Usually it makes no sense to fight against normal distribution. But there are setups which have got a high probability of unexpected behaviour. Volatility can be the key to future market movements.

Bollinger bands width percentile

Bollinger Bands are a great tool to describe market volatility. And my favourite tool to measure the width of Bollinger Bands is Bollinger percentile.

Like the IV percentile indicator my Bollinger percentile indicator is a probabilistic indicator. It gives the probability of Bollinger Bands having a narrower upper band – lower band range than currently given.

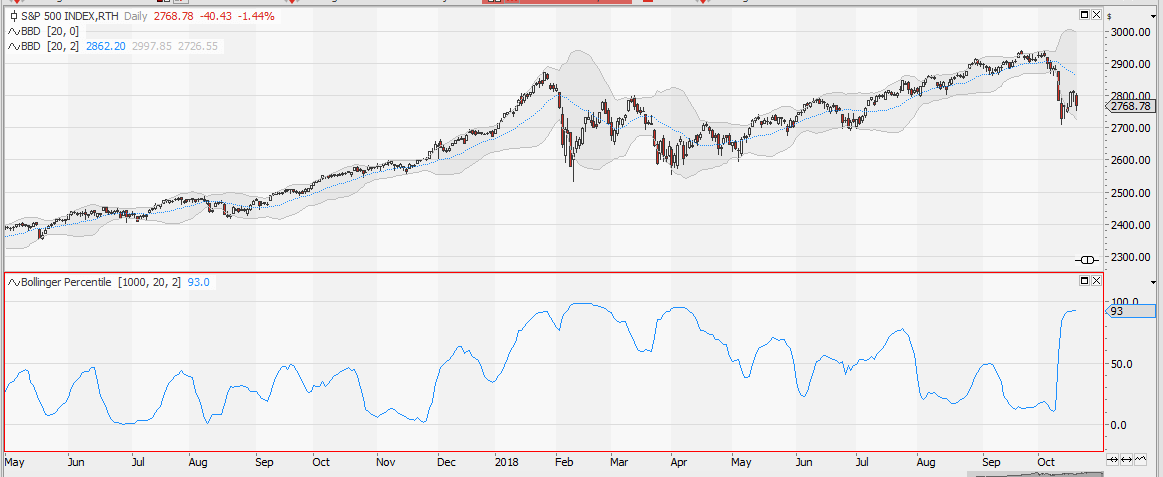

A Bollinger percentile of 93% (screenshot) means, that in only 7% of the last 1000 trading days Bollinger bands have been wider than they are today.

A Volatility Prognosis

We already had some statistics on how likely the market will be within today’s Bollinger band in a given number of days from now.

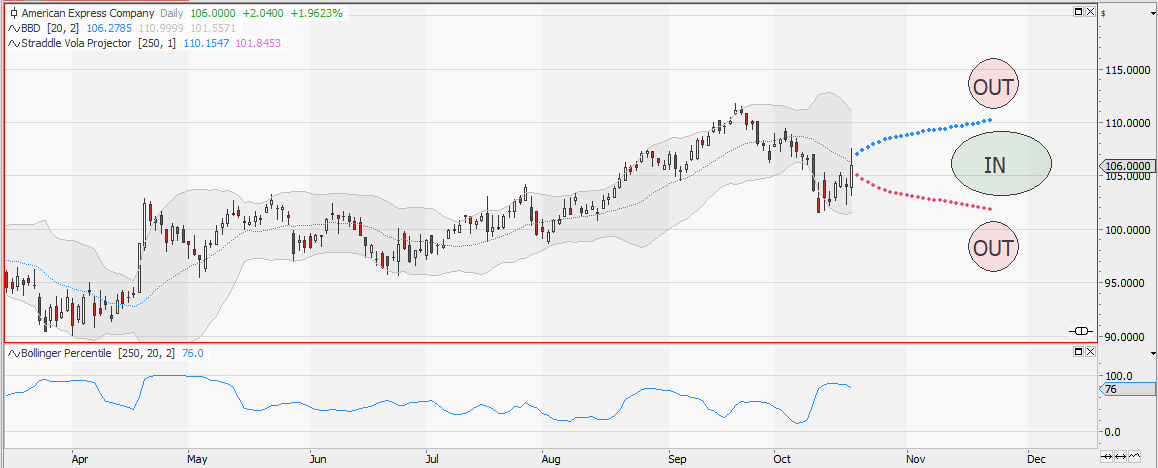

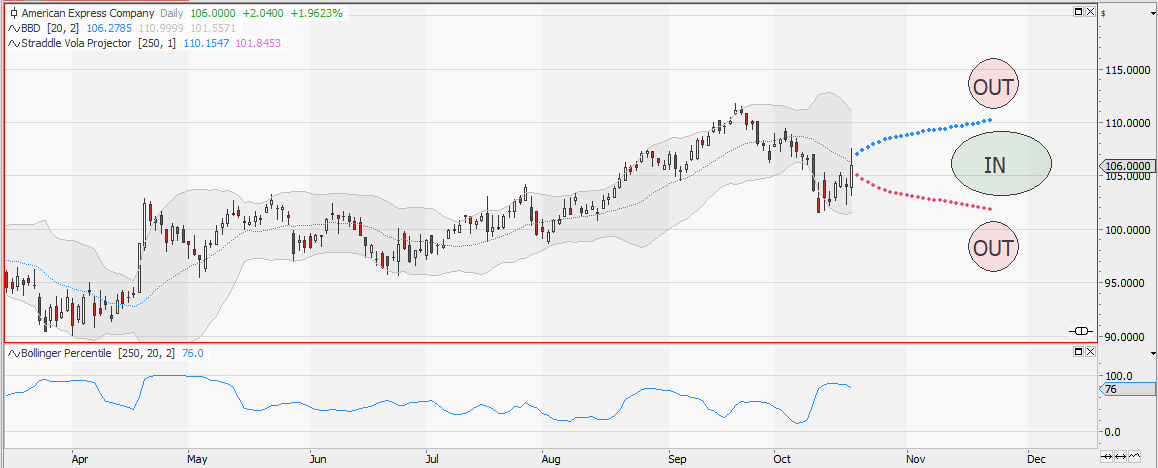

This time I would like to find out if the market will be within a market neutral volatility prognosis cone in a given number of days from now.

Bollinger bands are somehow trend following. This comes due to the moving average they are based on. The volatility cone I am testing in this article is market neutral. It has no bullish or bearish offset. I am using Kahler`s volatility to calculate this fair bet vola cone.

Questions:

- How likely is the market within the shown volatility cone within 20 days from now?

- Can Bollinger Percentile identify areas with a higher/lower probability of being inside/outside of the vola cone?

Outside Kahler`s volatility cone in 20 days from now

First let’s run a test on the probability of the market to be outside the shown fair bet vola cone within 20 daily bars from now.

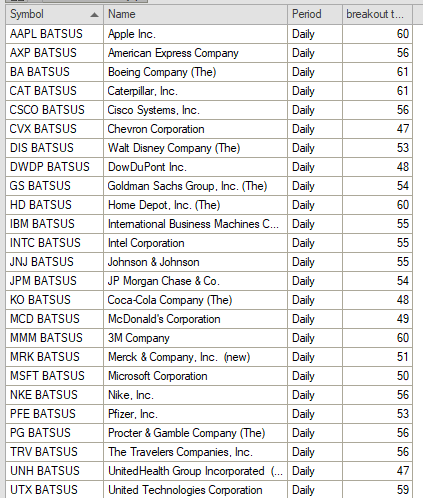

Running on 10 years of daily data the test shows the expected result; In slightly more than 50% of time the stocks have been outside of the fair bet vola cone.

Bollinger percentile volatility prognosis

Old market wisdom says that after a volatile phase things will calm down. This is the basic idea behind the next tests.

I would like to see if the probability of being in or out of the projected vola cone can be determined by looking at the width of the current Bollinger band.

Running the same test as above, but calculating the results depending on the level of the Bollinger percentile indicator gives a new picture.

If Bollinger percentile is above 50, you got a higher probability of being outside the volatility prognosis in 20 days from now than you would have with a Bollinger percentile below 50. Bollinger percentile above 50 means, that the width of the Bollinger band has been below the current level in more than 50% of the last 250 bars.

The width of the volatility cone itself is not influenced by the width of the current Bollinger band. It’s width is calculated over the last 1000 daily bars of historic data and does not change a lot over time. The Bollinger band is calculated over 20 days.

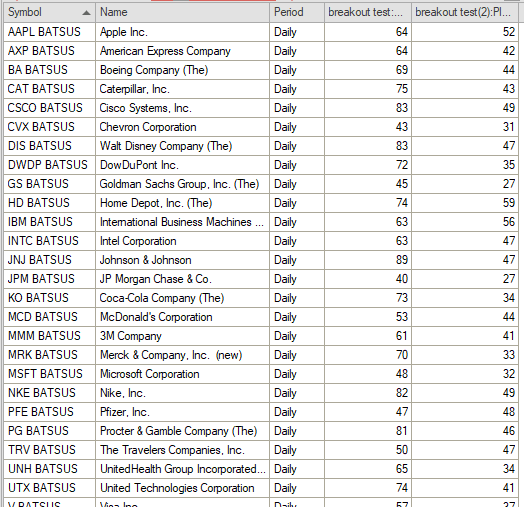

On the screenshot above you see the probability of the market of being outside the volatility cone in 20 days from now. The first row of results gives the probability of being outside if Bollinger percentile is above 75%, the second row gives the results for being outside the vola cone when Bollinger percentile is below 25%. As you can see, there is quite a difference.

The results behave opposite to what I would have expected.

A wide Bollinger band does not lead to a higher probability of the market being inside a market neutral vola prognosis. I would have assumed, that if we got a wide Bollinger band, the market would calm down and stay within a range for some days. But the opposite is true.

Takeaways

Depending on your trading style these findings can be used is several ways.

- If you trade market neutral strategies, the vola projection gives the break even points of a fair priced at the money straddle, you can use these findings to decide if it is better to buy or sell a straddle.

- If you are trading directional you can use these findings to look for probable breakout scenarios or for placing target/stop orders to make use/protect form unlikely events.

Research pays off, contact me for more details.

The analysis has been done using the tradesignal software suite.