all tests I used the 20 day, 2 standard deviations setting, which is the standard setting for most charting packages. Then I analysed the positioning of the market in 20 days form now to see if Bollinger bands can be of any help with these questions.

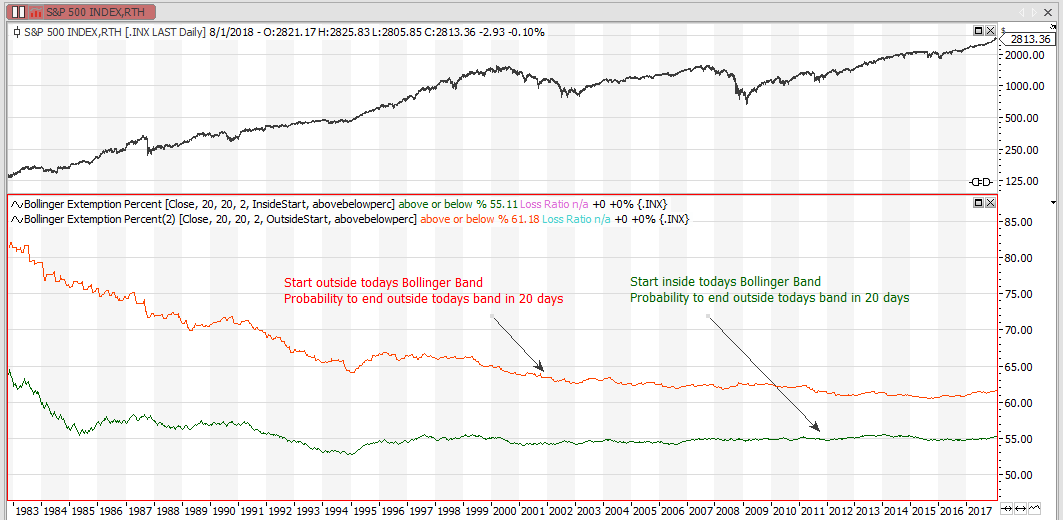

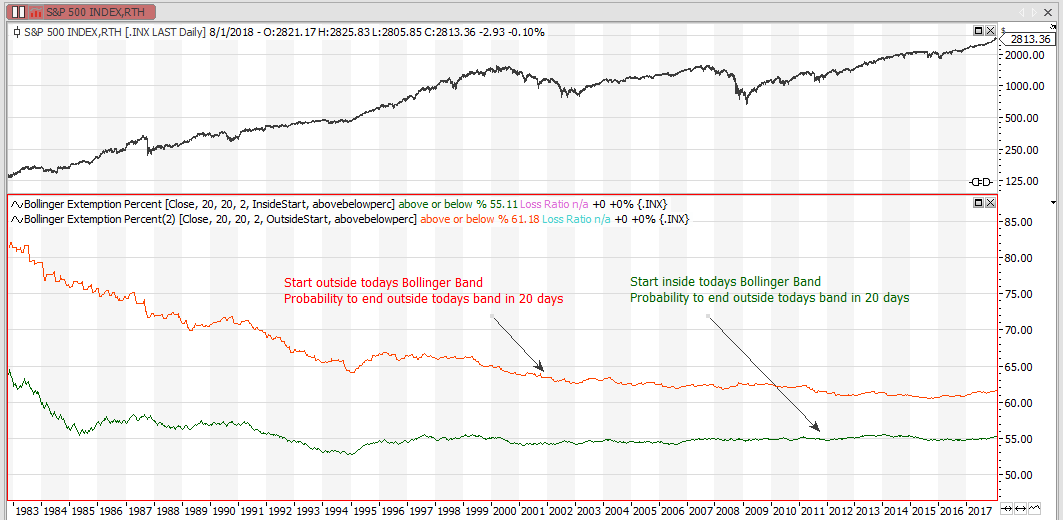

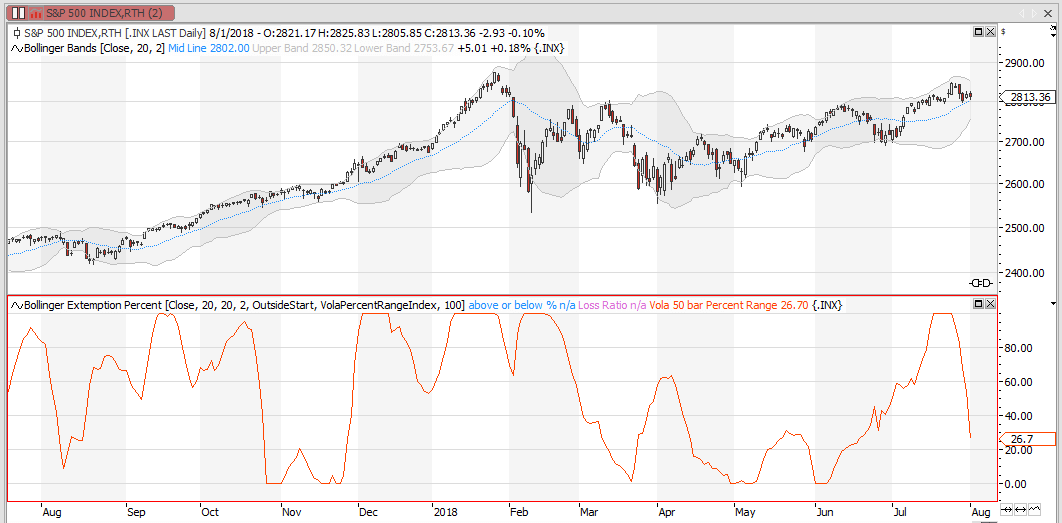

The first test was done on the S&P500 index, using data since 1983. The indicator shown on the screenshot below gives the probability of the market being outside today’s Bollinger band in 20 days from now.

The red line is the probability of being outside today’s band if we are already out of the band today. The green line shows the probability of being outside of today’s band, in 20 days from now, if we are trading inside of the band today.

The findings:

The outside starters are more likely outside of today’s band in the future than the inside starters are. Once a break out of today’s Bollinger band has occurred, it seems to be be quite likely it either vigorously reverses or that it carries on. Both events lead to an outside of today’s Bollinger band event. You might make use of this event by buying a straddle and make money if the market stays outside, regardless if it is above or below today’s band.

On the other side, the green line shows it, if the market trades inside the Bollinger band, there is only a slightly above 50% probability that it will be outside of today’s band in the future.

So if you want to place a bet that the market stays outside of today’s Bollinger band, wait until the market breaks out of the Band and then bet it does not return.

Stability of results

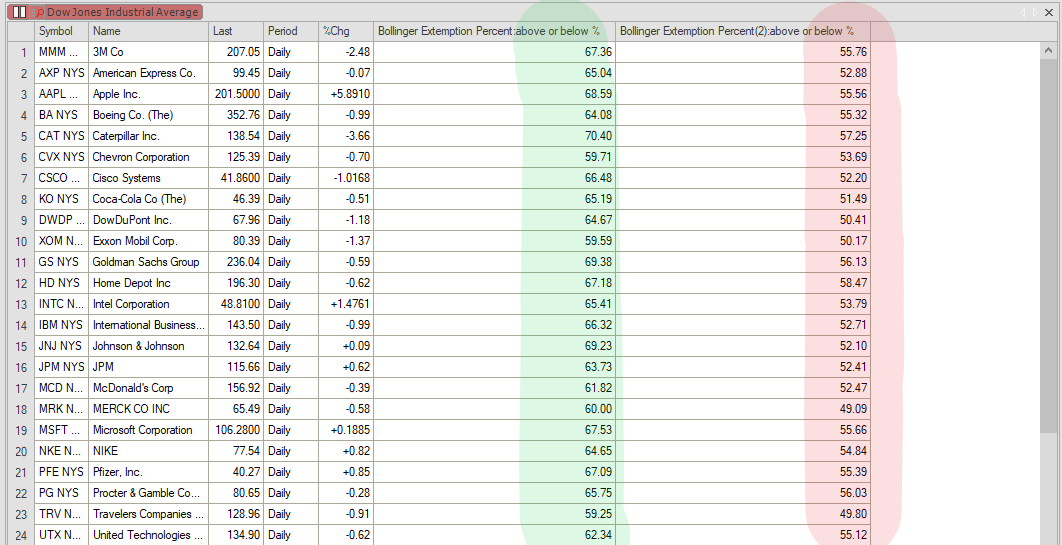

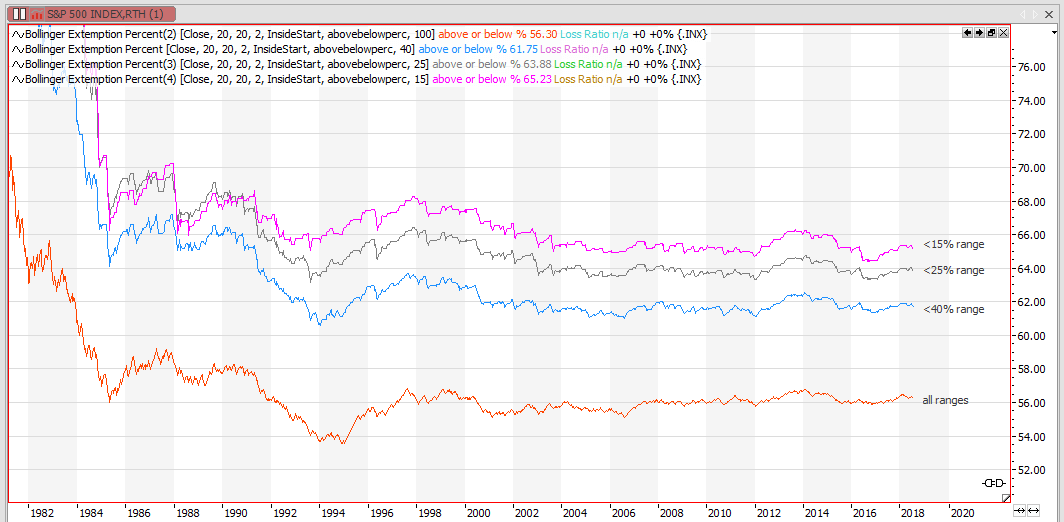

This behaviour of staying outside of today’s band seems to be quite consistent. The screenshot below shows the result of a simulation using stock data over more than 10 years of history. The green column gives the probability of being outside today’s Bollinger band in 20 days from now if the market trades outside the band today; the red column gives the future outside probability if the market today trades inside the band. There is not a lot of variation in the data, it seems to be a stable effect.

Importance of Volatility

The next question is, if these probabilities can be pushed up a little bit. A mere 60% is not the white cream of trading.

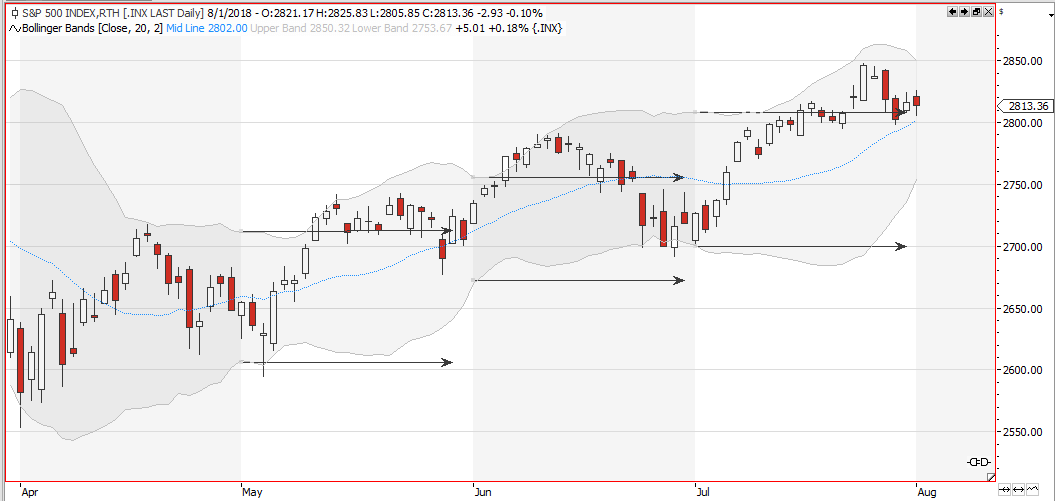

Volatility is reflected in the width of the Bollinger band. Doing an oscillator which shows the relative volatility, compared to the previous 50 days, I can build another trick into the out-of-bollinger probability. I can ask he question on how current volatility relates to the future outside probability. Is it probable to be outside the bands in 20 days from now if today’s relative volatility is high or low?

The results are quite clear. The tighter the band is today, the higher the probability of being outside of it in 20 days from now.

The chart above shows the probability of being outside of today’s band in 20 days from now (starting inside band) as a function of the level of relative volatility. The lower the relative volatility is, the higher the probability of being outside in the future.

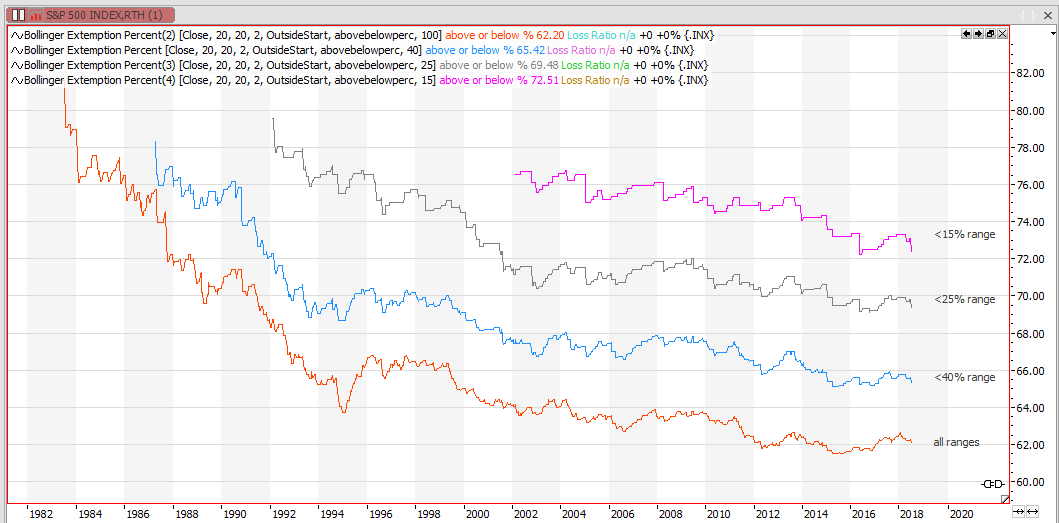

Outside of today’s Bollinger band

The probabilities are even higher if we already start outside of today’s band.(see chart below) A market outside of a tight Bollinger band would be the perfect setup for a long strangle.

A long strangle setup

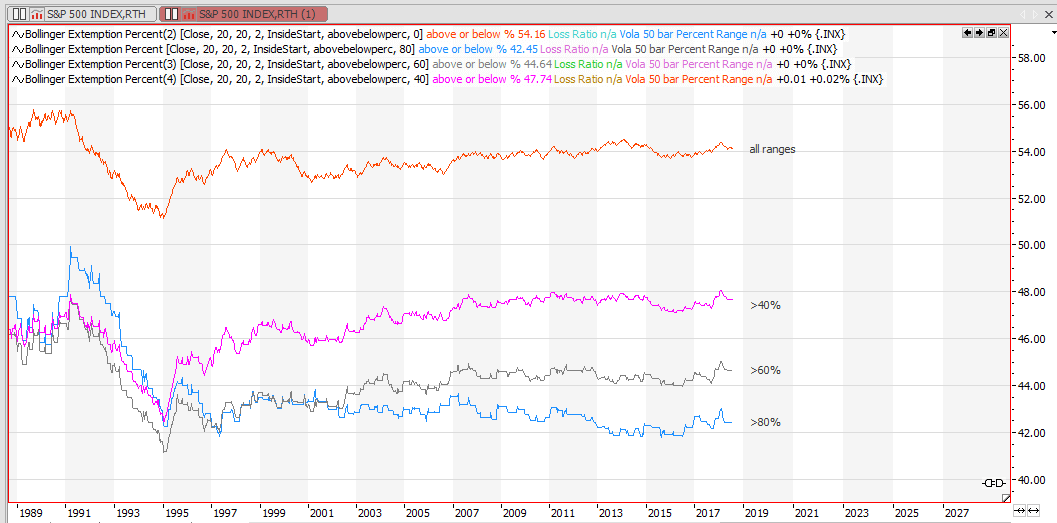

if you want to know if the market will break out of today’s Bollinger band in 20 days from now, the following chart will be of interest to you.

If today’s Bollinger band is wider than 50% of it’s highest last 50 days volatility, you have got a higher than 50% chance to be within today’s band within 20 days from now. This would not qualify as my favourite setup for a trend following position, but might be a setup for a selling a strangle.

Conclusion

A tight Bollinger band seems to be the best setup for a breakout strategy. or a long strangle option trade. Although these tests did not say anything about direction, the charts make it quite obvious that Bollinger bands can be used as a tool for detecting a no-go zone.

keep researching…

The analysis has been done using the tradesignal software suite.