Usually we chart the market at it’s absolute level. But what, if we would just chart the net daily, weekly, monthly movement? Would this be an advantage? Would this show us new trading opportunities?

The short answer is: Yes! The trend is not everything, and it seems to be of some significance for further movements, if the market has moved more than x % from the beginning of the day, week or month.

But let’s have a look at some charts – and you will see how well it works:

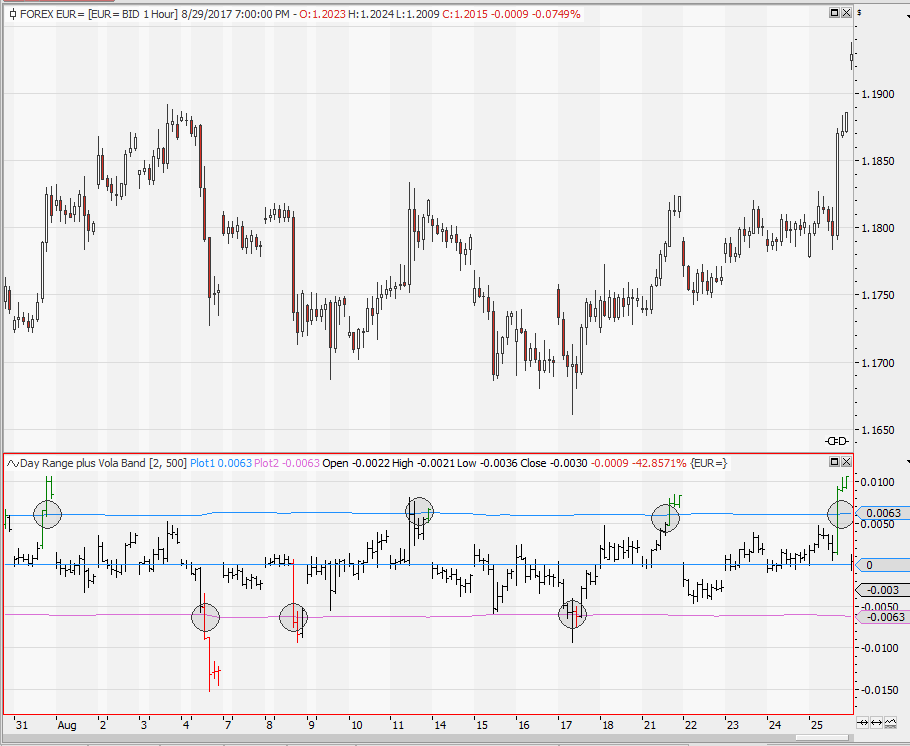

The first chat is an intraday chart of EuroDollar, 8am-5pm CET. It shows you the daily net movement.

If (at the end of the chart) the indicator says +0.01, it means, that EUR is 0.01 above it’s 8am quote. The band around the daily movements is just a 2 standard deviation band.

Trading Idea: Buy if the indicator crosses the upper band, short if the indicator crosses below the lower band. Exit at the end of the day.

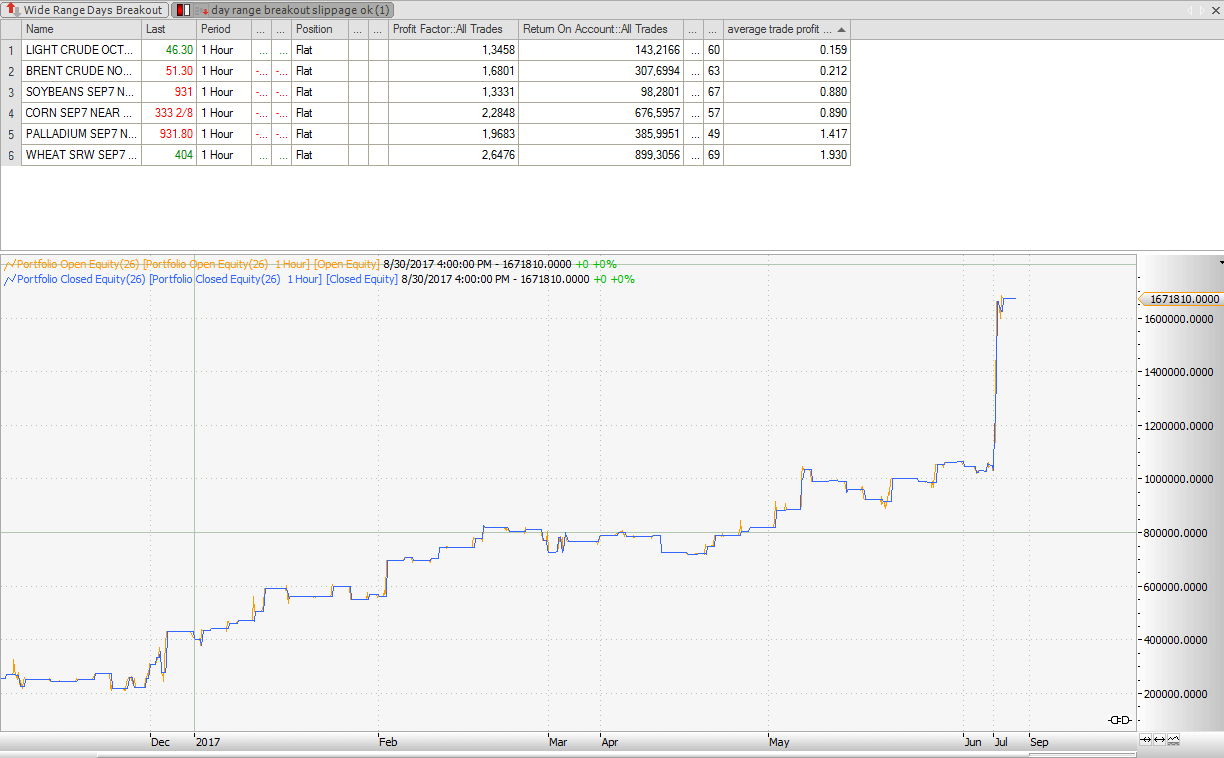

This is a profitable approach, as you can see on this screenshot of a commodity portfolio trading according to this methodology.

And if it works on an intraday timeframe, also have a look at the higher timeframes. The next chart shows you the weekly and monthly movements, but now it is up to you to com up with an appropriate trading idea.

see also: http://www.quanttrader.com/index.php/intraday-vola-ausbrueche/KahlerPhilipp2015 (in German)

codes for indicators (passwort: code) http://www.quanttrader.com/index.php/equilla-codes-rhythm-of-the-market

I am using the Tradesignal Software, the code for the Volatility Breakout Strategy is available for institutional clients only. Supported software packages: Tradesignal, TradeStation Easy Language and MultiCharts